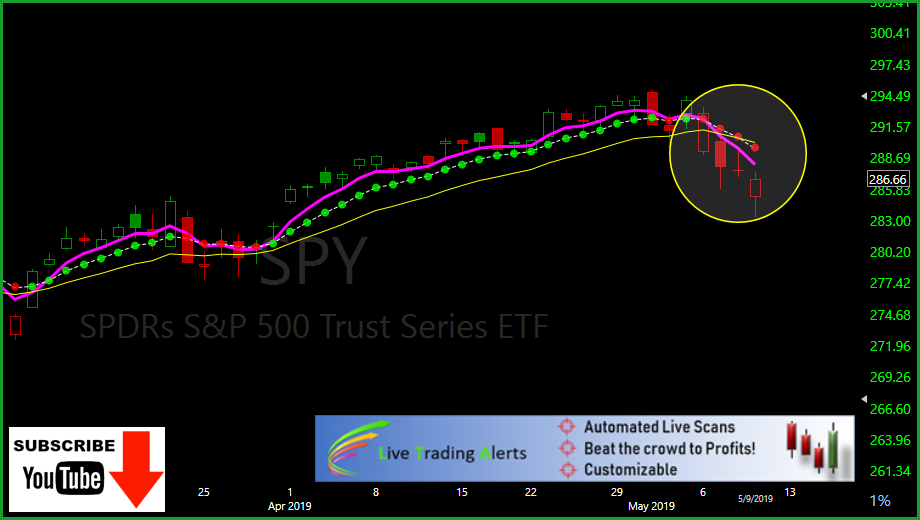

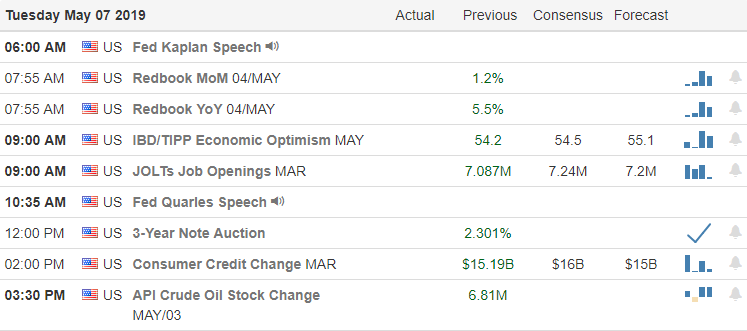

Sellers Have Contol

In Friday’s blog post I posted my Candlestick Dark Chart using just three moving averages. The moving averages (3-EMA, 8-EMA and the 17-EMA) shows how the bulls had control and now clearly shows the bears in control. Bullish candlesticks (price action) with these line in bearish formation is thought to be a bottom but requires confirmation. One more time please “Requires Confirmation.” 👉 Friday has not confirmed it was simply the buyers and sellers creating a candle; confirmation would be above about $289.00 based on Friday’s candle. Notice on the above chart the red dot above Friday’s candle, when the dot turns green you most likely will have confirmation. This indicator or strategy can be used on any chart if you are wondering. ✅ The Red/Greem T-Line Dots on TC2000 and the Alerts from The LTA Scanner are a top tool for trading. Just like a fork is the #1 for eating pie.

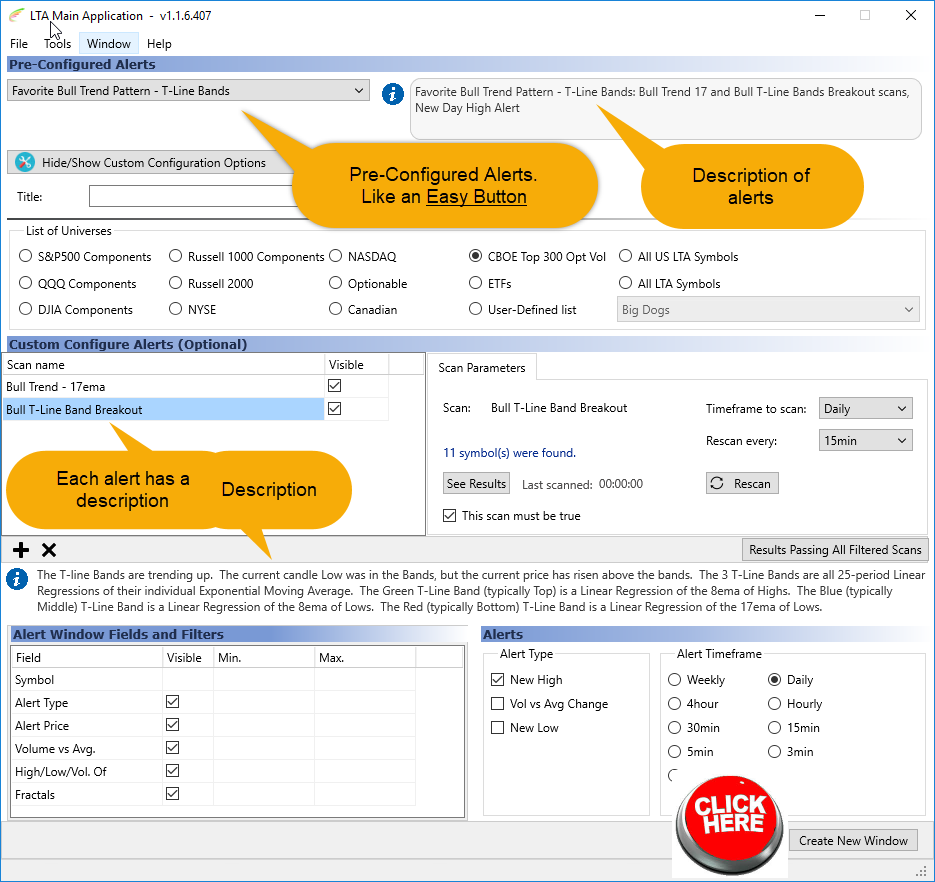

🎯 I use 3 of the best tools in the world for trading stocks and options. 👉TC2000 for charting, LTA-Live Trading Alerts 👉 for real-time price action, candle and candle patterns, and western patterns. 👉TradeHawk for placing the trades. Crazy enough, not one of them are expensive.

👍 A good tool improves the way you work. A great tool improves the way you think. – Jejj Duntemann

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service