After a brief rest, the bulls are back in a big way, reversing price action overnight to challenge recent record highs. Jerome Powell says the economy is ‘extraordinarily uncertain,’ but looking at the charts’ price action, it would seem there is no price too high for investors. So let the party continue but be very aware of the risk should the markets decide to test price support levels. Remain diligent in your trade planning and avoid the chase with a fear of missing out.

Overnight Asian markets were higher across the board after reporting that China’s manufacturing hit a 10-year high. European markets are surging higher this morning as Pfizer and BioTech both apply for vaccine approvals. Ahead of earnings, ISM, and Powell comments the bulls are stampeding higher this morning, suggesting a Dow reversal of 300 points when writing this report.

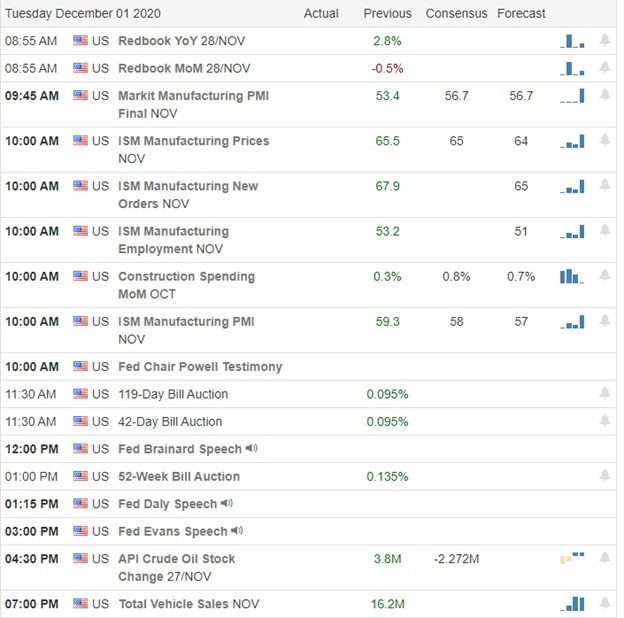

Economic Calendar

Earnings Calendar

We a busier day on the Tuesday economic calendar. Notable reports include CRM, BMO, VNS, BOX, HEP, NTAP, & TCOM.

News and Technicals’

This morning, there is not much to say except that after a brief Cyber Monday rest, the bulls are back on the gas with a significant overnight reversal to test recent market highs. Pfizer and BioTech both apply for vaccine approval in Europe, and it seems as long as we can matain vaccine headlines, the market reacts bullishly. Powell will be speaking again today, defending the Cares Act provisions and calling the economic outlook ‘extraordinarily uncertain.’ However, after a historic November, the bulls appear unconcerned, and no price seems too high as P/E ratios continue to stretch out. Perhaps with Amazon reporting that holiday shopping this year was the biggest in history suggests we move right into the Santa Claus rally.

I mentioned a couple of times yesterday the there was no fear in yesterday’s selloff and the technical patterns in the indexes remained bullish. However, when a 400 point selloff in the Dow is insignificant, it’s also a warning of just dangerous it could quickly become to traders that chase already extended stock prices. Let the party continue but be diligent in your trade planning, taking trades with acceptable risk to a stop and avoiding the chase with a fear of missing out.

Trade Wisely,

Doug

Comments are closed.