Consumer Price Jumped 5%

As the consumer prices jumped 5%, the largest gain in nearly 30-years, the market seemed to have little to no concern. The moral of the story stay with the trend and let’s continue to party like it’s 1999 as long as it lasts. Although we ended the day respecting overhead resistance levels and leaving behind some uncertain price patterns, the VIX squeaked out a new closing low, suggesting inflation is nothing to worry about, at least for now. Now we wait to find out if the FOMC will begin to shift policies next week.

Asian markets traded mixed overnight with modest gains and losses. Across the pond, European markets trade in the green across the board as investors shrug off inflation. With a light day of earnings and economic reports, U.S. futures once again are pumping the premarket, trying to inspire buyers to break overhead resistance to set new record highs. Trade wisely, and have a fantastic weekend, everyone.

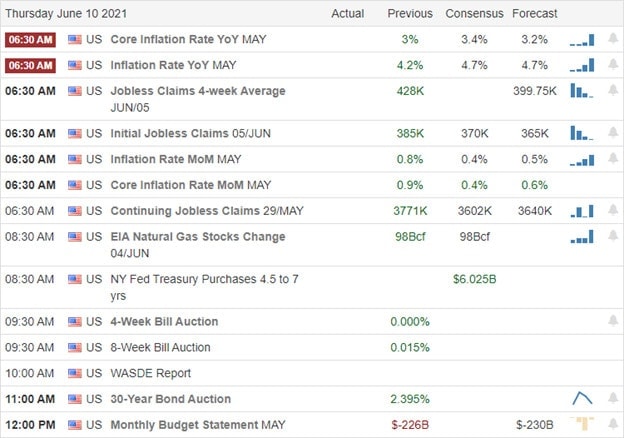

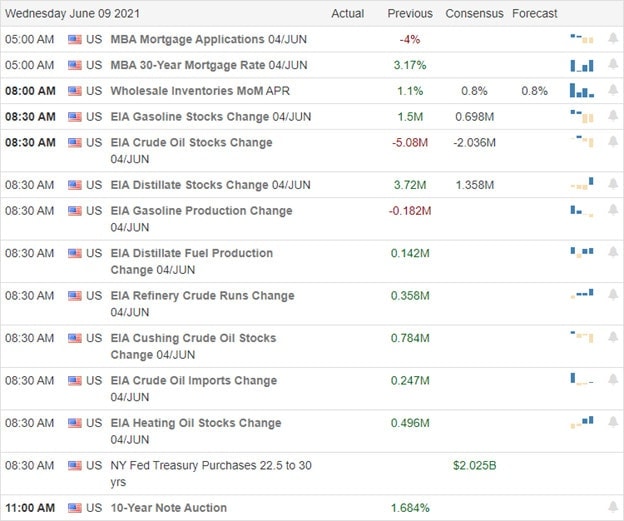

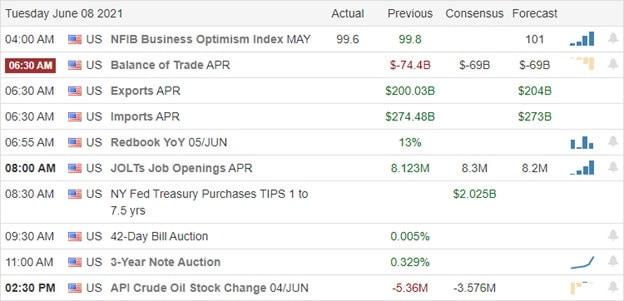

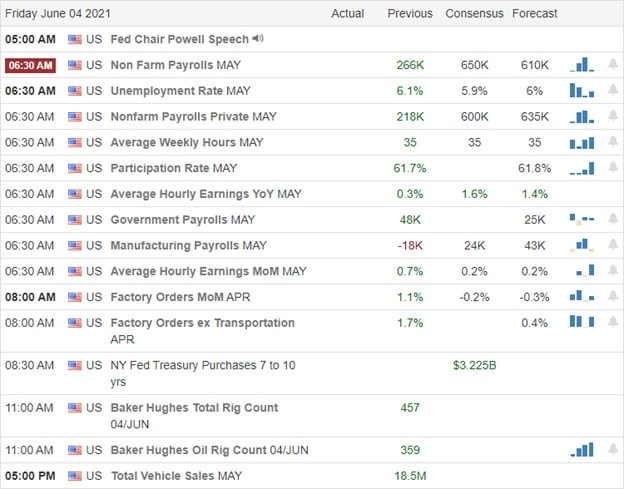

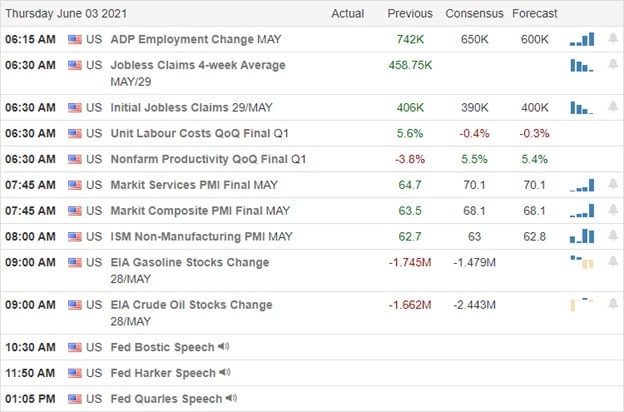

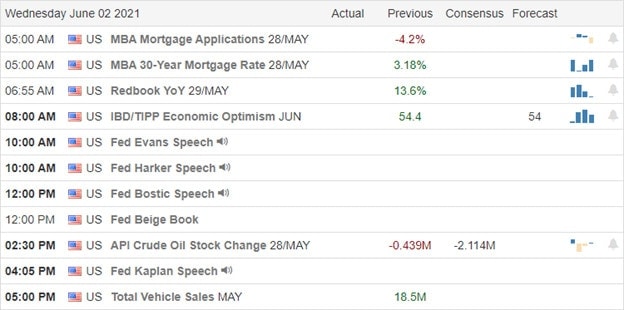

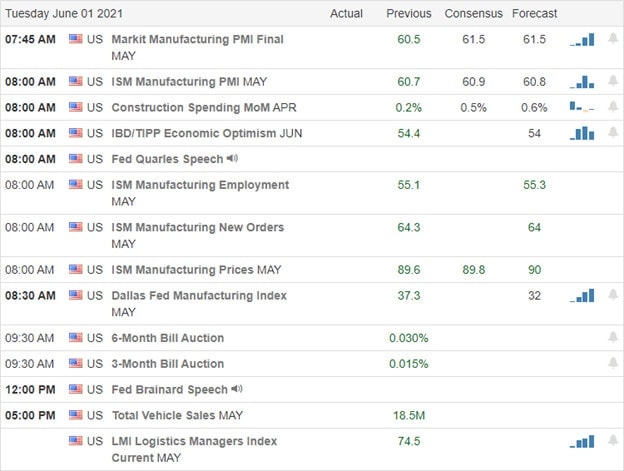

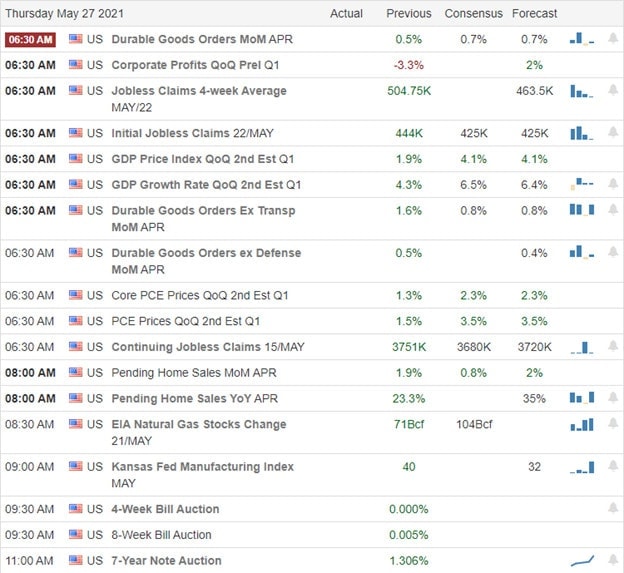

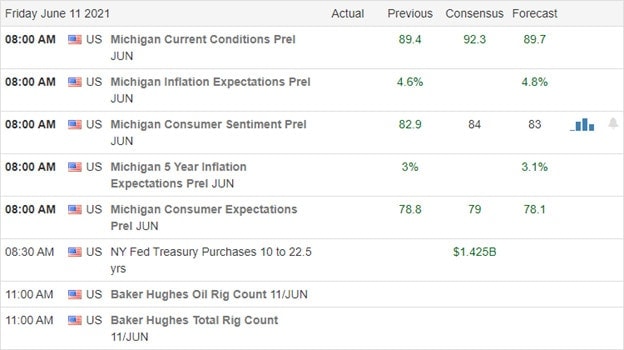

Economic Calendar

Earnings Calendar

We have a slow day of reports on the Friday earnings calendar with 14 companies listed but only two confirmed. Though they are not particularly notable, the verified reports are CMCM & NATH.

