The bulls ran hard Tuesday with the dollar pulling back and the anticipation of strong earnings results from the titans, but unfortunately, big tech disappointed and delivered weak forward guidance. However, the norm of late is for significant pre-market recovery from overnight lows, and today that pattern is repeating. Although the market has primarily ignored bearish economic reports this week, we should still take note of the Mortage Apps, International Trade, Inventories, New Home Sales, and Petroleum numbers out this morning. Though technical conditions have improved, watch overhead resistance levels and plan for the challenging price action to continue.

During the night, Asian markets rallied despite the Australian inflation rate hitting a 32-year high. However, European markets trade flat to slightly lower in a volatile session. With a big day of earnings hope and several potential market-moving economic reports, U.S. futures are well off their overnight lows after the disappointment of big tech results. Watch for the possibility of a pop-and-drop or big-point whipsaw, keeping in mind the Durable Goods, GDP, and Jobless Claims figures before the bell Thursday.

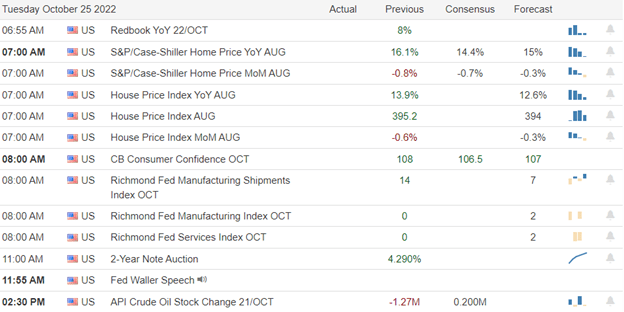

Economic Calendar

Earnings Calendar

The ramp-up continues with nearly 150 companies listed on the Wednesday earnings calendar. Notable reports include AEM, ADP, BA, BOOT, BSX, BMY, CHDN, COUR, DLR, F, GRMN, F, GRMN, GD, HOG, HLT, KLAC, KHC, LC, MAS, META, NSC, OLN, ORLY, OC, PTEN, PPC, R, STX, NOW, SAVE, TMO, UPWK, VFC, WM, & WING.

Sorry everyone has some internet trouble this morning, so I only had time for a short blog this morning.

Trade Wisely,

Doug

Comments are closed.