Bears back in hibernation?

Last week saw a tremendous bullish recovery, and the bears seemed to go back into hibernation. Hopes remain high for another 1.9 Trillion in stimulus, but I’m beginning to wonder if we’ve already priced it into the market. That said, stay with the trend but stay on your toes in case a profit-taking wave begins. Avoid overtrading and chasing already extended stocks, and remember we can’t be consistently profitable traders unless we consistently take some profits.

Asian markets were green across the board overnight, led by the NIKKEI up more than 2%. European markets are also pushing higher this morning with modest gains across the board. U.S. Futures markets point to a bullish open ahead of earnings, a busy week of political news, and a light economic calendar.

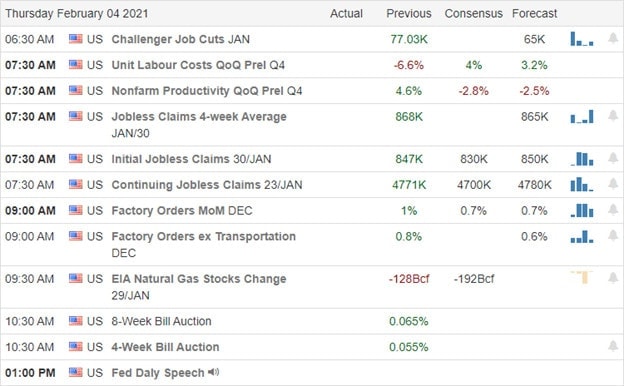

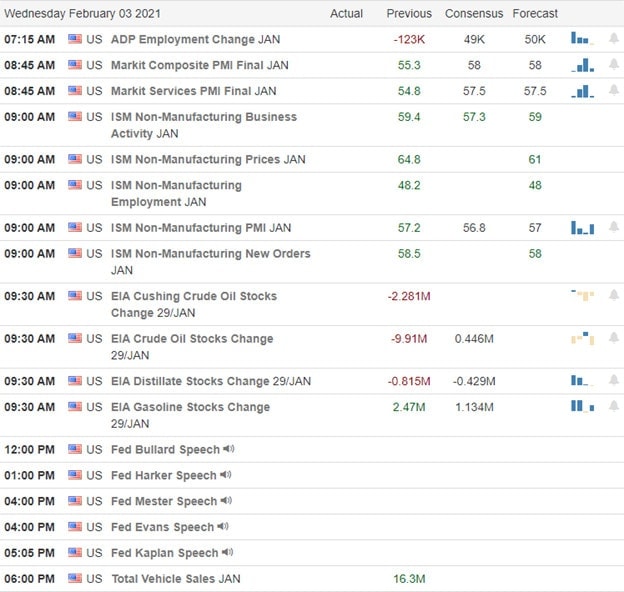

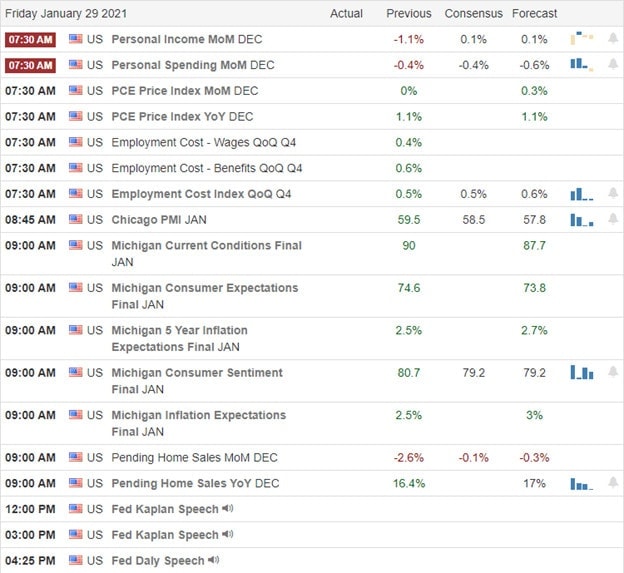

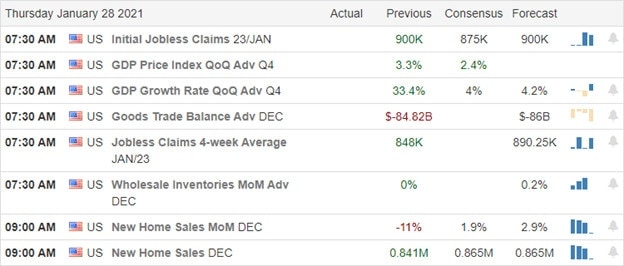

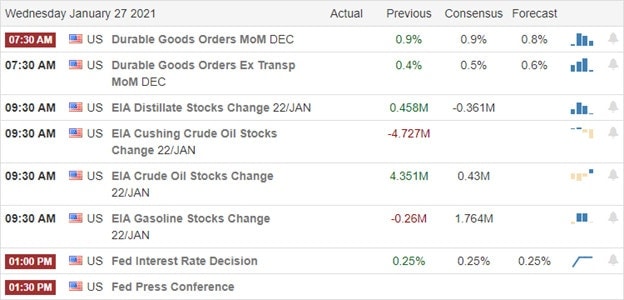

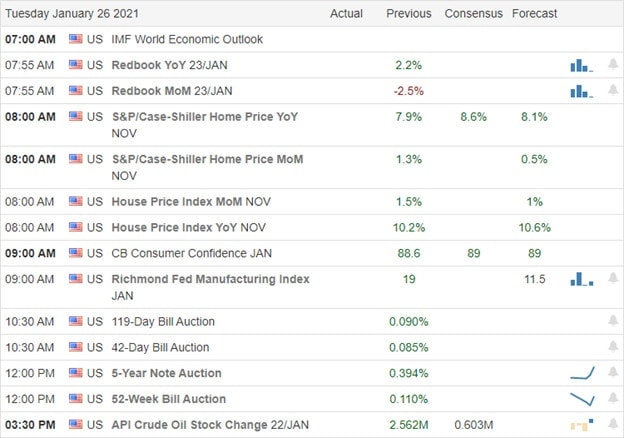

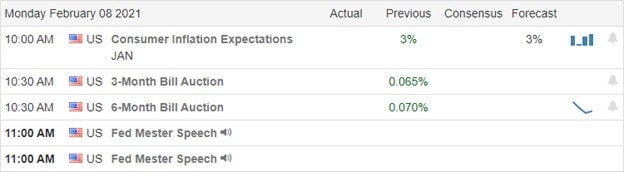

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 64 companies scheduled to report quarterly results. Notable reports include ACM, CHGG, ENR, RE, JKHY, KKR, LEG, L, NUAN, SPG, & TTWO.

News & Technicals’

