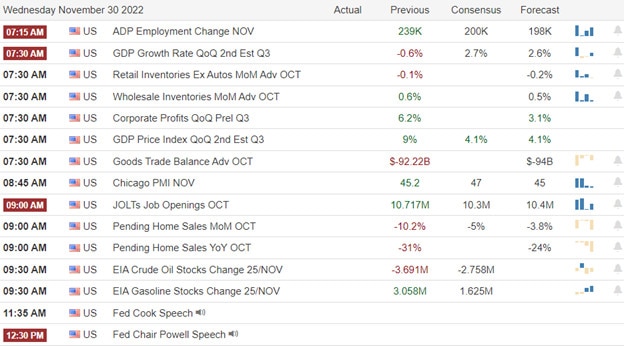

The wait for the GDP report and another speech from Jerome Powell was not a surprise to have produced another frustrating day of low-volume chop. However, today we have a lot of potentially market-moving data, but will it inspire the bulls or the bears? The stakes are high, with the SPY and QQQ near critical support levels, so plan carefully with a likely spike in price volatility. Intraday whipsaws, head fakes, and quick reversals could be seen today as the data rolls out.

Asian markets finished the day primarily bullish after a volatile session as China’s factory activity declined. European markets are moving higher this morning, reacting to a decline in inflation to 10%. U.S. futures traded flat most of the night, but as the premarket pump began, the bulls try to put on a brave face with GDP, housing, and jobs data just around the corner. So, buckle up, keeping in mind that Uncle Jerome will have the final say on today’s overall market sentiment later this afternoon.

Economic Calendar

Earnings Calendar

The Wednesday earnings calendar picked up the pace of reports with nearly 30 confirmed though several are tiny small caps. Notable reports include DCI, FIVE, FRO, HRL, LZB, NTNX, OKTA, WOOF, PSTG, PVH, RY, CRM, SNOW, SPLK, SNPS, TITN & VSCO.

News & Technicals’

A Nov. 9 software update included an additional AirDrop feature applying only to iPhones sold in mainland China. AirDrop, which allows users to share content between Apple devices, has become important in demonstrators’ efforts to circumvent authoritarian censorship. The feature relies on wireless connections between phones rather than internet connectivity, placing it beyond the scope of internet content moderators. While Chinese authorities could gradually unwind restrictions in March, zero-Covid policies are starting to hurt global confidence in the country’s industrial supply chains, said Li Daokui, Mansfield Freeman professor of economics at China’s Tsinghua University. In the short term, supply chains will be largely unaffected since factories are still operating, Li, a former advisor to the People’s Bank of China, said in an extended interview with CNBC’s “Squawk Box Asia” on Wednesday. If China relinquishes its Covid-zero policies, it should be able to get back to a “magic” growth rate of 5% to 6%, which is the right amount of growth given the current size of China’s labor market.

The Euro Zone reported slightly easing inflation to 10% due to a modest decline in energy prices. Energy and food continued to contribute to the lofty inflation figures, but with a noticeable drop in the former. According to Eurostat, energy is expected to have stood at an annual rate of 34.9% in November, compared with 41.5% in October. With inflation at record highs and a number of rate hikes under its belt, markets are awaiting details on how and when the European Central Bank will sell bonds. In October, ECB President Christine Lagarde said the discussions over bond sales would consider three main factors. “It is appropriate that the balance sheet is normalized over time in a measured and predictable way,” Lagarde said Monday.

Tuesday turned out to be another frustrating day of choppy price action accompanied by low-volume waiting on the GDP and more conversation from Jerome Powell. Perhaps today, with all the data coming our way, the bulls or bears will find inspiration, breaking the wide-range consolidation in the index prices. The good news is that the selling has successfully relieved the short-term overbought condition providing some upside space if today’s reports can inspire the bulls. On the other hand, both the SPY and QQQ are flirting with critical price support, so if it happens to be the bears that find inspiration today, a painful market selloff could result. It would be wise to plan for considerable price volatility, including substantial intraday whipsaws, head fakes, and reversals.

Trade Wisely,

Doug

Comments are closed.