Travel Restrictions

With the longest bull run in market history officially over and unprecedented travel restrictions going into place, investors continue to run for the doors. As the markets continue to tumble, expect more forced selling as mutual fund, 401K redemption’s and margin calls grow. We are in uncharted waters as the now official pandemic personal, business, and economic impacts create an uncertain path forward. Protect your capital!

Asian markets closed lower across the board as Japan falls into bear a bear market. European markets just one day after a central bank rate cut sees losses of more than 5% this morning. Ahead of a huge day of earnings and economic reports, the US Futures have to trigger their second circuit breaker in a week. Halting trading but pointing to a morning gap down of more than 1200 points. Hold on tight; this will be a bumpy ride today!

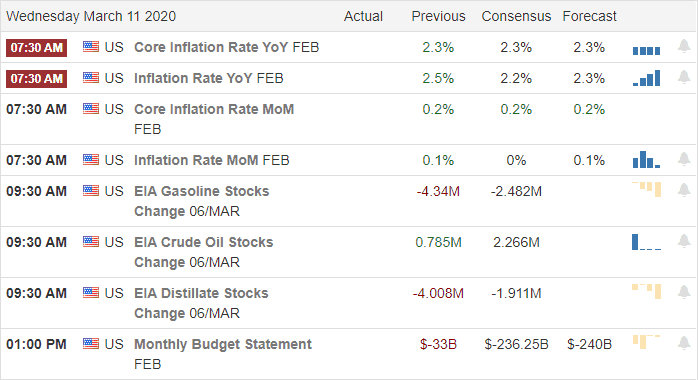

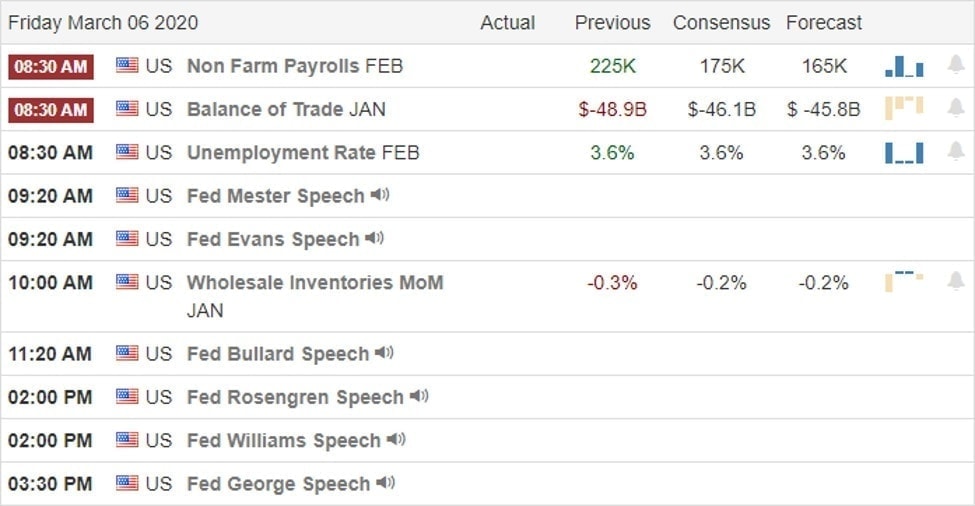

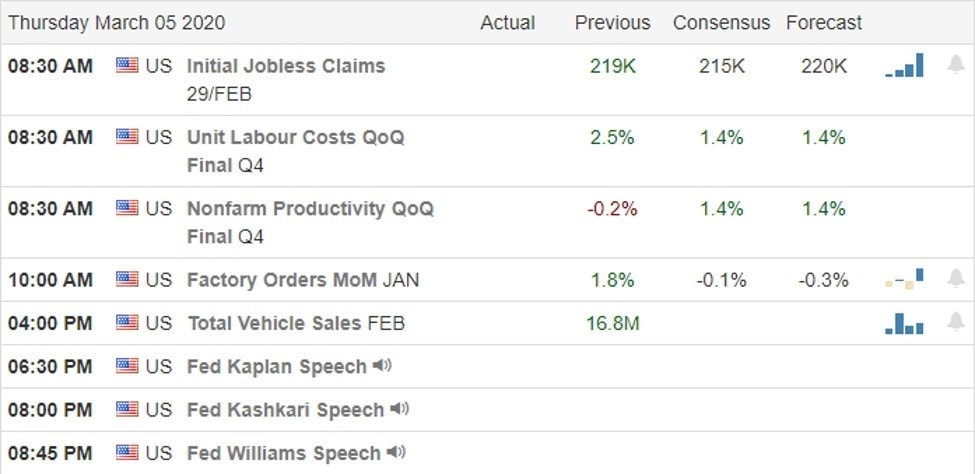

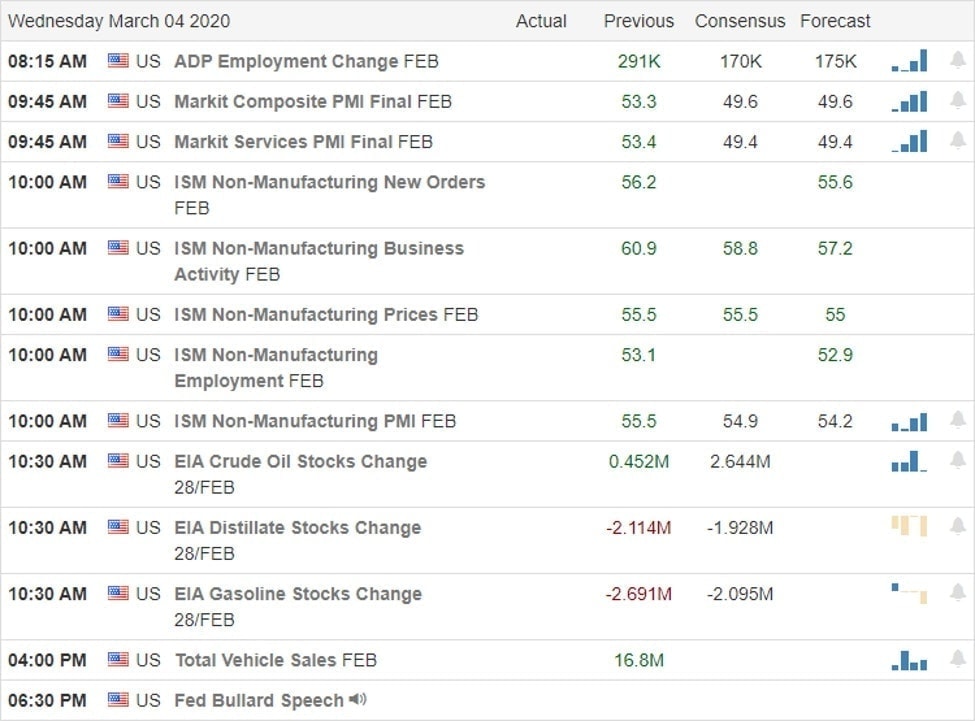

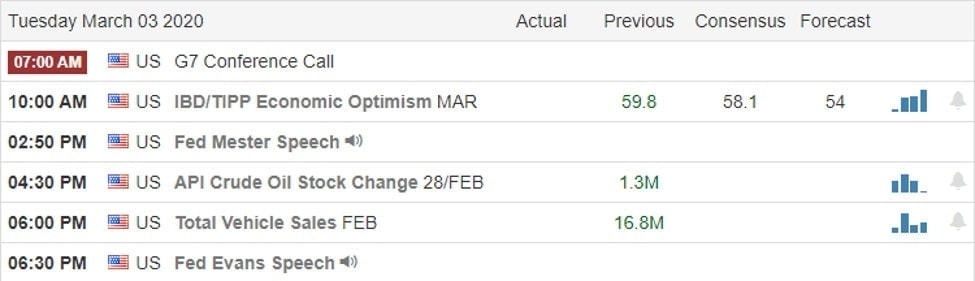

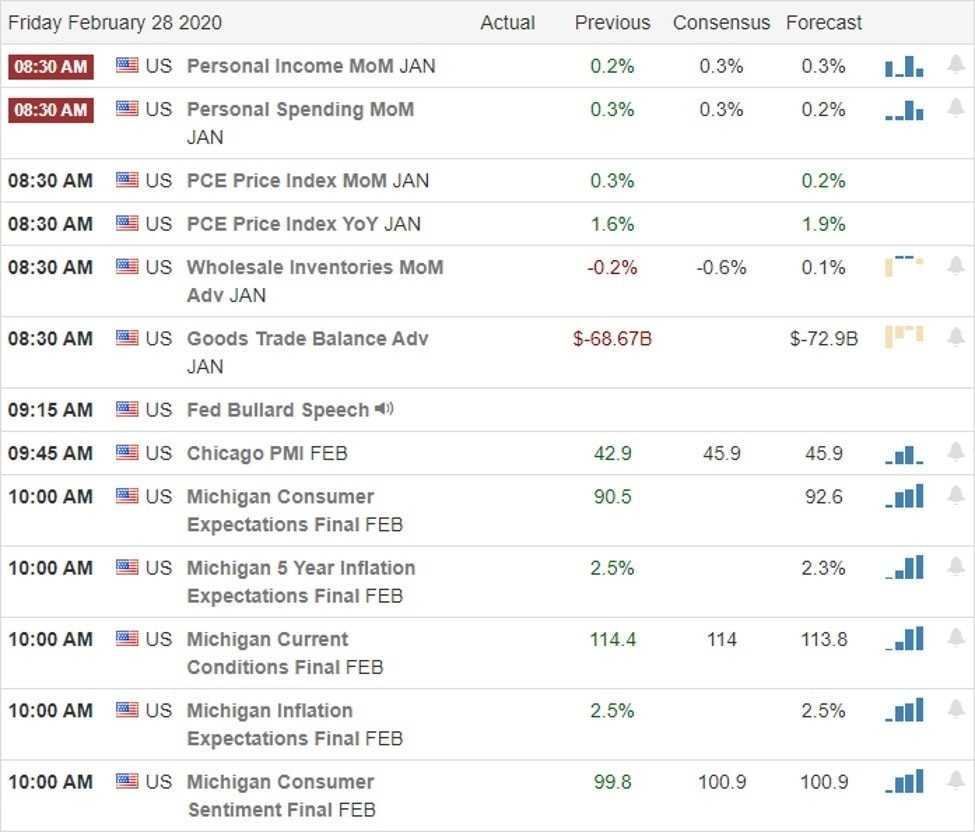

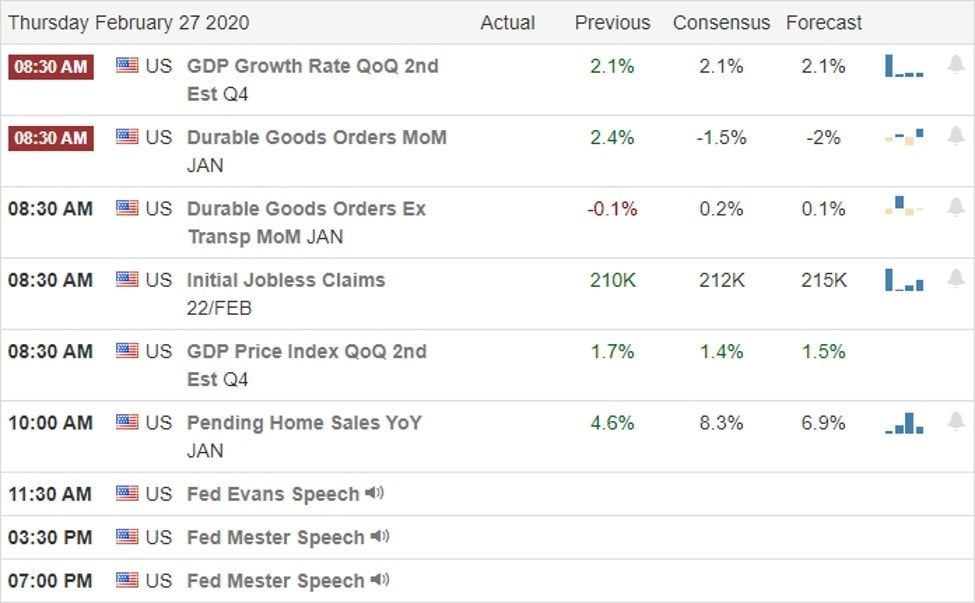

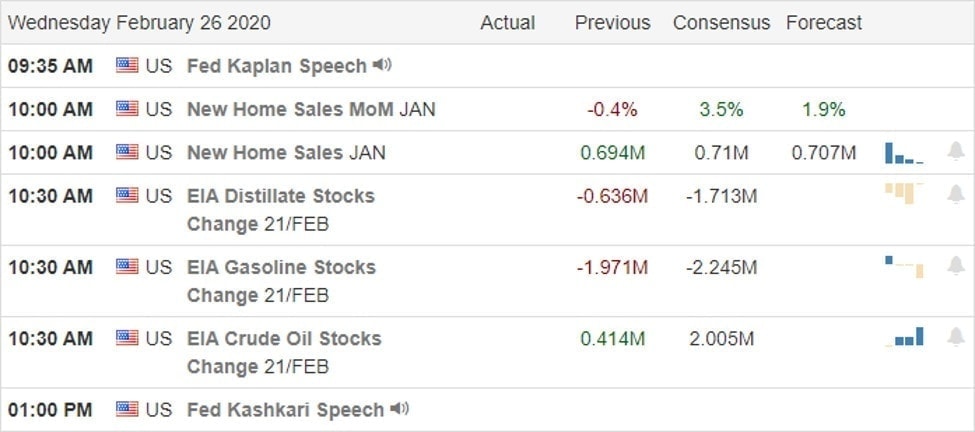

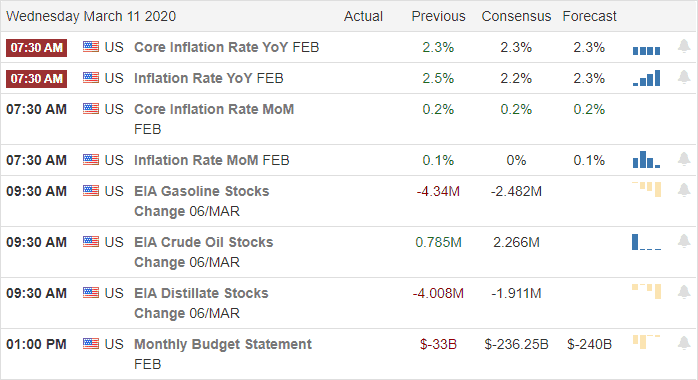

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have our biggest day this week, with more than 250 companies reporting. Notable reports include DG, AVGO, WORK, ADBE, CRON, GPS, JBL, ORCL, TLYS, TUP, ULTA, & ZUMZ.

Top Stories

Yesterday the WHO declared a global pandemic as the virus continues to spread around the world. The White House bans travel from most European countries for 30 days in an attempt a slow the spread of the virus.

The NBA suspends the season, and March Madness will happen with no spectators allowed.

The longest bull run in market history is now officially over as US markets slump into bear market territory and continuing to slide south.

Technically

What’s there to say other than the charts are a mess and continue to worsen as virus panic grips the market. Although it seemed nearly implausible just a few days ago that the market would test the 2018 lows this morning that looks very likely with the Dow pointing to more than 1000 points lower at the open. While the virus situation could get much worse, there is a silver lining if we can get past the emotion of the selloff. Eventually, this will be over, and great stocks will be at bargain-basement prices. The massive price volatility is currently very dangerous, but given time it will get better, so protect your capital and be patient.

Trade Wisely,

Doug