There are stampeding bulls everywhere you look this morning with futures point to massive gap up at the open lead by the colossal tech giant AAPL the will split its stock after the bell today. The market is also looking to the Fed to bring more support and clarity to there future policy actions with the beginning of there Jackson Hole symposium. With the Nasdaq and SP-500 at new record highs, how much more money printing do we need until the market can stand on its own? Perhaps we will find out soon.

Asian markets enjoyed a nice rally overnight, with the HSI up nearly 1.75%. European markets are profoundly bullish this morning with the DAX and CAC up more than 2%. US Futures ahead of a light day of earnings and economic news point to a substantial gap up, setting new records and lifting the Dow to challenge breakout resistance.

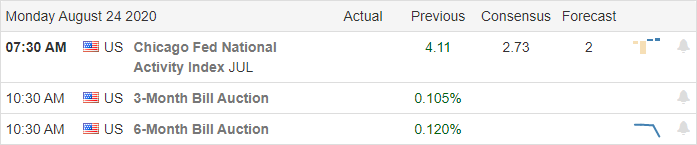

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 26 companies reporting results. Notable reports include PANW & QFIN.

News & Technical’s

As two tropical storms threaten the Gulf states, the market is seeing nothing but bullishness this morning following the led of Asian and European markets up sharply this morning. Though many tech companies appear priced to perfection, traders and investors can’t seem to get enough of these high flyers no matter the price. AAPL stock will split after the bell today as it continues to ride the wave of this historic rally as the most valuable company in market history. With the SP-500 at new record highs and the Nasdaq setting records almost daily, the Dow remains about 5% below record territory but working hard to catch up this morning gaping up more than 250 points. With such a massive gap up, we have to consider the possibility of a pop and drop pattern, but I wouldn’t hold my breath waiting for it with such wild exuberance. Markets will be looking to the Fed’s annual Jackson Hole symposium hoping for more market supporting operations and assurance of long term low rates. How long and how high do the markets have to go being propped up by Federal debit before it can stand on its own?

The strong bullish trends continue bouncing of price support levels at the end of the last week. Price patterns are also very bullish in the DIA, SPY, and IWM. While the trend in the QQQ is remarkably bullish, it is also very extended nearly 9% above its 50-day average. With just five of the tech giants dominating the indexes, any stumble could signal a top, so don’t become complacent.

Trade Wisely,

Doug

Comments are closed.