New Records

New records were set yesterday as the bulls continue their relentless drive higher. The SP-500 inked a new all-time high at the same time pandemic hospitalizations topped 100,000, and the daily death toll set a new record of more than 3100. However, the hopefulness of another $900 billion stimulus and record-setting holiday consumer spending continues to inspire higher and higher stock valuations even as the Beige Book suggests the economy is slowing. Let’s party like it’s 1999 but stay focused because a pullback could begin at any time.

Asian markets traded mixed but mostly higher overnight as they reported growing services activity. European markets trade cautiously this morning, currently showing mixed results. U.S futures also appear a bit cautious this morning ahead of earnings reports and Jobless Claims.

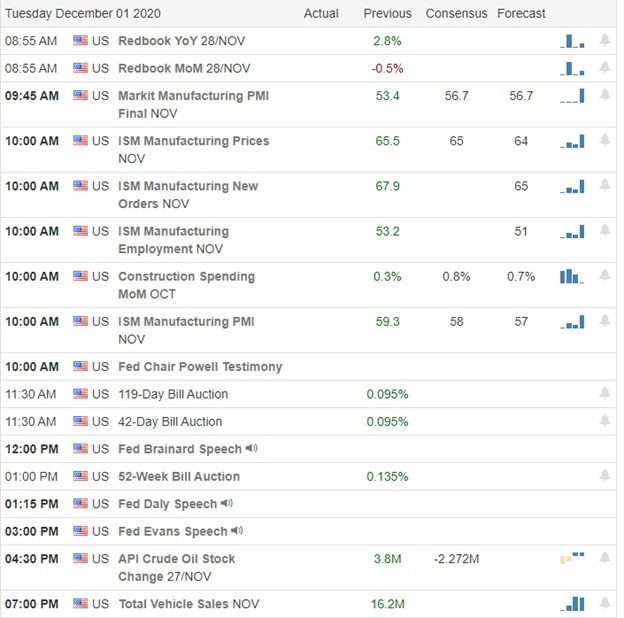

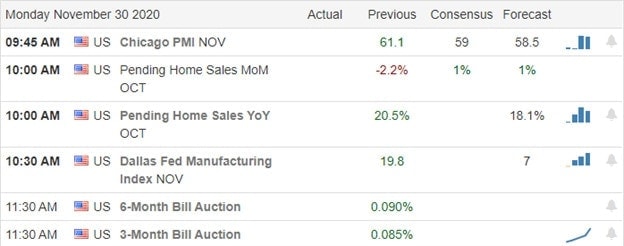

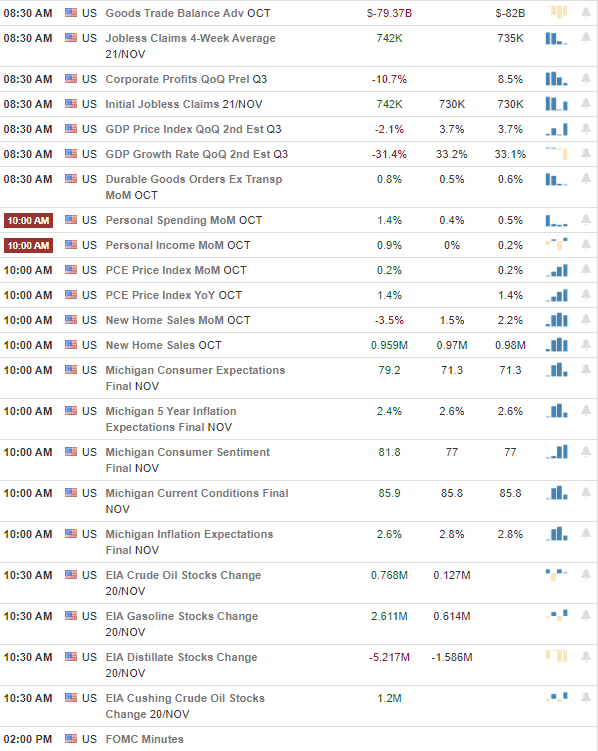

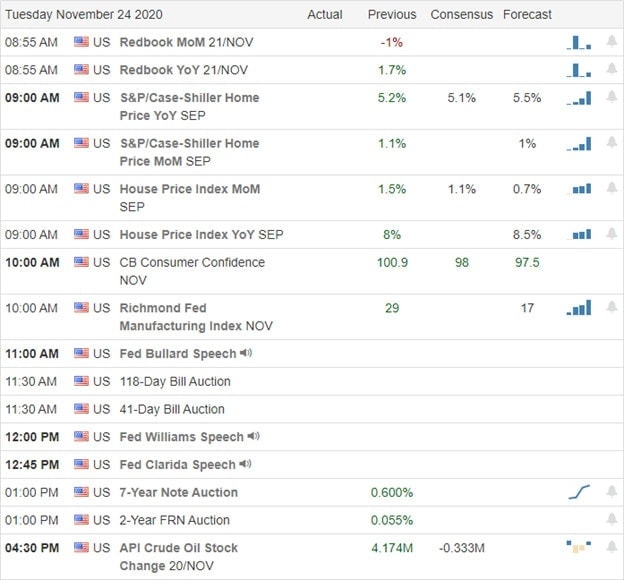

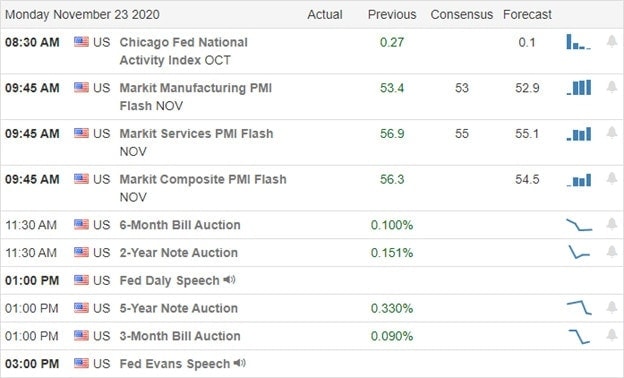

