After a little intra-day pop and drop, the bulls came out in force once again, setting new records pushing the SP-500 above 3400. The bulls want to add to yesterday’s impressive display of strength, pointing to yet another gap up open with all eyes on a possible inflation policy change from the Fed expected on Thursday. The Dow still needs about 4.5% to set a new record, and with significant changes coming in the average at the end of the month, institutions will have to work hard to get that headline.

Asian markets closed mixed but mostly lower overnight. However, European markets are modestly bullish across the board this morning. US Futures are currently mixed this morning with the Dow expected to gap more than 150 points and NASDAQ flat to slightly lower.

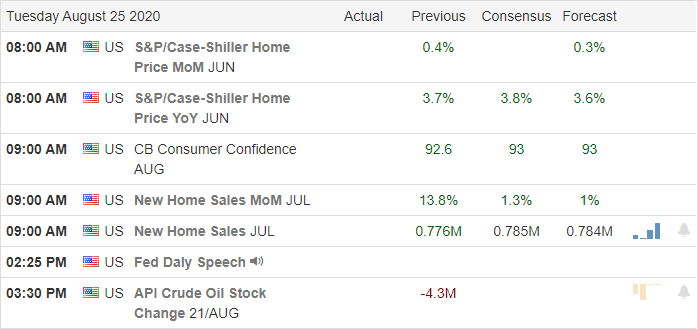

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar shows 24 companies stepping up to report quarterly results. Notable reports include JWN, ADSK, ATHM BMO, BNS, BBY, PLCE, HAIN, HPE, HRL, INTU, SJM, MDT, CRM, TOL, & URBN.

News and Technical’s

More record highs after a day of robust bullish activity as the market looks forward to a significant policy speech from Powell on Thursday. According to reports, the Fed Chair will lay out a plan that changes the way the committee views inflation. The idea is to keep rates very low until they see a substantial increase in inflation, which is a significant shift in the FOMC history that worked to control inflation. Big changes are coming to the Dow Industrial Average with CRM replacing XOM, AMGN replacing PFE, and HON will take the position of RTX before the market opens on August 31. The change intends to balance the index after the AAPL decided to move forward with a 4-for-1 split, which will move it weighting from number 1 down to the 17th position. Delta announced plans to furlough 1900 pilots in October as a result of pandemic impacts with other airlines likely to follow their lead soon.

A look into the index charts, you can see nothing but bullishness as we continue to pump-out new records almost daily. With the possibility of a new inflation policy coming to the Fed and seemingly no substantial concerns about Federal debt, we may have to come up with a new definition for what constitutes an overly frothy market environment. As traders, all we can do is stay with the current trends, stay focused, and avoid becoming complacent in case the music does suddenly stop.

Trade Wisely,

Doug

Comments are closed.