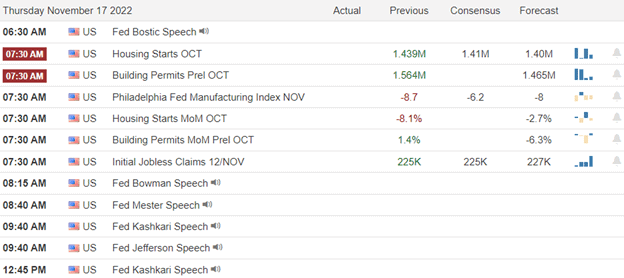

The theme of the week continued with Thursday producing another big point whipsaw as robust economic data encouraged more hawkish statements from Fed members. Though the recovery rally left a lot of bullish engulfing patterns across charts, index volumes remained noticeably low with significant overhead resistance that the bulls have yet to breach. As you plan forward, keep in mind the holiday week ahead, and the likelihood of choppy light volume as traders hit the airports and byways.

After Japan reported the highest inflation in 40 years, the Asian markets closed the day mixed and relatively flat. However, European markets trade decidedly bullish this morning as rate hikes and recession worries linger. The U.S. futures point to another morning gap up, hoping to capitalize on yesterday’s recovery rally with housing data ahead as we slide into the weekend and toward the Thanksgiving holiday. Expect the volatility to continue.

Economic Calendar

Earnings Calendar

The Friday earnings calendar only has eight confirmed reports. Notable reports include BKE, FL, & JD.

News & Technicals’

Swedish and Danish investigators are investigating a flurry of detonations on the Nord Stream 1 and 2 pipelines on Sept. 26 that sent gas spewing to the surface of the Baltic Sea. The explosions triggered four gas leaks at four locations — two in Denmark’s exclusive economic zone and two in Sweden’s exclusive economic zone. The Swedish Prosecution Authority said in a statement that “residues of explosives have been identified on several of the foreign objects seized,” according to a translation.

St. Louis Fed President James Bullard noted that “the policy rate is not yet in a zone that may be considered sufficiently restrictive.” Using the so-called Taylor Rule for monetary policy, Bullard suggested the proper zone for the fed funds rate could be in the 5%-7% range, higher than current market pricing and unofficial Fed forecasts indicate.

Internal Slack messages shared with CNBC showed engineers and other employees posting goodbye messages to a “watercooler” chat group during the 5 p.m. ET Thursday deadline that Musk set just a day earlier. Hundreds of salute emojis (which convey the message “thank you for your service”) streamed by, along with dozens of goodbye messages. Amazon will continue to lay off employees in the coming year, CEO Andy Jassy wrote in a memo to workers on Thursday. The company began informing workers this week that they were being let go. “I’ve been in this role now for about a year and a half, and without a doubt, this is the most difficult decision we’ve made during that time,” Jassy wrote.

Thursday proved to be just another big point whipsaw, with the Dow swinging more than 350 points from low to high, reacting to better-than-expected economic data and hawkish Fed statements. However, after gapping sharply lower at the open, it was nothing but buying the rest of the day, leaving behind a lot of bullish engulfing patterns in the charts. Unfortunately, the index volumes were markedly low, and bulls still have significant overhead yet to breach. So, take caution over overtrading as we head into the weekend, remembering subsequent week volumes are likely to decline sharply due to the holiday.

Trade Wisely,

Doug

Comments are closed.