Slowing U.S. Economy

Economic reports continue to point to a slowing U.S. economy, but the bulls show no signs of concern as the index trends remain bullish in stark contrast to the data. After the data-driven price volatility, the volume quickly declined into a choppy afternoon session, waiting for today’s Employment Situation report. With little on the earnings calendar, the job numbers will be the source of bullish or bearish inspiration as we slide into the weekend. Plan carefully and remember to take some profits because this extended market condition could bring sudden bear attacks, so avoid complacency.

Asian markets had a rough overnight session, wanting clarity on pandemic rules as the lockdowns continue. European markets trade slightly bearish this morning as they wait on the U.S. job data. With a very light day of earnings, all eyes will focus on the Employment Situation number out before the bell. The question is will it inspire the bulls or the bears? We will soon find out, so plan carefully and expect a shot of price volatility as we wrap up another trading week.

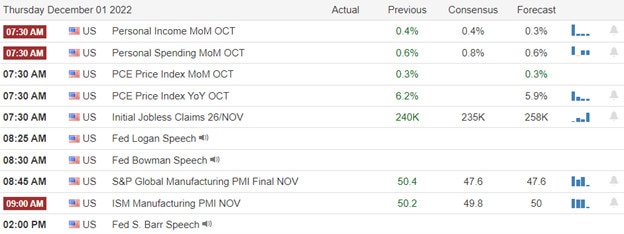

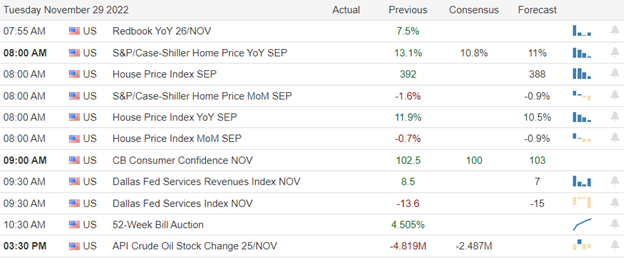

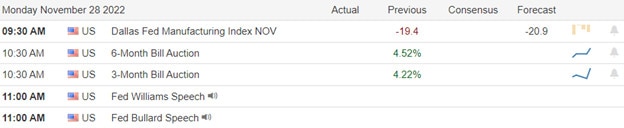

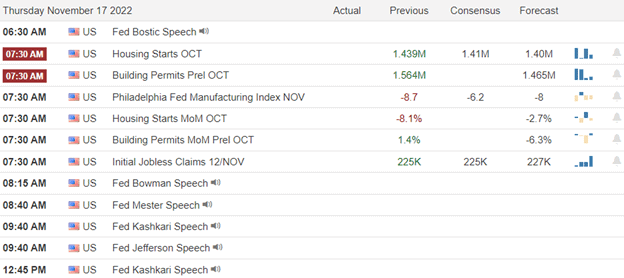

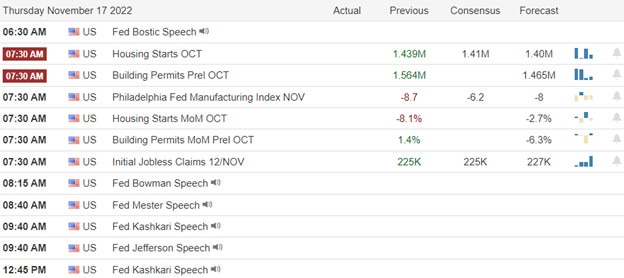

Economic Calendar

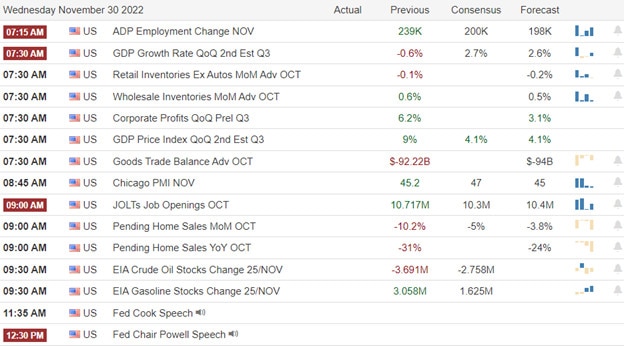

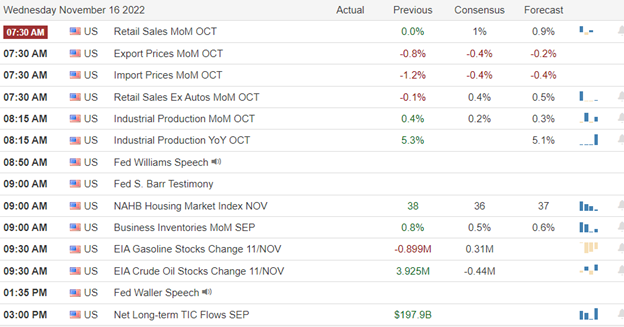

Economic Calendar

We have a light day on the Friday earnings calendar to wrap up the week. Notable reports include CBRL & GCO.

News & Technicals’

While the European Union has dubbed China as a “strategic rival” on different occasions, it is pursuing a different approach from the U.S. Data from Europe’s statistics office showed that China was the third largest buyer of European goods and the most important market for imported EU products in 2021. The importance of China as a market for Europe becomes even more relevant at a time when its economy is struggling from Russia’s invasion of Ukraine.

OPEC+, a group of 23 oil-producing nations led by Saudi Arabia and Russia, will convene on Sunday to decide on the next phase of production policy. The highly anticipated meeting comes ahead of potentially disruptive sanctions on Russian oil, weakening crude demand in China, and mounting fears of a recession. However, RBC Capital Market’s Helima Croft said there was no expectation of a production increase from the upcoming OPEC+ meeting and a “significant chance” of a deeper output cut.

The Senate passed legislation that would force a tentative rail labor agreement and thwart a national strike. A separate vote on adding seven days of paid sick leave to the agreement failed. The legislation now goes to President Joe Biden, who urged Congress to move quickly on its passage.

Economic data continued to roll in, indicating a slowing U.S. economy, and although we saw some selling, the index trends remained bullish in another light volume session. However, as we slide into the weekend, we could get a spark of inspiration today from the Employment Situation numbers. Once again, the T2122 indicator is signaling a short-term overbought condition, but despite so many parabolic-looking charts, we still have no sign the bulls are ready to stop. That said, stick with the trend but be careful not to overtrade, watching for a bearish attack that could begin any time. Remember to take some profit along the way and enjoy the ride as long as it lasts.

Trade Wisely,

Doug