A disappointing Durable Goods report brought out the bears yesterday, and they continued their attack after the FOMC decided to take no further action on rates or spending programs. The wild volatility continued after the close as sellers drove down AAPL, FB, and TSLA after reporting. With the VIX elevated above 37 handles and a busy day of earnings and economic reports, expect the will prepare for the wild rollercoaster ride to continue today.

Asian markets had a rough session overnight led by the HIS selling off 2.55%. European markets see red across the board this morning in reaction to the Wall Street plunge. That said, U.S. futures are trying to put on a brave face this morning, bouncing off overnight lows ahead of another big day of data. Keep that seatbelt fastened for a bumpy ride.

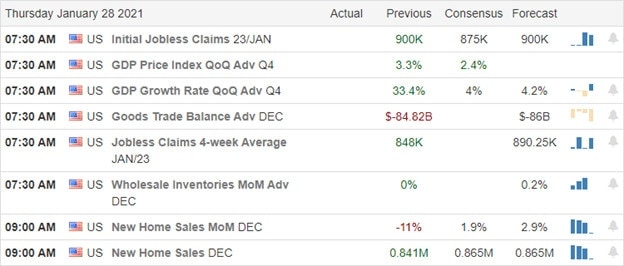

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have our busiest day of the week, with nearly 100 companies reporting. Notable reports include MCD, FLWS, AOS, MO, AAL, CMCSA, DHR, DLB, DOV, DOW, ETH, JBLU, JNPR, MA, MKC, MDLZ, MSCI, MUR, NOC, NUE, PHM, RHI, RCI, SWKS, LUV, SWK, TROW, TSCO, X, VLO, V, WRK, & XEL.

News and Technicals’

The bears went to work yesterday after the disappointing Durable Goods reports and stayed on task into the close after the FOMC decided to stand pat on rates and buying programs. After the bell, Apple reported a blowout quarter but sold off in the post marekt trading. Tech giants FB and TSLA also struggled in the post-market trading but look a bit healthier this morning. Overnight, GME and AMC fluctuated wildly as the speculation short squeeze traders continued to pile into the stocks. President Biden says they are looking into the situation. That kind of market attention usually brings rule changes not favorable to traders.

Yesterday’s selloff spiked the VIX closing at the high of the day above a 37 handle. Unfortuntually, the T2122 indicator suggests there is still more room to the downside before indicating a short-term oversold condition. Options traders may particularly find this morning challenging with wide bid/ask spreads and very high priced options due to the volatility. Facing another big day of earnings and economic data, be prepared for the possibility that the rollercoaster ride is likely to continue.

Trade Wisely,

Doug

Comments are closed.