Yesterday push toward upward ended the day leaving behind some concerning technical patterns. The Dow is beginning to show a possible lower high failure with disappointing reports from MCD, TRV, and CAT early this morning. The SPY and QQQ left behind bearish engulfing candle patterns by the end of the day as it reacted to the uncertainty of Brexit and a big wave of reports today. Although the price resistance above is proving to be quite challenging to breach, at least the indexes are still holding above their 50-day averages.

During the night, Asian markets closed mixed but mostly lower as Brexit seeks another extension from the EU. Currently, European markets are mixed but slightly lower overall with the more Brexit political roadblocks to clear. US Futures are also currently mixed with the Dow and SP-500 suggesting a lower open but the NASDAQ trying hard to hold on to modest gains even as Mortgage Applications drop by 12%.

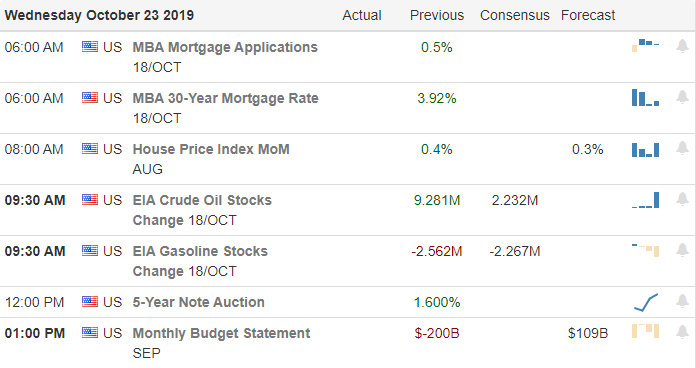

On the Calendar

On the Hump Day Earnings Calendar we have a big day with more than 200 companies reporting results. Notable reports include ABB, AEM, AMP, SNTM, ARI, AVY, BX, BA, BCOV, CP, CAT, CLF, EBAY, EW, LLY, EFX, FFIV, F, LLY, FXC, GD, GWW, HLT, IVZ, LRCX, MSFT, MHP, NDAQ, NSC, ORLY, OC, PYPL, RCI, ROL, SEIC, NOW, SAVE, TSLA, TMO, WM, WGO, and XLNX.

Action Plan

After failing to pass an expedited schedule to complete the Brexit agreement and extension of the October 31st, deadline extending the uncertainty fo the outcome. It’s anyone’s guess what happens next and how their decisions could affect the overall market. Earnings have taken over the headlines, and progress on the Phase One trade agreement seems to have faded entirely from the news cycle and the mind of the market. Disappointing earnings our of MCD and TRV yesterday and the early morning miss from CAT is becoming concerning considering the lower high the index has begun to display. We are still waiting for the embattled BA to report this morning.

Technically speaking, we have some worrisome patterns developing on the index charts. The Dow is showing a possible lower high, the SPY, and the QQQ printed bearish engulfing patterns very near price resistance levels, and the IWM continues to struggle with downtrend resistance. On the positive side, all the indexes remain above their respective 50-day averages, and perhaps this is merely a rest. I think traders must remain flexible and be careful not to overcommit directionally.

Trade Wisely,

Doug

Comments are closed.