Indexes remain bullish

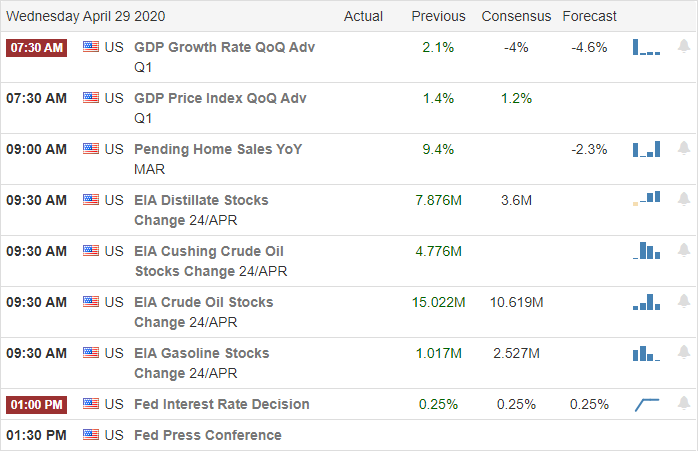

Yesterday say saw some profit-taking come in immediately after the substantial gap up open. Still, the overall trend trajectory in the indexes remains bullish as we continue to test price resistance levels. Today we face a big round of earnings reports, a GDP reading that consensus suggests will dive into negative territory and an FOMC decision. Anything is possible, so cinch up your big boy pants and prepare for price volatility to continue to challenge your trading skills.

Asian markets closed the day flat, and European markets seem to be doing the same this morning, chopping around with modest gains and losses. However, the US futures seemed filled with confidence this morning, pointing to another gap up ahead of a big day of data.