News & Technicals’

Although the consumer prices jumped 5% in May, the most in nearly 30-years, the overall market seemed to not really care. Will the FOMC respond to the rising costs? Some are suggesting Fed will stay the course, at least for now. Remarkably, to me, Treasury yields are pulling back this morning, with the 10-year trading at 1.443% and the 30-year dipping to 2.14%, shrugging off the surging inflation. President Biden has endorsed the 15% global minimum corporate tax and a new tax linked to the places where companies make money. Amazon faces another antitrust probe from the European Union as the country steps up its pressure on the tech giants. On Friday, the G-7 nations gathering in Cornwall, England, plan to pledge 1 billion doses of the Covid vaccines to low-income nations.

After the CPI number came in hotter than expected, the futures gapped the market higher buyers seemed to rush in for a brief period, with the Dow surging more than 200 points. However, as prices ran into overhead resistance, the bears pushed back with a nasty whipsaw that filled the gap. Buy the close the Dow left behind a shooting star pattern while the QQQ held firmly to gains through the SPY and IWM retreated. The VIX held a new closing low, suggesting the hot inflation number is of little to no concern though the Absolute Market Breadth Index remained notable weak. Long story short, stay with the trend and continue to party like it’s 1999 but don’t become complacent because someday I suspect the market will someday suddenly care.

Trade Wisely,

Doug