We had another day of record highs on Friday, and with a quick look at the futures market, the bulls are ready to continue extending the indexes. Congress has a busy week attempting to move forward on the 1.9 Trillion dollar stimulus plan while running a Trump impeachment trial in the Senate. Stay on your toes over the next couple of weeks because the political news could create some price volatility. The rumor that Apple was close to a deal with Hyundai, Kia, to develop the Apple car is apparently not valid after the automaker announced they are not in talks. Hyundai, Kia shares are lower this morning as a result. Janet Yellen says the U.S. could return to full employment by next year if Congress passes the proposed trillion stimulus plan. Of course, there was no mention of how the U.S. plans to deal with the massive debt.

On the technical front, the bulls have reengaged the bullish trend, and it appears the bears have gone back into hibernation. I suspect the high hopes of additional stimulus will continue to supply market levity, but I am concerned that it may soon be fully priced into the market. The T2122 indicator continues to flash a short-term overbought condition, so traders will have to stay focused on the possibility that a profit-taking wave could begin anytime. However, stay with the bullish trend, but be careful not to overtrade or chase already extended stocks. As of February 5th, the SP-500 P/E Ratio was 79% above its historical average. How much longer this bull run can extend is anyone’s guess but be aware we could have some irrational exuberance at work here.

Trade Wisely,

Doug