Though trade and Brexit issues continue to plague the market with uncertainty, this week’s ramp-up of 4th quarter earnings will draw all the attention. As we begin to hear results from industrial’s , multi-nationals, and big tech let’s hope they can follow the lead of the big banks producing earnings that support or bolster current prices. Trouble at BA and JNJ will need some strong results out of companies such as CAT that reports this week to counterbalance the index. As always, with earnings, anything is possible, so remain flexible and focused on price action for clues.

Asian markets closed the day cautiously green across the board amid Brexit uncertainties while European indexes shrug off concerns putting on a brave face with all indexes trading modestly bullish this morning. US Futures ahead of earnings reports and a quiet economic calendar currently indicate a slightly bullish open having declined slightly from overnight highs. Ready or not, the earnings ramp-up volatility begins.

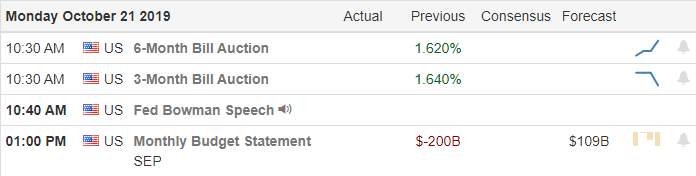

On the Calendar

The Monday Earnings Calendar has over 60 companies expecting to report results today. Notable reports include ACC, CE, TACO, ELS, HAL, LOGI, PETS, AMTD, & ZION.

Action Plan

Friday proved to be an interesting day of price action after learning that BA may have misled the FAA and that and that JNJ may have been selling baby power with trace amounts of asbestos. With both companies included in the Dow average, the index had a very tough day falling 255 points by the close. The Brexit uncertainty also likely played a hand in the reduction of risk as we headed into an expected vote. Unfortunately, we now know that the Prime Minister was forced to ask for an extension and postponed the divorce deal vote. Now we wait to find out if the EU officials will grant the extension with the deadline rapidly approaching.

Looking over the technicals, the DIA took the brunt of the damage on Friday, but all in all, the indexes held above important price support levels and their 50-day averages. Futures have softened slightly from overnight highs, but at the time of writing, this report suggests a modestly bullish open this morning. With 4th quarter earnings ramping up and several market-moving reports on the economic calendar with week price action volatility is likely, and anything is possible. Let’s hope as industrials, and big tech begin to report they can follow the lead of the big banks with better than expected results.

Trade Wisely,

Doug

Comments are closed.