Though futures opened lower Monday evening, the bulls found inspiration overnight as European markets surged to new records after better than expected economic data. With the SPY in striking distance of a new record at the open, it seems unlikely the institutions will miss the opportunity to grab a new headline to kick off the first trading day of June. That said, keep we still have substantial resistance in the QQQ and IWM to overcome. With bond yields ticking higher this morning with inflation pressures growing, that may still be problematic, particularly for the tech sector. Stay focused and flexible as we test price resistance levels.

Overnight Asian markets traded mixed with Chinese factory activity expanding. However, European markets are decidedly bullish this morning on solid data and rallying oil prices. U.S. futures have sharply recovered off opening lows ahead of manufacturing data to kick-off the first trading day in June. Keep in mind that big gaps can create significant price volatility. Plan according.

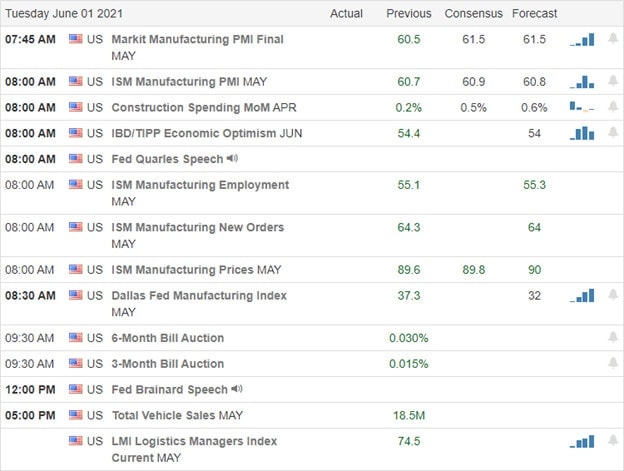

Economic Calendar

Earnings Calendar

We have 27 companies listed on the earnings calendar as we begin trading this short trading week. Notable reports include ZM, Kirk, AMBA, CGC, APPS, & HPE.

News and Technicals’

Futures opened trading lower Monday evening, but the bulls found inspiration to surge higher with the SPY in striking distance of new record highs sometime during the night. Oil prices surged overnight, with the benchmark Brent crude futures up 2.15% and U.S. crude advanced 2.8%. The world’s largest meat processors were hit over the weekend by an organized cyberattack. Australian and North American units were affected, but the Australian attack shut down operations across several states with no indication as to how long the stoppage might last. Tesla is raising prices again due to supply chain pressures in raw materials. Treasury yields tick higher this morning, with the 10-year coming in at 1.6130% and the 30-year rising to 2.2924% after April’s Core inflation number rose 3.1%, which was hotter than expected.

When it comes to the technicals, the DIA and SPY bull trends continue to test record levels, and with this morning’s gap up, the SPY could breakout at the open. Strength in the financial, oil, and healthcare sectors allowed the IWM to recover its 50-day average; however, it still has substantial overhead resistance to overcome. The QQQ is also dealing with overhead resistance, and though the bulls are pushing in the premaket to kick off the first trading day in June, rising bond rates may prove problematic for the tech sector. Getting this close to new records, I can’t imagine that the institutions will pass up on the opportunity to gain the headline but remember, the possibility of pop and drop at resistance also exists. That said, try not to chase overextended stocks at the open. Let’s wait and see if there is a follow-through of buying after the gap.

Trade Wisely,

Doug

Comments are closed.