Concerns around Chinese protests and hawkish Fed statements allowed the bears to exploit some weakness in the bullish armor on Monday. Although the pullback may have been painful for those that jumped into trades late last week, the selling produced little to no technical damage in the index charts. That could change if the bears find the inspiration to follow through to the downside today, but directional momentum remained unclear with volume so low yesterday.

Asian markets rebounded during the night, led by Hong Kong, up 5.24% as Chinese protests subsided. This morning, European markets trade primarily positively in a choppy session trying to gauge the Chinese lockdowns. U.S. future currently suggests a flat to slightly bullish open ahead of earnings and economic data as both bulls and bears struggle to find momentum in a low-volume environment. Plan for the choppy and challenging price action to continue as hawkish FOMC member statements raise uncertainty about the path forward.

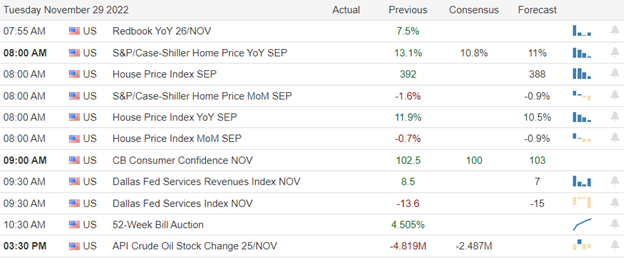

Economic Calendar

Earnings Calendar

The Tuesday earnings calendar is a bit busier, but the market-moving reports continue to dwindle. Notable reports include BZUN, BILI, CMP, CRWD, HE, HIBB, INTU, NTAP & WDAY.

News & Technicals’

Top U.S. health officials said China’s zero Covid strategies are ineffective in controlling the virus, and Beijing should focus on vaccinating the elderly. The White House, in a statement, said the Chinese people have the right to protest peacefully. Over the weekend, riots broke out against Covid lockdowns in Beijing, Shanghai, Urumqi, and other cities. Mainland China reported the first decline in daily Covid infections in more than a week on Monday. There was no indication of new protests after public demonstrations over the weekend. Stringent Covid controls this year have weighed heavily on business activity and economic growth in China.

S&P Global Ratings earlier this month affirmed its positive outlook on the country, citing a net external creditor position and the implementation of some of the government’s long-desired structural reforms. However, South Africans have faced rolling blackouts as Eskom — which has long been a thorn in the side of the country’s economy — contends with shortfalls in generation capacity due to equipment failures and diesel shortages. Headline inflation rose from an annual 7.5% in September to 7.6% in October, defying the South African Reserve Bank’s expectations for price pressures to ease.

In a series of tweets, Twitter owner Elon Musk claimed that Apple had threatened to remove the Twitter app from the App Store as part of its app review moderation process. “Apple has also threatened to withhold Twitter from its App Store, but won’t tell us why,” Musk tweeted.

Although the bears found a weakness in the bullish armor, Monday’s selling may have raised some concerns, but there was little to no technical damage in the index charts. The DIA remains the strongest of the indexes, be it a bit parabolic, while the QQQ continues to lag behind. News of Apple’s production problems due to Chinese lockdowns and protests only adds uncertainty to the tech sector. Perhaps this afternoon’s reports from HPE, INTU, and NTAP can boost the lacking sector momentum. The hawkish statements from the FOMC committee members cloud the direction forward and will likely keep price volatility high until the next meeting in mid-December. Hopefully, the volume will pick up today as traders return to work and holiday sales deals end.

Trade Wisely,

Doug

Comments are closed.