Big Bank Earnings

Friday’s big bank earnings failed to inspire the bulls as Middle Eastern uncertainty, declining consumer sentiment, and rising oil and bond yields worried investors headed into the weekend. All last week we dealt with a premarket pump that whipsawed by the end of today and it looks as if the same game plan has started for Monday. Today we have Empire State figures, bond auctions, and Fed speeches with a couple of notable earnings reports for the bulls or bears to find inspiration. However, with about 98% of companies within their blackout period don’t be surprised if we whipsaw on anemic volume.

Overnight Asian markets closed red across the board with the Nikkei leading the selling down 2.03% waiting on Key economic data this week. European markets have recovered from early losses to show modest gains at the time of writing this report despite the Middle East war worries. However, U.S. futures point to a bullish gap up open with high hopes on 4th quarter earnings results.

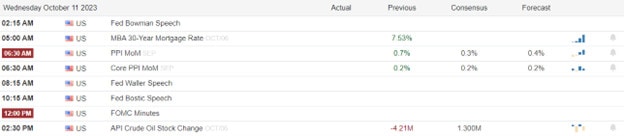

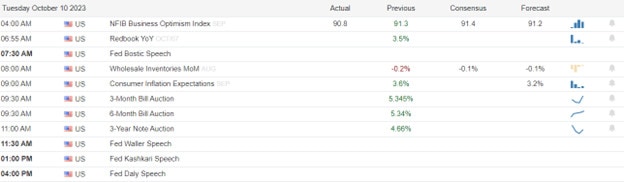

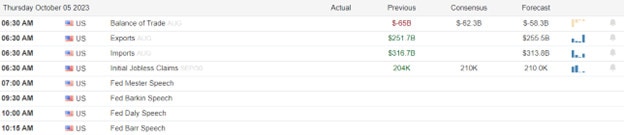

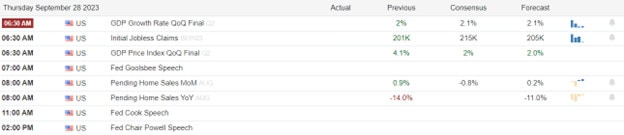

Economic Calendar

Earnings Calendar

Notable reports for Monday include SCHW and ELS.

News & Technicals’

Pfizer, the pharmaceutical giant that produces a Covid treatment and vaccine, lowered its earnings and revenue outlook for the year on Friday. The company’s shares fell in after-hours trading. The company said that the demand for its Covid products has declined, as the Covid booster rollout has faced challenges and the Covid cases have become less severe for many people who have been vaccinated or infected before. Pfizer also said that it expects more competition from other Covid treatments and vaccines in the future.

Rite Aid, a drugstore chain that operates in the U.S., has filed for bankruptcy protection under Chapter 11 in New Jersey. The company has also named Jeffrey Stein as its new CEO, who will lead the company’s restructuring plan. Rite Aid has been struggling with declining sales, high debt, and legal troubles related to the opioid crisis. Rite Aid faces fierce competition from its rivals, such as CVS and Walgreens, which have expanded their healthcare services to cope with the challenges in their retail businesses.

The conflict between Israel and Hamas has escalated into a deadly humanitarian crisis. Hamas, a militant group that controls Gaza, launched a surprise attack on Israel last week, firing hundreds of rockets and killing more than 1,400 people, mostly civilians. Israel responded with a massive air campaign that has killed at least 2,670 people in Gaza, mostly militants. Israel also cut off the supply of food, water, fuel, and electricity to Gaza, and warned the residents of northern Gaza to flee before launching a ground invasion to destroy Hamas. The international community has called for an immediate ceasefire and a peaceful resolution of the conflict.

The market ended the day with losses on Friday, despite the big bank earnings reports from several U.S. banks. but the rising oil prices, bond yields, and uncertainty of the war in the Middle East kept the bears engaged. The weak consumer sentiment report from Michigan also worried investors about the strength of the pending 4th quarter reports. Today we have a light earnings and economic calendar but once again the premarket pump we experienced all last week is underway despite weakness in Asia and Europe. Watch for whipsaws with about 98% of all companies within their blackout period momentum could be lacking as we test overhead resistance levels.

Trade Wisely,

Doug