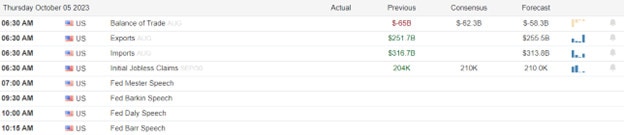

The price action Wednesday produced a sputtering relief rally that provided some hope through the lack of momentum kept uncertainty high. The sharp decline in the ADP signaled a weakening jobs market while at the same time suggesting the rising rate increases may be coming to an end. Big tech names enjoyed the majority of the bullish energy while the energy sector sector pulled back sharply on worries of consumer demand declines. Today we face data from International Trade, Jobless Claims, Natural Gas figures, as well as several Fed speakers to find bullish or bearish inspiration. Plan your carefully with the likely market-moving Employment Situation report before the bell on Friday.

Overnight Asian markets closed mixed but mostly higher inspired by the pullback in treasury yields. European markets are also showing some relief with modest gains across the board this morning despite the plunge in Metro Bank. Though U.S. Future has recovered some of its overnight lows they still suggest a modestly lower open ahead of trade and jobless numbers. Buckle up for another day of uncertainty as we wait on the big Friday jobs report.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include CAG, LW, STZ, LEVI.

News & Technicals’

Metro Bank, a British retail bank, saw its shares plunge by more than 29% on Thursday before trading was suspended by the London Stock Exchange. The reason for the sharp drop was the news that the bank was trying to raise £600 million ($727 million) in debt and equity, amid its financial troubles. The bank has been struggling since 2019 when it revealed a major accounting error that damaged its reputation and profitability. The bank has been trying to improve its balance sheet and reduce its costs, but it has faced challenges from the pandemic, the low-interest rate environment, and the intense competition in the UK banking sector. The bank said that it was in talks with existing and new investors to raise the funds, but it did not provide any details or confirmations. The London Stock Exchange, which lists the stock, confirmed to CNBC that the trading was briefly suspended due to its circuit breaker mechanisms, which are designed to prevent excessive volatility.

Ofcom, the UK’s communications regulator, has expressed its concern that the cloud computing market is dominated by a few large players, known as “hyperscalers”. These are companies like Amazon Web Services (AWS) and Microsoft Azure, which provide cloud services such as storage, computing, and networking to other businesses. According to Ofcom’s estimate, AWS and Microsoft Azure together account for about 60% to 70% of the total cloud spending, leaving little room for other competitors. Ofcom said that this could limit the choice, innovation, and quality of cloud services for consumers and businesses in the UK. Ofcom also said that it is monitoring the cloud market and exploring potential regulatory interventions to promote competition and protect consumers.

LG Energy Solution, a South Korean company that makes batteries for electric vehicles (EVs), has announced that it will supply EV batteries to Toyota, the Japanese automaker, for its cars that will be produced in the U.S. LG Energy Solution’s CEO, Youngsoo Kwon, said in an exclusive interview that the company will invest about $3 billion to build new factories for battery cells and modules exclusively for Toyota and that the factories will be completed by 2025. He also said that the company decided to invest in the U.S. market because of the high inflation, labor costs, and tax incentives in the country. He said that the IRA tax credit, which is a federal tax credit for EV buyers, is a big factor that offsets the costs and boosts the demand for EVs in the U.S. He said that LG Energy Solution is aiming to become a global leader in the EV battery market by partnering with Toyota and other automakers.

Indexes Wednesday began a sputtering relief rally after finding some encouragement in the ADP payroll data showed some signs of a slowing labor market, which could ease the inflation pressure. The bond yields helped ease rate pressures declining modestly giving stocks a little breathing room The sectors that have been lagging, such as consumer discretionary and technology, performed better on Wednesday. However, the energy sector was a big loser, as the oil prices dropped by more than 5%, their worst daily decline in a year. Today we have a few notable earnings, International Trade, Jobless Claims, Natural Gas figures as well as several more Fed speakers to inspire the bulls or bears. Keep in mind the next big market-moving report is Friday before the bell with the release of the Employment Situation numbers so plan your risk carefully because the sputtering relief could continue as we wait.

Trade Wisely,

Doug

Comments are closed.