A smaller-than-expected rise in producer prices and geopolitical concerns served up another whipsaw day as the Dow shifted more than 600 points from high to low. The substantial overhead resistance and uncertainty of the market-moving economic reports we face this morning also played a role. Despite the volatility, the bulls remain in control, and although very dangerous to the trader, the huge point intraday swings have not technically damaged the index charts. However, plan carefully, as a busy day of earnings and economic reports could quickly produce another wild, emotionally driven ride today.

Asian markets closed mostly lower overnight. With U.K. inflation topping a 40-year high and the geopolitical tensions of the Poland missile strike, European markets are trading red across the board this morning. With a mix of early morning earnings results and the uncertainty of market-moving economic reports before the open, U.S. futures suggest a flat to slightly bearish open. However, anything is possible after the data is revealed, so plan carefully.

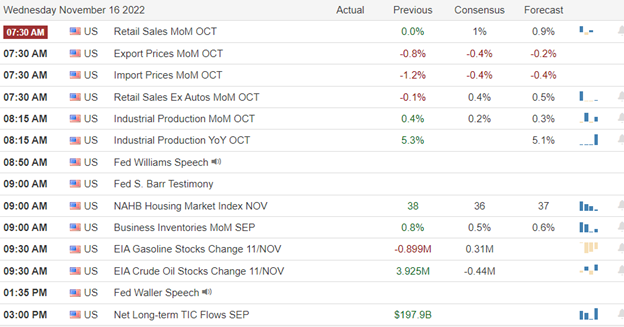

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have nearly 30 companies confirmed, but many are non-market-moving small-cap names. Notable reports include CSCO, LOW, NVDA, BBWI, HP, KLIC, MANU, SONO, TGT, TJX, VSCO, & WSM.

News & Technicals’

Crypto.com CEO Kris Marszalek has taken to Twitter, YouTube, and the airwaves to reassure customers that their deposits are safe and the company is on solid footing. However, in the last few months, the company has reportedly cut over one-quarter of its staff, and concern has mounted since FTX’s collapse last week. “I understand that right now in the market, you’ve got a situation where everyone is done taking peoples’ word for anything,” Marszalek told CNBC on Tuesday.

Lowe’s reported third-quarter earnings Wednesday, beating analyst expectations. However, the home improvement retailer also lowered the top end of its full-year revenue guidance. Lowe’s reported results a day after rival Home Depot’s earnings topped expectations. In addition, Amazon has begun laying off employees in its corporate and tech workforce. CEO Andy Jassy has moved aggressively to cut costs across Amazon, and the company previously said it would freeze hiring in its corporate workforce.

Economists polled by Reuters had projected an annual increase in the consumer price index of 10.7%, and October’s print marks an increase from the 40-year high of 10.1% seen in September. “Indicative modeled consumer price inflation estimates suggest that the CPI rate would have last been higher in October 1981, where the estimate for the annual inflation rate was 11.2%,” the ONS said.

Tuesday served traders another whipsaw day, surging in the morning on a smaller-than-expected rise in PPI but pulling back by the close facing an uncertain Retail Sales report. Geopolitical-political concerns also played a role, with the Dow dangerously swinging more than 600 points from the day’s high to the low. Along with a busy economic calendar that will reveal the October retail numbers, we also have several big retailers fessing up to quarterly results. Index charts remain bullish; however quite dangerous due to the substantial point whips and the uncertainty of the path forward. I suspect with all the data coming our way today, wild price gyrations are likely to continue, so avoid overtrading and plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.