Though yesterday’s economic data was primarily bearish, Powell’s statement of slower rate increases triggered a powerful short squeeze ripped through recent price resistance levels. The emotional move was remarkable, considering rate increases will continue to a restrictive level according to the chairman’s comments. So, the question for today is, can the bull hold or even follow through to the upside with another busy morning of market-moving economic data? Expect more wild price gyrations as this very emotional market reacts.

While we slept, Asian markets rallied in response to the Fed’s smaller rate hikes. Likewise, European markets are trading with bullish energy across the board as the Powell comments reverberate worldwide. However, U.S. futures point to a slightly lower open, possibly suffering from a little hangover after parting hard yesterday afternoon with another big round of economic data just ahead.

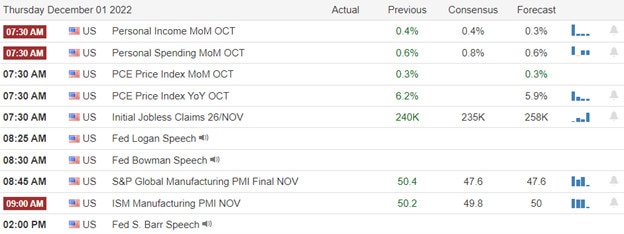

Economic Calendar

Earnings Calendar

Notable reports include AMBA, AOUT, BIG, CHPT, DBI, DG, GIII, KR, LI, MANU, MRVL, PCEO, TD, ULTA, VEEV, WEBR, & ZS.

News & Technicals’

The 27 countries of the European Union agreed in June to ban the purchase of crude oil from Dec. 5. They have been working on the details ever since. The EU discussed a $62 barrel limit this week, but Poland, Estonia, and Lithuania refused, arguing it was too high. India and China are crucial to the success of the ban. But India’s Petroleum Minister Shri Hardeep S Puri told CNBC in September: “We will buy oil from Russia, we will buy from wherever.”

A year after being promoted to the co-CEO role alongside Marc Benioff, Bret Taylor is leaving Salesforce. It’s the second time in less than three years that Benioff has lost a co-CEO. Keith Block held the position for 18 months before leaving in 2020.

Former FTX CEO Sam Bankman-Fried said he’d had a “bad month” but denied committing fraud at his crypto exchange. Bankman-Fried spoke at the Dealbook Summit weeks after FTX filed for bankruptcy protection amid a cryptocurrency meltdown. He also started Alameda Research, a crypto hedge fund that allegedly commingled FTX customer funds with trading funds. Yet, the former FTX CEO claims he committed no fraud.

Jerome Powel triggered a powerful short squeeze Wednesday, stating a slower pace of rate increases is possible beginning in December, with increases continuing to a restrictive level. The emotional reaction to was nothing short of remarkable as the indexes sliced right through resistance levels, and the SPY popped its 200-day average for the first time since last April. Interestingly, most of the economic data delivered yesterday were bearish, indicating that the economy is slowing down. So, now the big question is can it hold or follow through? This morning we face Jobless Claims, a Core PCE reading, PMI MFG., ISM MFG. numbers meaning a volatile morning of price action is likely.

Trade Wisely,

Doug

Comments are closed.