More record highs in the SP-500 & NASDAQ indexes as the Absolute Breadth Index continues to decline. Although this divergence is a bit troubling, the bullish trends and price patterns in the indexes remain bullish. The VIX is also a little perplexing stubbornly holding above 20 handles as the market stretches higher. However, the upcoming speech from Jerome Powell that’s likely to layout a new inflation policy that will keep interest rates low for the foreseeable future may well inspire the bulls even higher in the days ahead.

Asian markets closed mixed but mostly lower overnight. European markets trade mixed and cautiously flat this morning as they wait on the Fed policy speech. US Futures ahead of earnings, a Durable Good report, and a possibly damaging hurricane bearing down on the gulf coast point to cautiously flat open today.

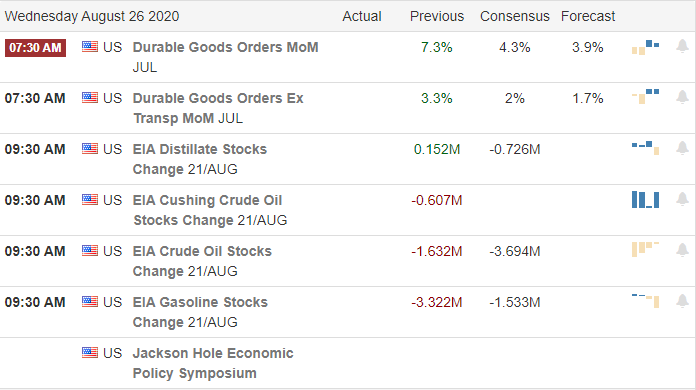

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have 21 companies stepping up to report quarterly results. Notable reports include WSM, BILI, BOX, CHS, DKS, EV, EXPR, HEI, LCI, NTAP, PTR, RY, & SPLK.

News & Technical’s

Yesterday we heard about layoffs from Delta Airlines, and today American Airlines says it will cut up to 19,000 jobs when the Federal-aid expires in October. In the restructure plan Bed Bath & Beyond said they would cut 2800 as impacts from the pandemic continue to mount for US business. However, a look at the index charts, and it appears the need for employment is no longer a requirement for a healthy economy as the NASDAQ and the SP-500 set new record highs. Gas futures are on the rise as hurricane Laura intensifies and takes direct aim on the Texas coast. Evacuations are underway as the oil and gas industry shuts down with the damaging storm set to make landfall late Wednesday night or early Thursday. CRM saw a nice bump up yesterday after learning it would be added the Dow average, but after the bell, the stock soared higher on the back of a strong earnings report. The stock is indicated to gap nearly 15% higher at today’s open.

Index trends remain very bullish, and though we saw just a little selling the Dow yesterday, the price patterns remain very strong. Overnight futures were a bit muted, and this morning point to a relatively flat open ahead of earnings reports and a Durable Goods number that consensus suggests will show a substantial decline. That said, the market has its focus on the Jackson Hole Symposium, where the Fed chair is likely to roll out a new Fed inflation policy that will keep interest rates low for the foreseeable future.

Trade Wisely,

Doug

Comments are closed.