Pre-Market Sweet

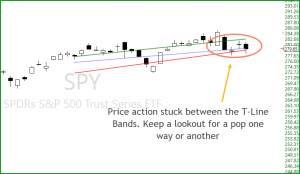

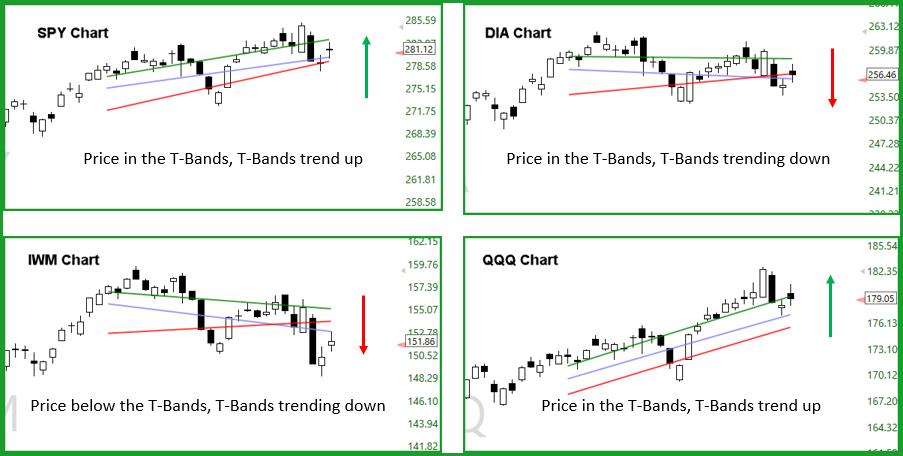

Kellogg and Keebler near a deal and China report unexpected growth in March. It looks like a new fire has been lite under the market. Pre-market up 170 points plus while I am writing the blog. With positive trading today and a positive close the $287.00 area would make a nice target for the SPY. Friday price closed near the Green upper T-Line Band which suggests the buyers where bullish going into Friday’s close. The SPY closed Friday below red V-Stops, a breakout today would flip the dot to green. The near term on the SPY the bulls would love to capture $287.00 then $293.00ish, of course, the bulls will need to push through resistance and maintain a tradable trend. Stay cautious and nimble and remember an important key to trading success is profits, think base hits and the runs will come in.

HRC Road To Wealth Mentoring

Mentoring with Rick Saddler: The Road to Trading Wealth can take several different paths; it’s important to find what works for you. The Trend, Price Action, Candlesticks, Chart patterns, Support and Resistance, and Strategies is the map we use to stay on the Road To Trading Wealth. Patterns and Strategies such as The Rounded Bottom breakout, The Continuation Pattern, Trending, T-Line Bands, and the Red Green Strategies are a few of our favorites. Patterns like J-Hooks, Pop Out of The Box, The Oreo, The Fig Newton, Candlesticks are some of our favorite patterns. Read More

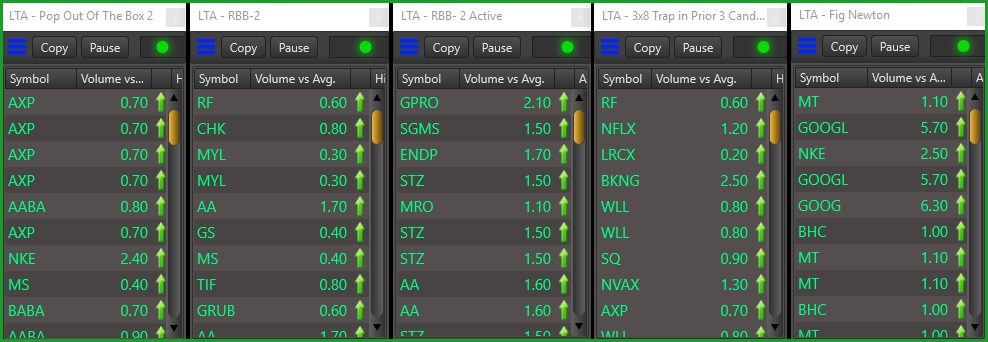

Hey, are you looking for the best money making tool in trading? Well, I found it and use it!! The Live Trading Alerts Scanner. I have about four terrific scans. Get it downloaded and I will be glad to work with you privately to get it set up.

✅ Trade-Ideas for consideration: HD, CSCO, JNJ, ATVI, WAIR, NVDA, SNAP, YUMC, ZEN, DLTR, DHR. Do your work, work your plan. Always have a plan/

Live Trading Alerts News

✅Save time reviewing hundreds of charts. ✅Find EXACTLY the right set up by being alerted for only those tickers that qualify. ✅Stop “Chasing trades” by being alerted of the move (not finding out later.) ✅Eliminate “trouble pulling the trigger” (be sure when a ticker is moving.) ✅Stop “leaving money on the table” (manage your exits with lower-time alerts.) ✅Stop “Predicting” by trading alerts that show the turn, not forecast it. ✅Stop ignoring the overall market (by watching alerts on DIA, SPY, IWM, QQQ.) ✅Gain massive efficiency over flipping through charts (hoping to find them at just the right time) or waiting on someone to feed you trade ideas.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service