The market hates uncertainty, and holy cow do we have a basket full of the unknown with a spreading outbreak heading into a weekend. After giving up the Wednesday rally, markets around the world are selling off this morning as worries of the mounting economic impacts continue to grow. To say the price action volatility is challenging is a gross understatement of the danger this market presents. Unless the wave bad virus news suddenly shifts this weekend, we should plan for more wild and unpredictable price swings next week.

Asian markets closed the week in the red across the board. European markets are down more than 3% this morning as traders run for the door leading into the weekend. Ahead of expected bullish Employment Report, US Futures point to dismal gap down of more than 600 points as worries virus economic impacts continue to inspire the bears.

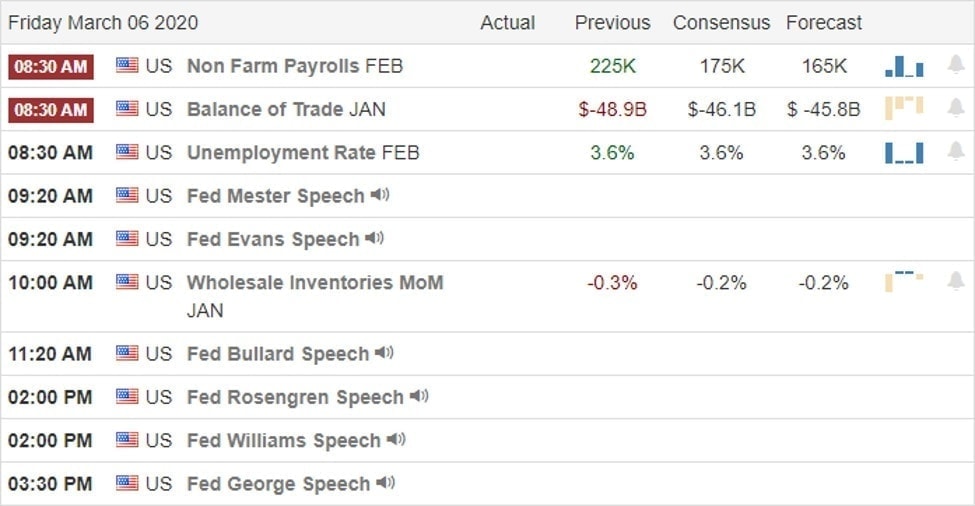

On the Calendar

Earnings Calendar

On the Friday earings calendar, we have our lightest day this week with just 29 companies reporting. Looking through the list, I see particularly notable reports.

Top Stories

As the virus fears continue to grow the 10-year Treasury yield, hit a new record low of 0.7% as investors run to safety. On the bright side and 30-year mortgage rates dip to 3.3% that may help home sales and inspire a round of refinancing to keep banks busy.

On the Virus front, South Korea infections have grown to 6600. In Iran, there were more than 1000 new infections, and their death toll has risen to 124. Australia shut down its first school the Netherlands confirms its first death, Vatican City reported its first case of the virus as confirmed infections in Italy rise above 3000. China invokes ‘force majeure,’ a provision that exempts business form contractual obligations. According to reports, the government has issued nearly 5000 such certificates as of March 3 due to the epidemic.

As oil demand continues to drop, OPEC is trying to get approval for the most significant oil supply cut since the 2008 banking crisis. Russia, to this point, has not endorsed the proposal.

Technically Speaking

The DIA managed to hold on to its 500- day average at the close yesterday, but the SPY once again failed to hold on to its 200-day. After yesterday’s overnight reversal, Wednesday’s big rally was wiped out as the spreading virus continues to worry investors. Now the concern is, will the indexes retest last week’s lows, and if so, will the lows hold as support? Only time will tell, but one thing for sure is that is is a hazardous market condition as it tries to come to grips with such uncertainty.

Action Plan

As we head into an uncertain weekend, US Futures point to another huge gap down as the extreme volatility makes it very challenging and dangerous to trade. Although analysts expect to get a good jobs number this morning virus fears are likely to rule the day. As confirmed cases grow around the world, fear of what comes next here is the US will likely get much worse before it gets better. No matter your level of trading experience, it will be tough to protect your capital if you choose to hold positions into the weekend. With that in mind, we should not be surprised to see another rough day of selling as traders go into weekend protection mode. With the bad news on the virus continuing to increase next week could easily be more of the same with very volatile price action. Remember, cash is a position, and protecting your capital during times like this may prove the very best decision you can make amidst all this uncertainty.

Trade Wisely,

Doug

Comments are closed.