Headline-Grabbing Record

The SPY managed another headline-grabbing record before Christmas with a low volume push. The DIA recovered more than 1200 points on declining volume in just four trading days, with the NASDAQ surging nearly 800 points. The question to be answered is whether they can hold and prove a higher level of support. With price resistance levels above, will the bulls have the energy with spiking pandemic worries, or will we find entrenched bears ready to go back to work? Plan carefully because low-volume markets add an extra element of risk.

Asian markets closed mixed overnight, with regional markets closed for Christmas. European market edge higher incautious and thinned holiday trading environment as pandemic restrictions increase across Europe. However, the U.S. markets have pre-market pump engaged with a substantial gap up at the open signaled.

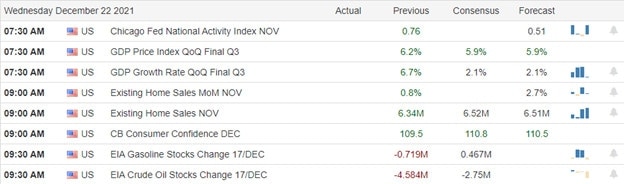

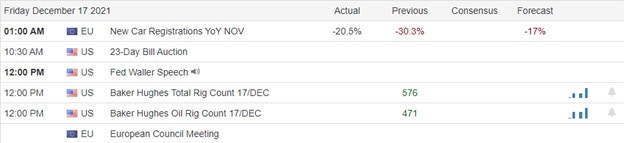

Economic Calendar

Earnings Calendar

To begin the last week trading week of the year, we have a very light day on the earnings calendar with just five listed and only two confirmed. Not particularly notable reports include QIPT and AEY.

News & Technicals’

U.S. airlines have canceled hundreds of flights over the Christmas holiday, citing increased Covid cases among crews. Airlines offered flight crews extra pay to pick up trips. Carriers have asked the CDC to lower its recommended quarantine period for fully vaccinated staff. Scotland, Wales, and Northern Ireland have already started new curbs to help stop the spread of the omicron variant, mainly focusing on indoor mixing. But England has held off on adding to current stay-at-home orders and increased mask-wearing. Johnson will reportedly digest new data on Monday looking at case rates, hospitalizations, ICU figures, and deaths. The Christmas holiday has meant official figures have paused over the weekend, but the U.K. reported a new record of 122,186 infections over 24 hours on Friday. Cases of Covid-19 are likely going to keep surging as the rapidly spreading omicron variant continues to tick up across the globe, U.S. infectious disease expert Dr. Anthony Fauci said Sunday. Every day it goes up and up. The last weekly average was about 150,000, and it likely will go much higher,” Fauci said on ABC’s “This Week.” Chinese authorities will allow full foreign ownership of passenger car manufacturing beginning Jan. 1, 2022. According to a release Monday from the Ministry of Commerce and the National Development and Reform Commission, the top economic planning agency. Treasury yields slide lower in early Monday trading, with the 10-year dipping to 1.4807% and the 30-year ticking lower to 1.880%.

Stretching out last Thursday on light holiday volume, the SPY managed to squeak out another headline-grabbing record before Christmas. The question for today can they hold these price levels with pandemic infection numbers spiking around the world, making for some challenging holiday travel. Nevertheless, index technicals have improved, with only the IWM languishing below the 50 and 200-day averages. However, getting above the averages is just the first step, and now we need to see some proof they can find some price support and hold above them. Expect volume to be lighter than usual this week due to the holiday unless the bears get active, increasing fear. As we challenge resistance levels in the DIA and QQQ, and IWM, we can’t rule out the possibility of entrenched bears. After such a huge point gain in just 4-days the long risk is high, so plan your risk carefully as we make our way toward the new year.

Trade Wisely,

Doug