After yesterday’s nasty whipsaw as oil plunged into negative prices for the first time in history, a shell shocked market braces for what comes next. Can the market hold up as businesses report the full impacts of the virus on company earnings? Only time will tell, but traders should prepare for challenging price action and significant volatility in the weeks ahead. As the country tries to emerge from the lockdown, one has to wonder what the new normal will look like as we wait for a possible vaccine.

Asian markets closed in the red across the board in reaction to the collapse in crude prices. European markets are decidedly bearish this morning with the major indexes sliding south more than 2%. US Futures point to steep losses at the open with bearish pressure seemingly growing as the morning progresses. Hold on tight; the open is shaping up to be a bumpy one!

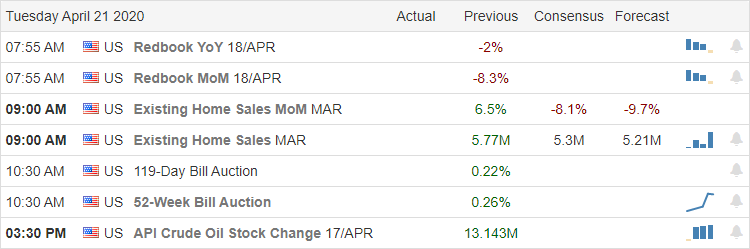

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have more than 100 companies reporting results. Notable reports include KO, NFLX, CP, CB, CMA, DOV, EMR, FITB, FLR, JBLU, LMT, NAVI, PM, PLD, REV, SNAP, SIX, SYF, TXN & TRV.

Top Stories

Citing the attack of the invisible enemy, the President has decided to suspend all immigration in a move drawing criticism from some and praise from others.

Anti-lockdown protests have sprung up around the country, with many finding themselves confronted by pro-lockdown protesters. Governor’s, say that its understandable everyone wants to bet back to normal but would like to see increased testing available before easing restrictions.

Yesterday oil experienced a historic event with the price dropping into negative territory. The President is now in the market to buy 75 million barrels to top of the strategic reserve, but some analysts that suggest the price may still go lower as supply continues to surpass demand.

Technically Speaking

Yesterday the indexes experienced a nasty intra-day whipsaw with Dow traveling nearly 1000 points throughout the day as oil price plunged into the negative on the short-term contracts. With supplies far outpacing demand, some suggest that oil could still go lower as we wait for the delayed impacts of production cuts. Coca-Cola reported this morning that the pandemic has hut demand for their products with the volume off by 20% so far in April. Today we have a big round of earnings, and the futures point to the nervousness of the market currently suggesting another gap down of more than 300 points. As I’ve mentioned before, this earnings season is likely to be very challenging with extreme volatility as we learn of the real business impacts of the pandemic.

The good news thus far is that the DIA and SPY have built helpful consolidation that may well prove to hold as support in today’s pullback. If it does hold, we could see bulls step up buying the dip, but should it fail the slide south to the next level of support will damage the current trends and shake the confidence of recovery. The QQQ continues as the strongest index, but appearing a bit overextended in the short-term a pullback to test the support of the 50-day average is not out of the question. We should expect and plan our risk with the idea that more intra-day whipsaws and full-on overnight reversals are possible in the days and weeks ahead.

Trade Wisely,

Doug

Comments are closed.