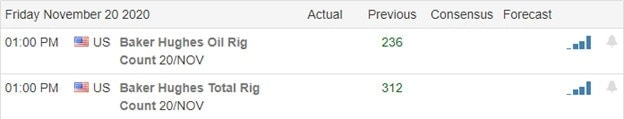

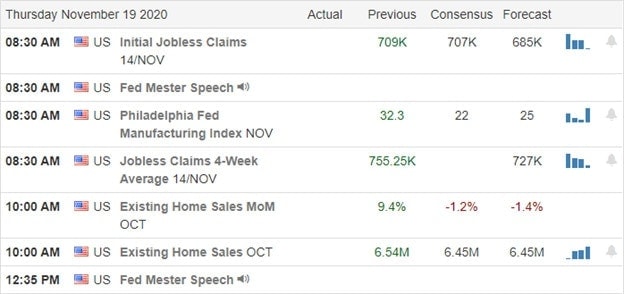

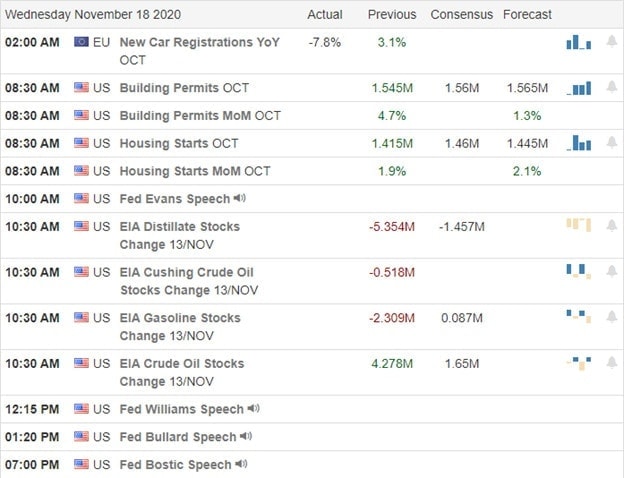

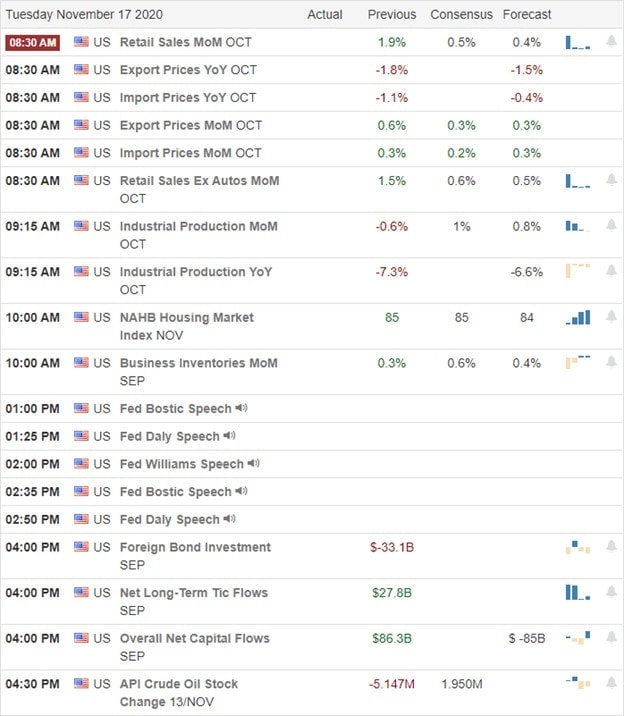

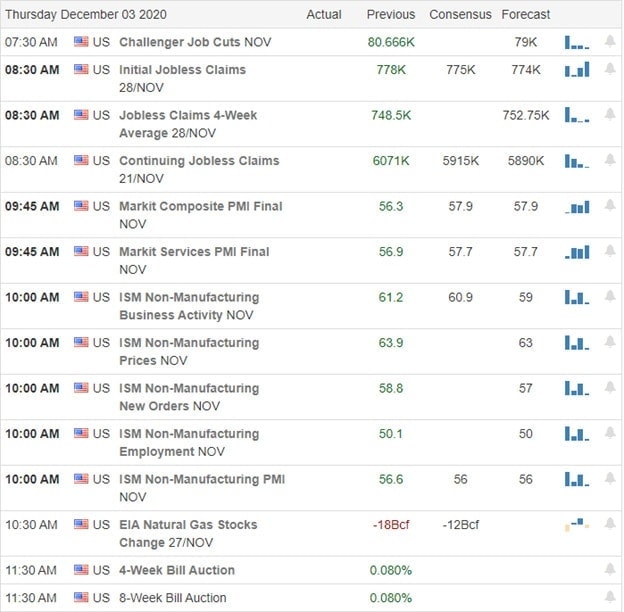

Economic Calendar

Earnings Calendar

We have a busy day on the Thursday earnings calendar. Notable reports include DG, KR, CM, COO, CVRL, DLTH, EXPR, KIRK, LE, MRVL, MIK, OLLI, SIG, SWBI, TLYS, TD, ZUMZ.

News & Technicals’

While we have a growing hopefulness of a bipartisan toned-down stimulus bill, the pandemic’s impacts continue to hit new records. Pelosi and Schumer have made concessions backing a $900 billion stimulus plan rather than the $2.2 Trillion plan that failed to gain traction. With a government threat of a government shutdown on December 11th and a Congressional recess just around the corner, there is not much time to get a deal passed. Yesterday, Congress unanimously passed a bill requiring Chinese companies to adhere to U.S accounting practices or face delisting from U.S. indexes. I suspect it will quickly be signed into law by the president. There may be some tough decisions for investors holding Chinese stocks and could easily create considerable volatility in their price action. Los Angeles issued a stay at home order yesterday as hospitalizations continue to spike around the country and the daily death toll hit a new daily record of more than 3100. The Chief of the CDC says the next few months could be the most difficult in U.S. history, and yesterday Beige Book hinted that the economy is slowing as a result. Keep that in mind as we continue to ignore impacts stretching the indexes higher, setting new record highs.

Technically speaking, the index trends remain incredibly bullish, and the ravenous appetite for high priced stocks continues unabated. Indeed, the record-setting holiday spending and the hopefulness of another stimulus deal could trigger a Santa Claus rally but be careful not to chase or overtrade should we suddenly decide to acknowledge the economic impacts of debit and the pandemic.

Trade Wisely,

Doug