Though the relief rally has proved impressive, the shooting star patterns left behind in many charts warrant some extra caution that a profit-taking pullback may be just around the corner. Unfortunately, the tech giant reports have created possible failure patterns in the SPY and QQQ under their 50-day moving averages, adding to the uncertainty. Nevertheless, with a busy morning of economic data and earnings and another 75 basis point rate increase expected next week, it may be wise to capture some profits should the bears find some inspiration heading into the weekend.

Asia markets had a rough session, with Hong Kong stocks falling to 2009 lows as the BOJ holds rates steady. European markets trade lower across the board due to ECB rate increases and disappointing earnings results. With the big tech disappointments, the Nasdaq futures point to a bearish open pulling the other indexes lower as we wait on a flurry of earnings and potentially market-moving economic reports. It has been a wild week of price action, and I suspect it will continue today as the market begins to focus on the pending rate increase next week.

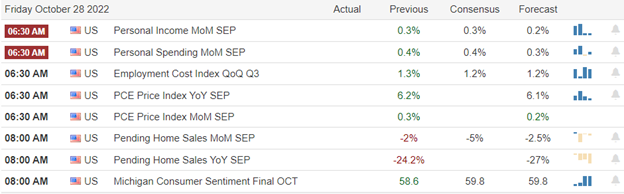

Economic Calendar

Earnings Calendar

We get a little break on Friday; though more than 80 companies are listed, many are unconfirmed. Notable reports include ABBV, AB, AON, ABR, BLUM, GTLS, CL, XOM, GWW, LYB, NWL, NEE, NEP, & SNY.

News and Technicals’

Amazon reported third-quarter results on Thursday that missed analysts’ estimates. It also gave a disappointing sales forecast for the fourth quarter. The stock sunk in extended trading. Apple reported fiscal fourth-quarter earnings on Thursday that beat Wall Street expectations on revenue and earnings per share. However, Apple came up short versus revenue expectations in core product categories, including the company’s iPhone business and services. Intel plans up to $10 billion in cost reductions and efficiency improvements in the next three years. In addition, the chipmaker said in the quarter that it would make chips for MediaTek.

CNBC’s David Faber reported that Tesla CEO Elon Musk is now in charge of Twitter. As a result, Twitter CEO Parag Agrawal and finance chief Ned Segal have left the company’s San Francisco headquarters. However, the CEO of Bank of America, one of the financiers of Elon Musk’s Twitter takeover, doesn’t appear worried about the deal. When asked if he would lose sleep over it, he said: “I’ve got experts that handle the clients, and I don’t lose sleep on them. Of course, I lose sleep for many other things, but not for that.” Musk secured equity financing from an array of investors, including technology firms, and debt financing from several investment banks. But with the rout in technology stocks this year and investors cautious about risky assets, that debt could be hard to sell to investors.

Russia’s invasion of Ukraine pushed natural gas prices to trade at historic levels back in August. However, these have significantly come down since then. “With gas storage near full, LNG inflows in oversupply, and favorable mild autumn weather, prices are doing the work to keep the system balanced as commodities trade in the present,” Ehsan Khoman, head of commodities research at MUFG Bank, told CNBC via email. But Europe’s energy crisis isn’t over, and analysts warn European policymakers against complacency.

The considerable bull run has been impressive, but the last couple of days of price action hints at an overextended condition with topping shooting star patterns in many charts. Of course, the trouble in the tech giant reports is to blame for the uncertainty, and the AMZN miss yesterday afternoon didn’t help the situation. Before the bell, we get the Feds favored Core PCE numbers in the Personal Income and Outlays report. The consensus estimate is the year-over-year increase despite the historic rate increases of late. Should the actual number come in hot, the bears could be encouraged to attack, so expect some pre-market price volatility. We will also have to deal with the Employment Cost Index, Consumer Sentiment, and Pending Home Sales reports as the QQQ struggles to hold the recent uptrend. Finally, while the DIA and IWM enjoy the benefit of their 50-day averages as price support, the SPY and QQQ show potential failure patterns below their 50-day, making for some uncertainty as we head into the weekend with an FOMC rate increase expected next week.

Trade Wisely,

Doug

Comments are closed.