With the signing of the stimulus bill, the bulls are bidding up the futures market this morning, suggesting a gap up open with the possibility of some new record highs as a result. However, there is a reason for some caution, with a significantly elevated T2122 indicator and the Absolute Breadth Index remaining in decline. Plan carefully and stay alert for the traditionally low volume that often accompanies the days between Christmas and New Year’s.

Asian markets closed mixed but mostly higher, with Hong Kong declining as Alibaba shares plunge nearly 8%. European markets are green across the board this morning, celebrating a Brexit trade deal and, in reaction, the $900 Billion stimulus spending. Here in the U.S., futures point to a bullish open and possible index records as we kick off the last 4-trading days of 2020.

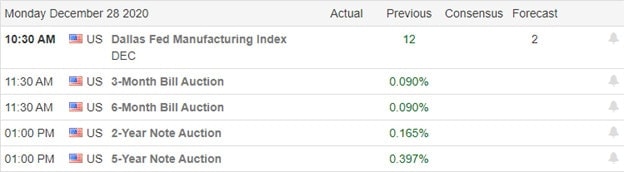

Economic Calendar

Earnings Calendar

We have only four verified earnings this Monday. Notable reports include FDS and HEI.

News & Technicals’

After hinting that he may not sign the stimulus bill, President Trump finally signed it into law while still supporting the idea of $2000 direct payments rather than the $600 the bill provides. That news is inspiring European markets and U.S. futures markets higher at the open. Treasury yields trade higher this morning as well relieved by the avoidance of a government shutdown heading into the end of the year. With air travel hitting new post-pandemic highs over the Christmas Holiday, Whitehouse advisor Dr. Fauci warns of a likely surge in infection rates coming in the weeks ahead.

With the overnight surge of bullishness after news of the stimulus bill came out, the indexes point to gap up open and possible new record highs. However, traders will have to stay on their toes as the trading days between Christmas and New Year’s traditionally suffer from a lack of volume, meaning momentum may quickly fade. With a light day on the economic calendar and very little in the way of earnings, the market could be quite sensitive to political news. Stay focused and plan your risk carefully, as price action could quickly become light and choppy.

Trade Wisely,

Doug

Comments are closed.