With Jerome Powell’s congressional tightrope walk complete the market couldn’t be happier with his dovish comments pointing to an interest rate cut later this month. Now the question to be asked is the potential rate cut already priced into the market? The just 28 trading days the Dow has gained 2400 points topping 27,000 for the first time in history. Could this become a buy the rumor sell the news kind of event? It might be wise to consider that as you plan your risk into the weekend.

Earnings session kicks off on Monday with many of the big banks reporting next week so buckle up for increased volatility. Overnight Asian markets closed with modest gains across the board after the release of trade data. European markets are also showing gains this morning, which is helping to lift the US futures that are pointing to another bullish open and likely more new record highs.

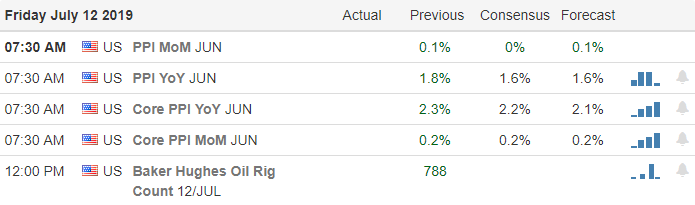

On the Calendar

On the Friday Earnings Calendar, we have 17 companies stepping up to report. Notable reports include INFY & HIFS.

Action Plan

With Jerome Powell’s congressional tour complete and his dovish comments suggesting an interest rate cut is forthcoming new market records highs continue. The power of an assumed rate cut is truly amazing with the Dow having gained 2400 points in just 28 trading days. That exuberance looks to continue this morning the futures pointing to another gap up open today. As we head into the weekend after such an impressive run, it may be wise to ring the register taking some profits to the bank with earnings season kicking off on Monday.

As of now, the bulls are in full control, and the technicals of the charts continue to look strong but be very careful chasing stocks so late in a rally. At some point, the low rate euphoria will begin to diminish, and the market will remember we still don’t have a trade deal with China. With punishing tariffs still in place, many companies continue to warn that they will miss analysts estimates this quarter. Something to at least consider as you plan your risk into the weekend and the beginning of earnings season. Have a great weekend!

Trade Wisley,

Doug

Comments are closed.