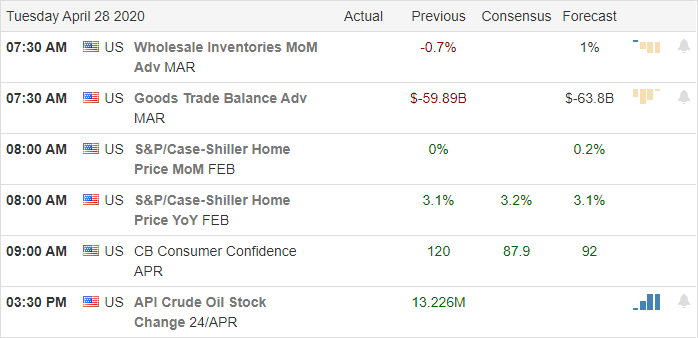

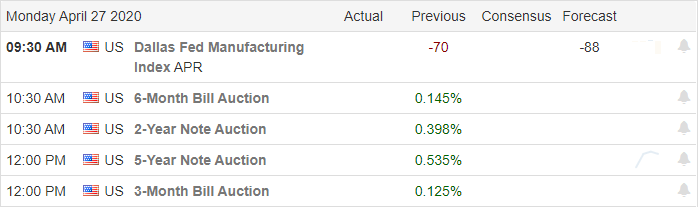

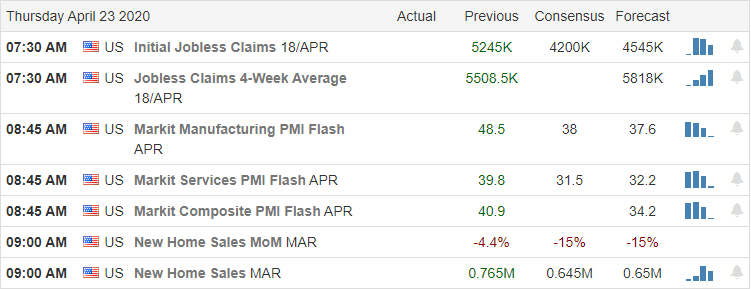

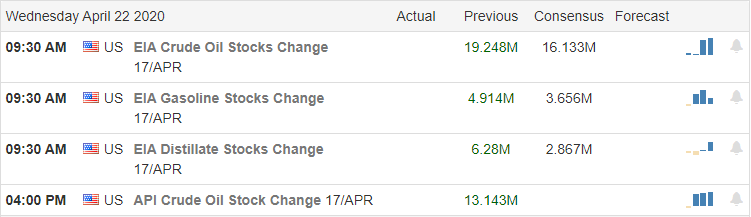

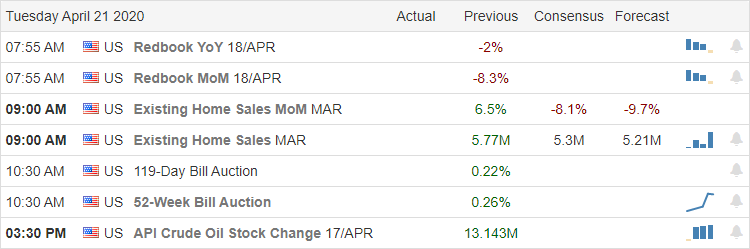

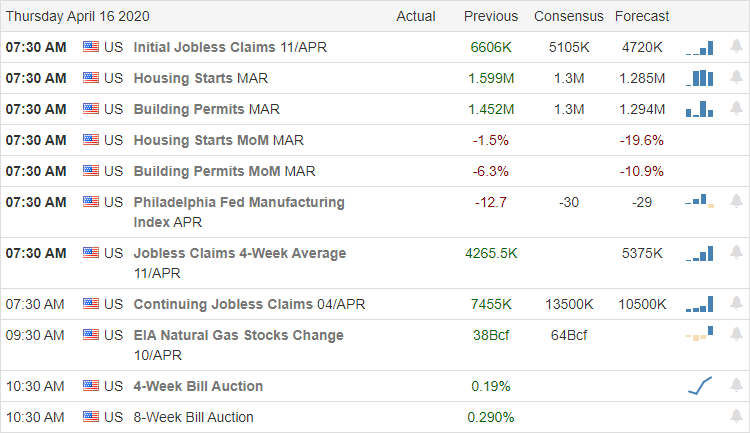

Economic Calendar

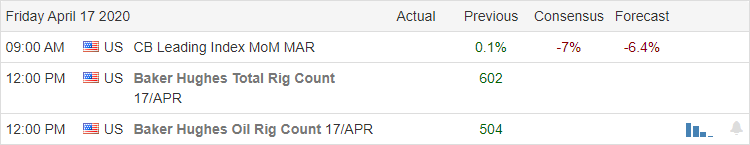

Earnings Calendar

On the hump day earings calendar, we have more than 300 companies reporting. Notable reports include AFL, AMT, ANMT, ADM, AZN, BA, BSX, CCL, CCI, DIN, EBAY, EPD, FB, GRMN, GD, GE, HAS, HUM, LH, MA, MSFT, NSC, NOC, PBI, QCOM, RCL, SBH, SCI, NOW, SHW, SPOT, TDOC, TSLA, RIG, VLO, & YUM.

Top Stories

Today we will hear from the FOMC that’s not expected to hold on current interest rates. However, they could provide more insight into the string of unprecedented actions.

The president invoked war powers to order meat packing companies to remain open as many warn that the supply chain is beginning to breakdown due to closures of many processing facilities. Health officials warn with so many of the industries workers infected, and lack of protective equipment could have serious ramifications.

The hard-hit country of Italy suffered a credit rating downgrade to just one notch above junk status as debts soar due to the pandemic impacts. Fitch warned that a second wave of infections could destabilize their economy due to debit risks with Italy.

Technically Speaking

The bulls stepped back slightly yesterday as if they were in a wait and see mode for the next FOMC decision. The QQQ suffered the most profit-taking of the indexes that began immediately after the significant gap up open. A good reminder not to chase opening gaps that challenge price resistance or price support levels! Even with the modest profit-taking yesterday, the trend trajectory remains bullish, with investors holding on to hope that the economy can restart quickly. However, a business that due resume operations will have to operate in a new normal that will require daily employee health checks, sanitization requirements, and lower capacity rules that provide for social distancing. The concern is, will consumers return and what liabilities will they face if new infections occur as a result.

Today anything is possible with a big round of earnings reports, a GDP that’s likely to dive into negative territory and the FOMC decision.

Trade Wisely,

Doug