New record highs printed in the Dow, SP-500 with the NASDAQ managing to close at historic highs as the market reacted to yesterday’s dovish comments from the Fed Chairman. Today Powell has a repeat performance on Capitol Hill, but today his hot seat is in front of the Senate Banking Committee. Although I think it’s unlikely we will learn any more during today testimony, we should still prepare for the possibility of volatility.

Overnight, Asian markets reacted bullishly to Powell’s comments closing up across the board. However, as I write this, European indexes are mixed and nearly flat, but that is not affecting the US Futures that point to another bullish open. The CPI and Jobless Claims report at 8:30 AM Eastern will, however, have the final say on the market open this morning. The trends are bullish, and the bulls are clearly in control with the market fueled up on likely interest rate cuts.

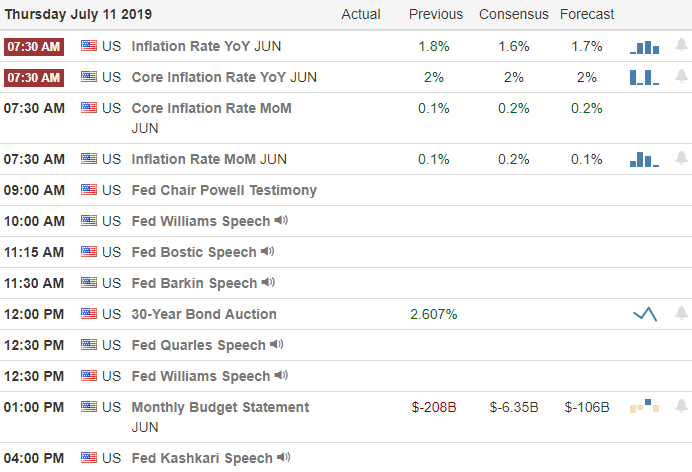

On the Calendar

On the Thursday Earnings Calendar, we have just nine companies reporting quarterly results. Notable reports include DAL and FAST.

Action Plan

The Fed Chairmans testimony in Congress yesterday all but confirmed a rate cut of at least 25 basis points is on the way. Today he must do it all over again at the Senate Banking Committee, but I would be surprised if we learned any new details today. The market reaction was initially very strong, pushing the SP-500 briefly over 3000 for the first time in history. The Dow printed a new record high but was also unable to hold it by the close leaving shooting star pattern on SPY and DIA charts. However, bulls carried the day in the QQQ closing firmly in new record territory with tech now leading the way.

A shooting star pattern is considered a bearish pattern, but that is only true if prices follow-through with a downside move. Without a follow-through, it may signal a little caution and possibly not even that if the bulls find the energy to move the indexes higher. We have the CPI and Jobless Claims at 8:30 AM Eastern that have the potential to move the market before the open. Currently, the futures point to a modestly bullish open with trends remaining very strong.

Trade Wisely,

Doug

Comments are closed.