The indexes had a tough day on Tuesday as financial reports, rising bond yields, Fed remarks, and the huge miss on the Empire State numbers weighed heavily on investor sentiment. Only the tech sector managed a positive close with just a small list of tech giants doing all the lifting. Wednesday is chalked full of earnings and economic reports but with the China CPI miss slowing economic concerns look to start the day with some bearish uncertainty. Watch for whipsaws with big point moves possible as investors react.

During the night Asian markets closed the day lower across the board with Hong Kong declining a whopping 3.71% and the Shanghai exchange falling near a 5-year low. European markets are also decidedly bearish this morning with U.K. inflation rising. U.S. futures suggest a bearish open but are already well off the overnight lows as we wait on retail sales data. Buckle up, the morning session could prove quite volatile.

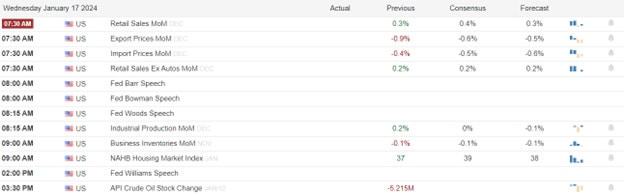

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AA, SCHW, CFG, DFS, FUL, KMI, PLD, SNV, USB, & WTFC.

News & Technicals’

China’s economic growth slowed down slightly in the fourth quarter of 2023, falling short of analysts’ forecasts. The GDP increased by 5.2% year-on-year, compared to 5.3% expected in a Reuters survey. The annual GDP growth rate was also 5.2%, the lowest since 1990. Retail sales, a key indicator of consumer spending, also disappointed, rising by 7.4% in December from a year earlier, below the 8% projection. China also resumed publishing the unemployment rate for young people, which stood at 13.1% in December, up from 12.9% in November.

Iran’s foreign minister issued a stern warning to the U.S. over its alliance with Israel, saying that it would be a mistake to link their future to that of Prime Minister Benjamin Netanyahu, who is facing corruption charges and political turmoil. He also blamed Washington’s unconditional backing of Israel for the instability and violence in the region, especially in Gaza, where Israeli airstrikes have killed hundreds of Palestinians. He urged the U.S. to “stop the war in Gaza” and respect the rights of the Palestinian people. He also emphasized that Iran was concerned about the security of the Red Sea, where it has a strategic interest and presence.

Tesla has lowered the prices of its Model Y electric SUVs in several European markets, following a similar move in China earlier this month. The company’s website shows that the Model Y prices in Germany have been reduced by up to 8.1%, while in France, the Netherlands, and Norway the prices have also been cut by varying amounts. The price cuts come as Tesla faces increasing competition from other automakers in the fast-growing electric vehicle market. Tesla’s stock price fell by 1.6% in the U.S. premarket trading on Tuesday.

The European Central Bank (ECB) is facing a dilemma as inflation in the eurozone hits a record high of 5% in December. While markets are pricing in aggressive interest rate cuts starting in the spring, some ECB officials are resisting such a move, arguing that it could be premature and counterproductive. One of them is Robert Holzmann, the governor of the Austrian central bank and a known hawk, who told CNBC on Monday that there were downside risks to the inflation outlook that could prevent any rate cuts this year.

Tuesday proved to be a tough day for the indexes, as earnings reports from financial firms and Fed remarks weighed on investor sentiment. The huge miss on Empire State numbers added a bit of uncertainty about a sharply slowing economy. Cyclical sectors, such as energy, industrials, and materials, underperformed, while tech was the only sector to end the day in the green all due to a very select few giant tech names. Global markets also declined, with Asian and European stocks closing lower. In Canada, CPI inflation increased by 3.4% year-on-year in December, matching expectations but exceeding the 3.1% rate in November. Bond yields rose, with the 10-year reaching around 4.05%, and the 2-year climbing to over 4.2%. The higher bond yields followed Fed Governor Christopher Waller’s statement where he said he did not see any need for the Fed to hurry into rate cuts. Today we have a few more notable earnings with Mortgage Apps, Retail Sales, Import/Export Prices, Industrial Production, Business Inventories, Housing Market Index, Beige Book, and three Fed speakers to provide bullish or bearish inspiration.

Trade Wisely,

Doug

Comments are closed.