Although the bulls rushed in to defend price supports, the pullback late in the day left behind more questions than answers. During the night, futures tested Wednesday lows, and so far, the bulls are defending, but it would be unwise to assume the bears have given up with so many stocks remaining under price resistance levels. Expect the price action to be challenging, with the VIX remaining elevated despite yesterday’s bullishness.

Asian markets closed in the red across the board, lead by the NIKKEI falling 1.89%. European markets trade modestly lower across the board this morning, with worries over the trading mania in GME, AMC, and others continue. U.S futures currently point to a bearish open though well off their overnight lows ahead of earnings and economic data. Expect the wild price action to continue, and the market manipulation gains regulatory attention.

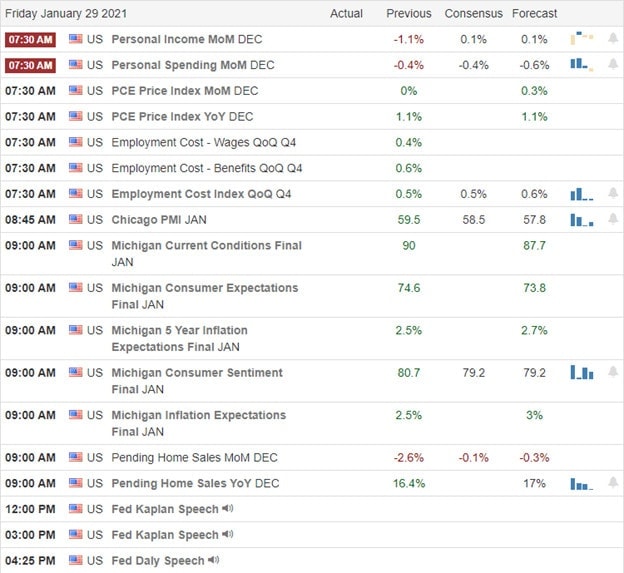

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have nearly 70 companies fessing up to quarterly results. Notable reports include CVX, BAH, CAT, CHTR, CHD, CL, LLY, HON, LHX, LYB, PSX, PSXP, ROP, SAP, SYF, TTM, & WY.

News & Technicals’

The bulls charged back yesterday but struggled to hold all the gains reacting to pirce resistance levels by the end of the day. The market manipulation in GME, AMC, and other heavily shorted stocks is now dominating the news cycle and has gained Congress’s attention. It may seem as if the little guy has finally found a way to stick it to “the man,” but this will eventually cost us all. The credibility of the entire market is at stake, and I suspect a new wave of regulation will soon be on the way. Brokers will have to protect themselves with significantly increased margin requirements, and option prices will necessarily increase due to the risk and wild volatility. Gamble if you must but also be willing to accept the consequences.

Yesterday’s rally index’s tested the resistance of price action and the break of the uptrend. While there were stocks all over the market that experienced a surge upward, you will see substantial resistance above. The question to be answered will the bulls have the energy to push through this resistance, or will the bears gain the strength to defend. The VIX remains significantly elevated, so traders should expect the wild volatility to continue. Overnight futures traded bearishly; however, this morning pump has lifted them well off the lows. Stay focused on price action and remain agile as anything is possible.

Trade Wisely,

Doug

Comments are closed.