Combine Chinese lockdown protests, a robust retail response to Black Friday, a big return home travel day, and the Cyber Monday event distractions, and we have an anything is possible trading day. The low-volume rally Wednesday and Friday puts the Dow in an overextended condition, with many of its component stocks shorting parabolic appearance. However, the hopes of a Santa Claus rally fueled by better-than-expected retail sales could keep the bulls inspired despite the worries of additional rate increases and worldwide recession.

Lockdown protests in China and the biggest-ever rate hike in New Zealand brought out selling across all Asian indexes overnight. However, European markets are responding in kind to the Chinese restrictions and public protests. U.S. futures also suggest a bearish open with little inspiration on the earnings and economic calendars with the distraction of Cyber Monday shopping events.

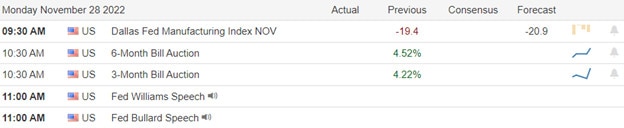

Economic Calendar

Earnings Calendar

We have small-cap companies reports primarily to kick off the new trading week. Notable reports include ARWR and AZEK.

News & Technicals’

Rare protests broke out across China over the weekend as groups of people vented their frustration over the zero-Covid policy. The unrest came as infections surged, prompting more local Covid controls, while a central government policy change earlier this month had raised hopes of a gradual easing. However, it was not immediately clear whether the protests reached a meaningful scale in a country of 1.4 billion people or whether a broad demographic participated. Despite this weekend’s protests, analysts said China wouldn’t likely make major changes to its Covid policy in the near future. “Without a clear guidance from the top, local officials are inclined to play safe by sticking to the existing zero-Covid stance,” said Larry Hu, chief China economist at Macquarie. “It upset many people, who expect[ed] more loosening following the ’20 measures’” announced earlier this month. “In the short term, the Covid policy will only be fine-tuned without moving the needle,” said Bruce Pang, chief economist and head of research for Greater China at JLL.

According to Adobe, consumers spent a record $9.12 billion online shopping during Black Friday this year. Overall online sales for Black Friday were up 2.3% year-over-year. In addition, buy Now Pay Later payments increased by 78% compared with the past week, beginning Nov. 19, as consumers continue to grapple with high prices and inflation. Walmart took the top spot among shoppers who are searching online for Black Friday discounts, according to data from Captify. Last year, Amazon topped the ad tech company’s list, but this year fell to fourth place as of Friday morning. Retailers are battling for shoppers’ eyeballs and wallets amid an unusual holiday shopping season clouded with sky-high inflation.

Better-than-expected Black Friday sales results, protests in China, holiday return travel, and Cyber Monday distractions set the stage for an anything is possible trading day. We have little to inspire the bull or bears on the earnings and economic calendars, so watch for sensitivity to the news cycle. The extremely low-volume rally before and after the holiday has the T2122 indicator back in the bearish reversal zone, with Dow stocks showing the most extreme parabolic extensions. That said, we should not rule out the possibility of additional upside pressure with all the financial news hype of a Santa Claus rally. Black Friday sales may help fuel that fire while the worries of a worldwide recession continue to loom.

Trade Wisely,

Doug

Comments are closed.