PreMarket Up with Empire Mfg Index Ahead

Markets made a modest gap higher at the open Friday and then waffled until mid-morning. At that point there a sharp rally for about 45 minutes before the market went dead-flat the rest of the day. This left us with strong white candles in the QQQ and SPY, but a Spinning Top in the DIA. On the day, SPY gained 0.75%, QQQ gained 1.06%, and DIA gained 0.51%. The VXX fell to 20.36 and T2122 rose, but remains in the mid-range at 71.00. 10-year bond yields rose to 1.578% and Oil fell a percent to $80.77/barrel.

During last week, Elon Musk ended up selling about $6.9 billion worth of TSLA stock. This included about $1.2 billion on Friday. Despite his having used a TWTR poll a week ago as justification, one of the main reasons behind his sale was to get the cash to pay taxes on a large pool of stock options he will be exercising this quarter. TSLA stock fell 15.4% on the week. However, in his apparent effort to remain in the news, this weekend, Musk taunted Senator Bernie Sanders and, in the process, suggested he may sell more shares of TSLA.

President Biden is scheduled to hold a several-hour “virtual summit” with Chinese President Xi today. The focus will be on Taiwan, its security, and rising tensions over what China calls a “renegade province” (or country, although we have never recognized them as a separate country). Trade, tariffs, and global supply chain issues are not scheduled to be on the agenda. However, the US-imposed tariffs are a major Chinese concern and on the US side, the Chinese commitment to reduce the use of coal (COP24 watered-down agreement) and the Chinese treatment of Uyghur minorities are priority issues.

Retail will take the earnings spotlight this week. WMT, HD, LOW, TGT, TGX, KSS, M, ROST, and FL all report later this week. In addition to Q3 reports, markets will be listening to how companies plan to cope with supply problems and spiking inflation in Q4. In related news, TSN beat on both lines and AAP beat on revenue, but missed on earnings in their reports this morning.

Overnight, Asian markets were mixed but mostly green. South Korea (+1.03%), Taiwan (+0.66%), and Japan (+0.56%) paced the gainers. Meanwhile, Malaysia (-0.58%), Indonesia (-0.53%), and Shenzhen (-0.47%) were the only appreciable losers. In Europe, markets are more mixed and lean to the red side on modest moves. The FTSE (-0.19%), DAX (+0.12%), and CAC (+0.42%) are typical of the spread across the continent at mid-day. As of 7:30 am, US Futures are pointing toward a green open. The SIA is implying a +0.29% open, the SPY is implying a +0.23% open, and the QQQ implies a +0.24% open at this hour.

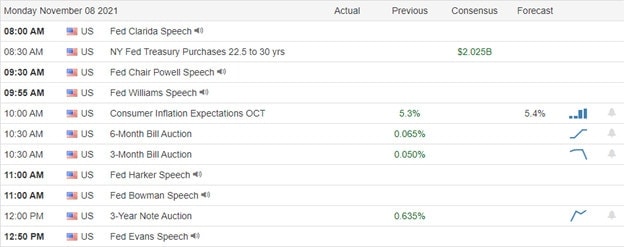

The only major economic news scheduled for release Monday is limited to NY Empire State Mfg. Index (8:30 am). Major earnings reports scheduled for the day are limited to ACM, DDL, TSN, and WMG before the open. Then after the close, AAP, EDR, and RXT report.

With only the Empire State Mfg. Index report this morning and little earnings news, the path seems open for bulls to follow through on Friday and move prices higher (at least early). Remember that the short-term (pullback) downtrend has been broken in the SPY and QQQ and is being challenged in the DIA. However, that longer-term strong bullish trend remains in place and we sit near all-time highs.

Watch your current positions before looking to add any new trades. Focus on your trade rules and on managing the things you can control. That should include consistently taking profits when you have them and moving your stops in your favor. Trade carefully and continue to think twice before holding through earnings…especially without a hedge.

Ed

Swing Trade Ideas for your consideration and watchlist: GRWG, BX, SKLZ, BMY, CRSR, ROOT, AAPL, NKLA. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service