Although retail is celebrating a colossal holiday consumer spending spree that set new records, small business sentiment dropped to a new record low. The consumer spending would suggest more market upside on the way in the so-call Santa Claus rally. However, with the SP-500 more than 60% above the March low in the face of pandemic economic impacts, a rest or pullback would not be a big surprise.

Asian markets closed the day modestly lower overnight after reporting a 7-month streak of manufacturing growth. European markets trade mixed but mostly flat this morning, seemingly taking a rest on this last day of November. The U.S. futures point to mixed open with a possible light volume day with traders likely extending holiday vacations and the distraction of Cyber Monday sales.

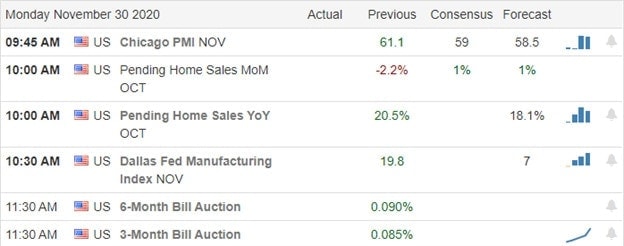

Economic Calendar

Earnings Calendar

On this last day of November, we have a light day of earnings reports. Going through the list, I don’t see any that are particularly notable.

News and Technicals’

According to retail reports, holiday shopping hit new spending records, which is likely to continue with the Cyber Monday sales event today. Don’t be surprised if volumes remain low as many will be distracted surfing the internet to bag a few deals. On the bright side, such a strong showing of consumer spending could spark the so-called Santa Claus Rally into the end of the year. Unfortunately, small business confidence seems to be going in the other direction, dropping to an all-time low according to the Q4 CNBC|SurveyMonkey Small Business Survey. The results show that 53% of small business owners say they expect tax policy & increased government regulation will negatively impact their business. With small businesses as one of the largest job creators, this negative sentiment could see employment numbers struggle in a post-pandemic recovery.

Interestingly the futures don’t seem inspired by the colossal holiday buying spree pointing to a pullback in the pre-market. However, with the SP-500 up more than 60% since the March bottom to set new records despite unemployment and a severely damaged economy, perhaps a rest is not that big of a surprise. Bullish trends remain, but there’s a danger with index prices so elevated from their respective 50-day averages. That said, plan carefully, and don’t be surprised if the volume is a bit light today with traders extending vacations to shop.

Trade Wisely,

Doug

Comments are closed.