We started the week with a nasty price action whipsaw in the indexes that kicked the VIX briefly above a 26 handle. Let it serve as a reminder of just how quickly and punishing a market reversal can be when indexes with indexes so elevated as earnings season ramps up. The bulls ultimately won the day defending price support and trends, but note that the bears are starting to show a bit more aggression as of late. Today, we will hear from our first tech giant, MSFT, after the bell. Prepare for the possibility of substantial morning gaps as a result.

Asian markets closed in the red across the board last night, with the HIS retreating 2.55%. However, the European markets are in bullish mode this morning despite vaccine challenges focused on earnings hopes. U.S. Futures point to modest gains this morning ahead of earnings and the latest reading on Consumer Confidence at 10 AM Eastern. Expect price volatility to continue and plan your risk carefully with market-moving reports after the bell and FOMC decision Wednesday afternoon.

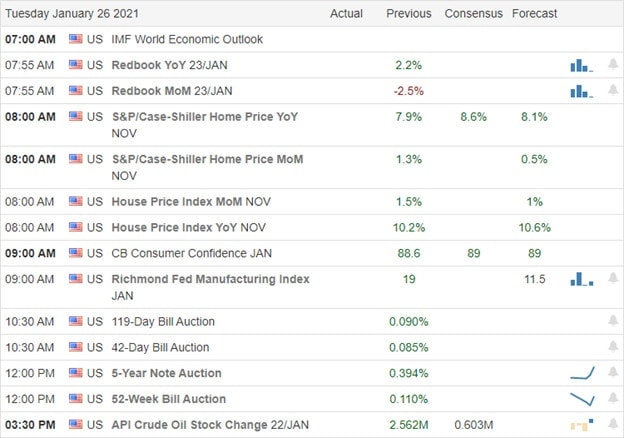

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we a busy day and dig in the tech giants’ reports after the bell. Notable reports include SBUX, MSFT, MMM, AMD, ALK, AXP, ADM, CHRW, CNI, COF, CIT, DHI, FFIV, FCX, GE, IVZ, JNJ, LMT, NAVI, NEE, NVS, CAR, PII, PLD, RTX, ROK, TXN, UBS, VZ, & XRX.

News & Technicals’

Yesterday’s market price action delivered a couple of whipsaws, creating some fear with the VIX popping over above 26 but closing the day above a 23 handle. Today, we a big round of earings that includes the first of the tech giants, MSFT, reporting after the bell. Traders should prepare for the possibility of substantial overnight gaps or reversals as these market-movers report. Janet Yellen, confirmed by the Senate, becomes the first woman to lead the U.S. Treasury Department. The U.S. House delivers the article to impeach former President Trump for a second time in an attempt to bar him from holding office ever again. The trail begins in early February. Minnesota confirms the first known U.S. case of the more contagious Covid variant discovered first in Brazil. A record spike in infections sparks fears of new lockdown restrictions in Dubai, which relies heavily on tourism.

Though the bears showed some aggression yesterday, the bulls ultimately won the day defending price supports and holding trends. However, as we ramp up earnings activity, the bearish aggression is worth noting, keeping us focused, flexible, and prepared. With price to earings valuations so high, an earnings miss is likely to create some punitive price action by the offending stock. Should one of the tech giants stumble, it could prove painful for the overall market. Have a plan to protect your capital should a stumble come to pass but until then, stick with the bullish trend but avoid overtrading or chasing already extended stocks.

Trade Wisely,

Doug

Comments are closed.