Markets finished mostly lower in a choppy Tuesday session as CPI uncertainty ruled the day. The QQQ outshined the rest with the tech giants providing the majority of the bullish effort. Optimism grew among businesses yet remains below the 50-year average of 98.8 continuing to indicate small business uncertainty. Today investors will look for inspiration in Mortgage Apps, Inventories, Petroleum Status, and Fed speak as we hurry up and wait on Thursday’s CPI report. A lot is riding on this inflation report with so much bullish sentiment so plan carefully as big point moves are possible before the market opens tomorrow.

While we slept the Nikkei broke the 34,000 level for the time since 1990 while at the same time, the Chinese CSI 300 declined to near 5-lows as Asian markets closed the day mostly lower. European markets trade mostly lower this morning with modest gains and losses in a caution session waiting on inflation data. However, U.S. futures are mixed this morning the Nasdaq leading the way higher as the tech giants dominate buying interest.

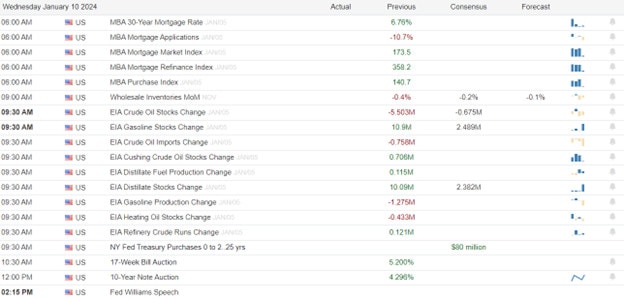

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include only, KBH.

News & Technicals’

X, a social media platform, said on Tuesday that it has finished a preliminary investigation into the hacked account of the U.S. Securities and Exchange Commission (SEC) that showed a fake post. The post claimed that the SEC was investigating a major company for fraud. X said that the hack was not caused by any flaw in X’s systems, but by an unknown person who gained access to a phone number linked to the @SECGov account through another service. X said it has taken steps to secure the account and prevent further incidents.

A major attack by Iranian-backed Houthi rebels on commercial ships in the Red Sea has triggered a response from the U.S. Navy, which has deployed four warships from Operation Prosperity Guardian to the area. The operation is a maritime security mission that aims to protect the vital waterway from Houthi threats. According to CNBC, about 50 merchant vessels are in the vicinity of the attack, which is the largest of its kind by the Houthi militants. The attack poses a serious risk to global trade and stability in the region.

HPE, a technology company that provides hardware, software, and services, announced on Tuesday that it will buy Juniper Networks, a network equipment maker, for $14 billion in cash. The deal will expand HPE’s portfolio of networking products and solutions, and strengthen its position in the cloud and edge computing markets. Juniper’s stock soared on Tuesday after the Wall Street Journal reported on Monday night that the deal was imminent. HPE is paying $40 per share for Juniper, which is 32% higher than Juniper’s closing price on Monday before the news broke.

Uncertainty ruled the day on Tuesday as stocks ended mostly lower, as investors look ahead to the December CPI inflation data and the Friday kick-off of earnings season. The Nasdaq did better than both the S&P 500 and Dow Jones with the tech giants doing most of the lifting. The NFIB Small Business Optimism survey rose a bit for December to 91.9, but was still lower than its 50-year average of 98.0, showing that small business confidence is low. Meanwhile, WTI crude oil recovered, rising over 1.5% to around $72, after falling over 4% on Monday, as oil markets faced more geopolitical and supply challenges. Today it’s likely more of the same hurry-up and wait choppy price action with a chance Mortgage Apps, Inventories, Petroleum Status, and more Fed pontification could provide some bullish or bearish inspiration. With so much bullish sentiment a lot is riding on tomorrow’s CPI number so plan your risk carefully as big price moves are possible before the bell.

Trade Wisely,

Doug

Comments are closed.