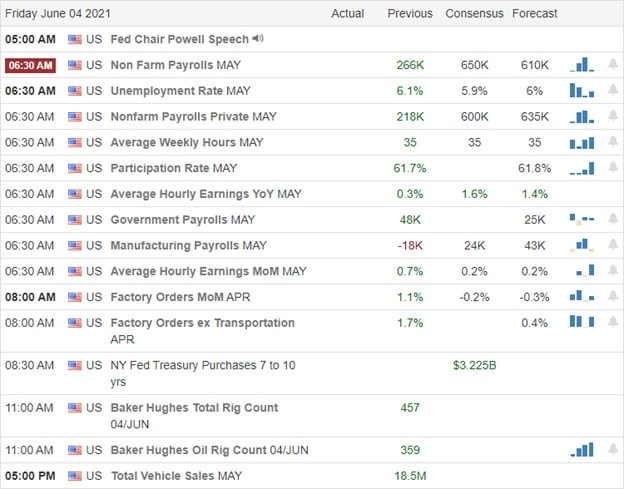

We received a strong dose of price volatility yesterday, but there was very little change technically in the index charts by the end of the day. We are still dealing with overhead resistance and possible topping patterns, and at the same time, the bulls remain vigilant defending price support levels. Today the market may pick a direction depending on how we react to the employment situation numbers. Come in strong, and we could finally get the bulls to challenge resistance levels and perhaps set some record highs. Come in hot, and the bears might act up as they worry about the possible changes to FOMC easy money policies. In short, anything is possible!

Overnight Asian markets traded mixed as the RBI keeps interest rates unchanged. Across the pond, European markets trade flat and slightly lower ahead of the U.S. jobs data. This morning stock futures are taking a wait-and-see stance but prepare for just about anything after the number release an hour ahead of the open. Prepare for more volatility as the market reacts.

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have a very light day with only 12 companies listed. The only notable report on the day is that from HOFT.

News & Technicals’

AMC is seeking approval to boots it’s stock authorization by 25 million shares laying out its case on a YouTube program. Facebook ran into another antitrust issue with the U.k.’s Competition and Markets Authority. The regulatory agency will investigate whether Facebook is abusing a dominant position in the social media or digital advertising markets through its individual data collection. Elon Musk is at it again, tweeting a meme about a couple breaking up and adding the hashtag Bitcoin and a broken heart emoji. Bitcoin fell 4%, and other cryptocurrencies also sank. How much longer will the SEC allow him to manipulate market prices! U.S. Treasury yields traded slightly higher this morning, with the 10-year ticking up to 1.6267% and the 30-year rose to 2.3024%.

Although we had a lot of price volatility yesterday, technically, there was very little change in the index charts. The bulls defend support levels, and the bears seemed to stand their ground defending overhead price resistance levels. The VIX made no decision, and the T2122 indicator ended the day back in the upper range after the bounce. All eyes will be on the Employment Situation number this morning that estimates that it will come in strong. The worry from the market is if the number comes in too hot, it could raise the pressure on the FOMC to act reducing some of the easy money policies. So your guess is as good as mine as to what happens next. Futures currently point to a flat to mixed open, but everything could change rather dramatically after the release of the numbers at 8:30 AM eastern. Stay focused and settle in for another bull/bear fight near overhead resistance.

Trade Wisley,

Doug

Comments are closed.