Aggressive Taper

With the Fed announcing an aggressive taper and three possible rate increases next year, the market surged, triggering a short squeeze that is now looking to gap setting new record highs in the SPY! Go figure? I guess it tells us just how problematic inflation had become! Of course, with a big gap up comes the risk of a pop and drop, so watch carefully for follow-through buying before diving into risk. We have a quadruple witching this Friday so expect price gyrations to remain challenging.

Asian traded chiefly higher led by Japan surging 2.13%, seemingly celebrating the more hawkish Fed. European markets are also surging higher after digesting the FOMC decision to taper aggressively. Ahead of earnings and a slew of possible market-moving reports, Dow futures point to a gap up open or nearly 300 points, and the SP-500 is set for new record highs at the bell. Remember, big moves like this increase trading risk dramatically, so plan carefully and trade wisely.

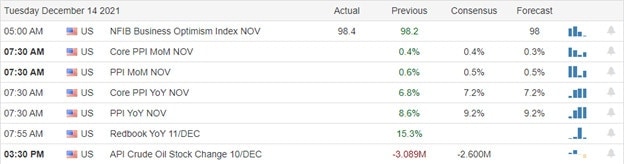

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 15 companies listed with several unconfirmed. Notable reports include ADBE, FDX, CAN, GTIM, JBL, SCS, & WOR.

News & Technicals’

As Sen. Joe Manchin withholds his support, Democrats are unlikely to meet their goal of passing President Joe Biden’s Build Back Better Act this year. The delay will have immediate implications, as the enhanced child tax credit is set to expire, and Democrats could instead turn their focus to voting-rights legislation. However, failure to pass the plan could have broader long-term implications, not only on the country’s social and climate policy but also in next year’s midterm elections. According to the Statens Serum Institut in Copenhagen, omicron cases are doubling every two days in Denmark, with variant expected to overtake delta in the next week. The rapid spread of omicron in Denmark, where 80% of the population is vaccinated, is an ominous sign for the U.S. Dr. James Lawler, an infectious disease expert at the University of Nebraska, said the U.S. has just weeks to take action to stem omicron. House Speaker Nancy Pelosi scoffed at the idea of banning congressional lawmakers and their spouses from owning stock shares of individual companies. “We’re a free-market economy,” Pelosi said. “They should be able to participate in that.” Since the beginning of the Covid pandemic, stock purchases by some senators have sparked investigations. Treasury yields traded mixed in early Thursday trading, with the 10-year dipping slightly to 1.4582% and the 30-year rising to 1.8627%.

The market surged, triggering a short squeeze after the Fed begins an aggressive taper and sees three rate increases next year. Though this is the opposite of how the market would generally react to a hawkish Fed but may suggest the impacts of inflation is the greatest evil. Yesterday’s rally didn’t break price resistance levels, but this morning, ahead of potential market-moving reports, the futures point to a considerable gap up that will set new record highs in the SPY and put the QQQ within striking distance. That said, a big gap sets up a possible pop and drop at the open, so be careful. Wait until you see some follow-through before diving in headlong. Expect price volatility to remain challenging as we head into the quadruple witching Friday.

Trade Wisely,

Doug