A big day of earnings and economic reports will give today’s market a lot to digest. With more than 22 million Americans out of work, there is an expectation that more than 4 million more will join them today. Add to that more than 200 companies reporting earnings and wildly fluctuating oil prices; we have the stage set for another day of challenging price volatility.

Asian markets closed mixed but mostly higher overnight as South Korea reports a decline in fist quarter GDP. European markets are hovering around the flat-line this morning, keeping earnings results in focus. US Futures are also relatively flat this morning ahead of a big day of data where anything is possible.

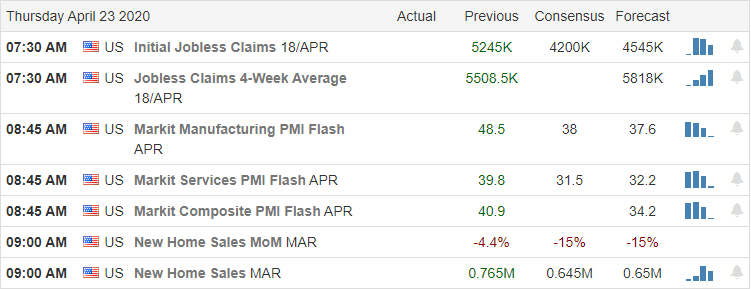

Economic Calendar

Earnings Calendar

We have our biggest day of earnings this week, with more than 200 companies reporting results. Notable reports include AAN, ALK, BX, COF, CTXS, DPZ, EW, LLY, FCX, HSY, ITW, INTC, IVZ, IRM, LOGM, PHM, LUV, TSCO, UNP, UAL, VRSN, GWW & XRX.

Top Stories

Traders will be keeping in an eye on the jobless claims this morning with an expectation of over 4 million additional Americans join the jobless rolls. There is also worry there will be a massive layoff of state and local governments with federal aid channeled elsewhere.

Georgia’s governor has decided to begin reopening the business starting today even though their infection numbers have yet to show a decline. The President said he disagrees with the decision to open os quickly.

Oil made a nice rally yesterday after the President issued a warning to Iran that harassment of tankers in the straight will no longer be tolerated ordering the US Navy to destroy violators.

Technically Speaking

Although we had a nice gap up yesterday as oil prices began to stabilize, price action in the indexes was choppy and displayed considerable uncertainty. On the one hand, we saw the bulls actively defending the support of the current consolidation. On the other, the bears were active enough to prevent prices from filling the entire gap down of the day before. Today the market will have to digest another round of Jobless Claims that may top more than 4 million, a reading on PMI as well as New Home Sales, amidst the biggest day of earnings so far this season. The DIA and SPY continue to struggle with the resistance of a declining 50-day average while the QQQ enjoys the benefit of using its 50-day as support.

Yesterday across the country, there were nearly 28,000 new infections reported, and over 2200 fellow, Americans, lost there lives. As of this morning, the US death toll tops 84,000. A grim reminder that recovery is still a long way off, and businesses face a very challenging environment as the country tries to emerge from lock-down. We should continue to see volatile price action in the days and weeks ahead as we try to navigate uncharted waters. Stay focused on price action and plan your risk carefully as we approach the weekend.

Trade Wisely,

Doug

Comments are closed.