Jerome Powell has a difficult task today as he attempts to walk a tightrope of rising inflation concerns and economic recovery. The 10-year Treasury yields hitting new highs ahead of the announcement raises the stakes, and the entire world economy is watching. Congress will have its own balancing act to perform today in a hearing to deal with illegal border crossings that have hit record highs. Stay focused and flexible because anything is possible as we wait on the data.

Asian markets closed mixed but mostly lower in a choppy cautious session as they monitor the FOMC. European indexes also trade cautiously this morning, bounding around the flatline as they wait on the Fed decision. Ahead of a big day of data, U.S. futures appear to be treading water near the flatline ahead of earnings and potentially market-moving reports. Buckle up!

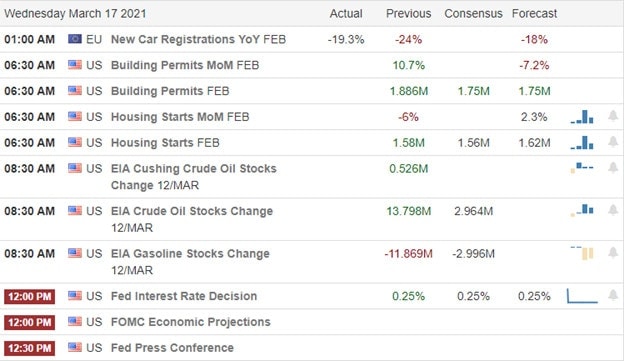

Economic Calendar

Earnings Calendar

We have 65 companies listed on the Wednesday earnings calendar, but a significant number of them are unconfirmed. Notable reports include AOUT, CTAS, FIVE, MLHR, LE, RIDE, OTCM, PDD, WSM, & ZTO.

News & Technicals’

The pressure on Jerome Powell today as he attempts to walk a tightrope between Washington and Wall Street. The fireworks begin at 2 PM eastern with the FOMC statement followed by the press conference at 2:30. Treasury yields have hit a 13-month high this morning ahead of the Fed decision. Simultaneously, the pandemic is improving here in the U.S.; German cases are rising exponentially. A reminder that we may still have a long road ahead of us in the battle against Covid-19. Italy and France have decided to restart AstraZeneca vaccinations they recently stopped due to blood clotting concerns. There will be in hearing in Congress today as illegal border crossings hit record numbers. Democrats frame it as a minor problem while Republicans suggest it’s an all our crisis. It should be an exciting day of political pandering and soundbites.

Markets paused yesterday, somewhat holding their breath as we wait on the FOMC decision. Yesterday’s economic data was a bit disappointing, and today we get the latest reading on Housing Starts and the status of Petroleum reserves. Though potentially market-moving, all eyes will be on Jerome Powell’s tightrope walk later this afternoon. The DIA, SPY, and IWM indexes remain in good condition holding on to bullish trends. The QQQ is another matter leaving behind a concerning candle pattern at its 50-day moving average. What today’s follow-through price action on the tech sector could be of critical importance. With the 10-yields on the rise this morning, there is a lot at stake.

Trade Wisely,

Doug

Comments are closed.