The bears decided to make an appearance yesterday, raising some concern in the IWM as it slipped below its uptrend. Although printing some bearish candles, the DIA, SPY, and QQQ uptrend remain intact as the bulls fight back in the premarket, suggesting a bullish open. Consider your risk carefully, as the volume could quickly diminish today, making it difficult for the bulls to sustain the opening pop. Plan your risk carefully as we slide into the holiday shutdown.

Overnight Asian markets traded mostly lower as China revised 2019 GDP growth lower. European markets trade flat to modestly lower this morning despite the positive vaccine news with stocks lacking momentum. The U.S futures bucking the trend point to a higher open as the bulls fight to regain record territory once again. Momentum could be a problem today, so stay focused and be careful not to get caught up in fear of missing out.

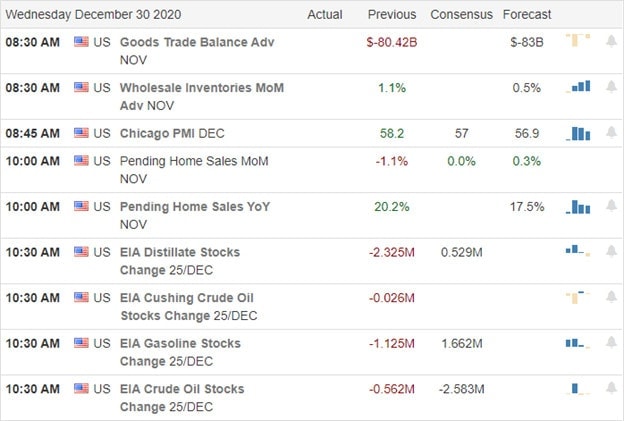

Economic Calendar

Earnings Calendar

There are no confirmed earnings reports today.

News & Technicals’

Vaccine is back in the news today, with the Oxford-AstraZeneca gaining approval in the U.K. McConnell blocks the $2000 direct payments approved just yesterday by the U.S. House. Then tied the bill to other legislation that includes election security as well as tech. McConnell also asked the Senate to approve the military spending bill that was vetoed by the President. Colorado has confirmed the first case of the new, more infectious strain of COVID discovered in the U.K. One of the newly elected Congress died yesterday in a Louisiana hospital from COVID-19 just days before being sworn in and taking his seat. He was only in his 40’s.

Although the bears came out to play yesterday, leaving behind some concerning daily candle patterns, yet three indexes remain in bullish trends. The very extended IWM index is of most concern following the Tuesday bearish engulfing candle to slip below its current uptrend. However, we once again see the futures pointing to a bullish open as the familiar morning pump begins. Yesterday’s selling relieved the pressure of overextended condition in the T2122 indicator, but the Absolute Breadth Index continues to decline, providing a reason for caution. Keep in mind volume is likely to drop quickly today, and the early pop higher may have trouble finding the momentum to sustain.

Trade Wisely,

Doug

Comments are closed.