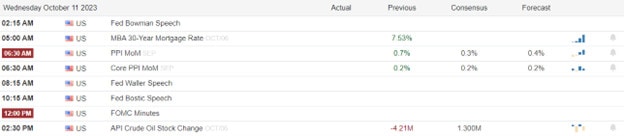

After a strong bull run on Tuesday, the pending inflation data brought in some profit-takers making for a choppy afternoon session. Bond yields on the long end of the curve continue to weaken and the better-than-expected results out of PepsiCo gave the bulls an extra dose of optimism. This morning’s trades will have Mortgage Apps and a PPI report before the bell so plan to opening gap up or down depending on the data. After that Fed Speakers and bond auctions until the afternoon release of the FOMC minutes that usually provides a shot of volatility. Plan for just about anything today and remember the uncertainty continues into Thursday with the pending CPI report.

During the night Asia markets closed bullish with the KOSPI leading the way up 1.98%. However, European markets are taking a cautious approach ahead of inflation data trading mixed with modest gains and losses this morning. U.S. futures on the other hand are putting on a brave face pushing for a bullish open ahead of the market-moving data as bond yields on the long end of the curve continue to decline. Buckle up because what happens next is anyone’s guess.

Economic Calendar

Earnings Calendar

There are no notable earnings for Wednesday.

News & Technicals’

The conflict between Israel and Hamas has not caused much reaction in the global markets, as they have only seen a slight rally. However, some experts warn that the markets have not fully accounted for the risks that the conflict poses. Bob Savage, the head of markets strategy and insights at BNY Mellon, said that Israel has enough budget and GDP to withstand a “long conflict” that could last more than eight weeks. He also said that the conflict could lead to higher inflation risks, as it could increase oil prices and defense spending. Savage advised the markets to be more cautious and vigilant about these risks.

The recovery of China’s consumption growth from the pandemic is expected to be slow and gradual, according to analysts from UBS and HSBC. Christine Peng, head of the Greater China consumer sector at UBS, said that the current consumption growth is still far below the pre-pandemic level and that it will take until the end of 2024 to reach 5% or 6%. She also said that there is “no way” that retail sales can return to 9% in the near future, as consumer confidence is low. HSBC reported that Chinese luxury spending, both domestically and overseas, in September was about 80% of what it was in 2019, which is a slight improvement from the 70% to 75% recovery seen in August. The data for overseas luxury spending was based on Global Blue, a company that provides duty-free shopping services.

General Motors has reached a tentative deal with its Canadian autoworkers, who had launched a national strike on Tuesday at GM’s four Canadian plants. The strike was initiated by Unifor, the union that represents nearly 4,300 GM workers in Canada. Unifor President Lana Payne said that the strike forced GM to “get serious at the table and agree to the pattern”, which is a set of terms that the union has negotiated with other automakers. The details of the agreement have not been disclosed yet, but Payne said that it includes “significant investments” in GM’s Canadian operations. The agreement still needs to be ratified by the union members.

The market ended the day with gains, though profit takers made for a choppy afternoon session with the uncertainty of the pending inflation data. PepsiCo delivered better-than-expected results for the third quarter, beating the estimates for both earnings and revenues. The market is also pondering the uncertainty of the earnings reports from several major banks on Friday. The market performance was diverse, with both defensive sectors, such as consumer staples and utilities, and cyclical sectors, like materials and consumer discretionary, among the top performers. As for today, bulls and Bears will be looking for inspiration in the Mortgage Apps, PPI, Fed Speakers, Bond Yields, and the afternoon release of the FOMC minutes. Plan for an opening gap that could go either way depending on the reaction to the data.

Trade Wisely,

Doug

Comments are closed.