Perhaps we can break the tight range chop today with all eyes focused on the critical CPI numbers, inflation data revealed before the open. Some suggest the number could come at its highest level in nearly 30-years! Will it inspire the bulls pushing the indexes to new record highs? Or will the number engage the bears, creating some technical issues with the possible topping patterns in the charts? Your guess is as good as mine, so stay focused and buckle up for some price volatility.

Overnight markets traded mixed but mostly higher with modest gains and losses. European markets hover around the flatline as they wait on the U.S. inflation data. Ahead of the CPI, U.S. futures are trying to put on a brave face, but anything is possible by the open, depending on the market reaction. A substantial gap is likely, so plan your risk accordingly.

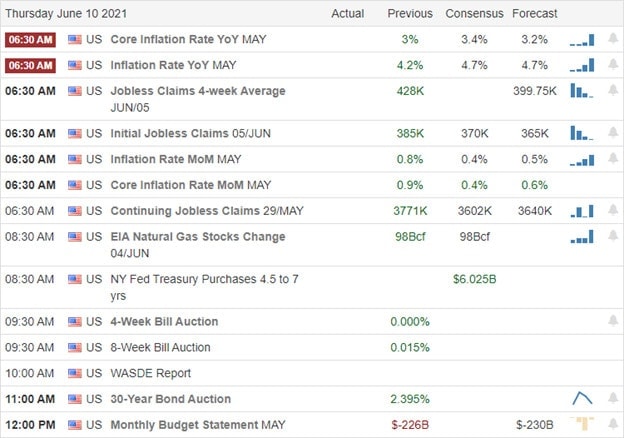

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 20 companies listed with several unconfirmed. Notable reports include XAIR, CHWY, PLAY, PLUG, FSLR, & SIG.

News and Technicals’

The owner of the Keystone XL pipeline, TC Energy, has now offically canceled the project after President Biden revoked an essential permit earlier this year. It would have carried 839,000 barrels per day and employed 1000’s. India reports more than 6,100 daily Covid death in a single day though infection rates have been in decline. According to a government announcement on Wednesday, a new 2.3 million stimulus checks for up to $1400 per person were just sent out. In total, another 4.2 billion in payments. Treasury yields rise slightly this morning ahead of the CPI number, with the 10-year coming in at 1.498% and the 30-year edging higher to 2.173%. More pressure is coming to the tech Giants as the Democrats circulate draft antitrust bills aimed at Apple, Amazon, Facebook, and Google. If passed, it could fundamentally reshape the businesses.

All eyes this morning will be on the CPI numbers revealed an hour before the market open. Some are suggesting the number will come with the highest reading in nearly 30-years. The market has traded in the tight range all week, challenged by overhead price resistance levels yet holding above price supports. What happens next is anyone’s guess, but it will be nice to get enough movement to break the logjam. With the next FOMC meeting just around the corner, today’s number could play a pivotal role in their decisions on dovish, easy money policies. Though U.S. futures are trying to pump up the premarket, the actual open could be much better or worse depending on the reaction. Stay flexible because new market highs could be on the cards or critical technical failures in the index charts if the bears find inspiration. Buckle up for some volatility.

Trade Wisely,

Doug

Comments are closed.