Overhead Resistance

The earnings results fueled bulls continued to push higher yesterday, but the overhead resistance seemed to slow their progress yesterday. Could this become the battle line between the bulls and Bears? Adding to the price action challenges, Pelosi’s visit to Taiwan is creating market repercussions around the world, rising tensions between the U.S. and China. So, the question for today is whether earnings results can overcome the political drama and the overhead resistance. Only time will tell but plan your risk carefully, keeping a close on the trend and support levels if the bears gain the upper hand.

Overnight Asian markets closed mostly lower, with Hong Kong leading the Pelosi-driven tension selloff, falling 2.36%. The mood is much the same across the pond this morning, with European markets reacting bearishly to the global risk. Likewise, the U.S. futures point to a bearish gap down at the open even as earnings roll out as the China saber-rattling spotlights their growing aggression toward the free people of Taiwan!

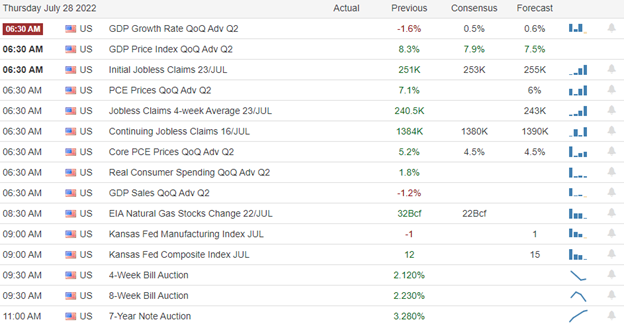

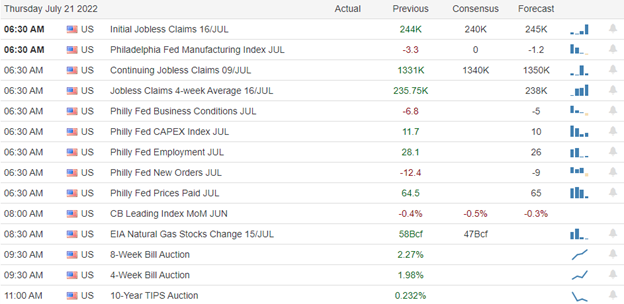

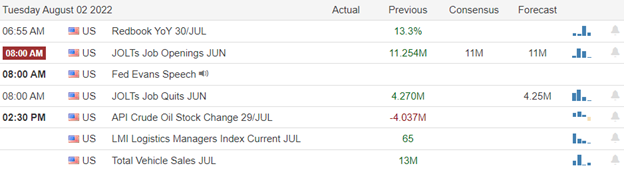

Economic Calendar

Earnings Calendar

The number of earnings reports ramped up today with around 160 companies listed, and the majority confirmed. Notable reports include AMD, ABNB, ARNC, AIZ, CAT, CZR, CWH, CNP, CRUS, CMI, CXW, DD, EA, AQUA, EXAS, FMC, GILD, HLF, HSIC, HUN, INCY, JBLU, LEA, LDOS, MPC, MAR, TAP, MTCH, MCHP, MSTR, OXY, PYPL, PRU, SEDG, SWI, SBUX, TRUE, UBER, WYNN, & ZBRA.

News & Technicals’

California’s declaration comes after Illinois declared a public health emergency earlier Monday. New York declared a state disaster emergency in response to the outbreak late Friday. The U.S. has reported nearly 6,000 cases of monkeypox across 48 states, Washington D.C., and Puerto Rico, according to the CDC. California, Illinois, and New York – home to the nation’s three largest cities – have reported 47% of all confirmed monkeypox infections in the U.S. The Biden White House has tried for weeks to convince Beijing and the world that House Speaker Nancy Pelosi’s expected visit to Taiwan says nothing about U.S. policy toward China or Taiwan. Yet experts say that effort misses the point because intra-party schisms in Washington are effectively meaningless to the rest of the world. The fact that U.S. policy toward Taiwan is deliberately ambiguous has only made it more difficult for the White House to distinguish between what Pelosi is doing and what Biden is saying. According to senior administration officials, President Biden has yet to decide on the options his advisors have presented on the tariffs. Ambassador Katherine Tai, as U.S. Trade Representative, holds the leading role on the tariffs and has suggested they have strategic value in maintaining leverage in negotiations with China. The world’s largest oil and gas companies have shattered profit records in recent months following a surge in commodity prices prompted by Russia’s invasion of Ukraine. Environmental campaigners and union groups have condemned Big Oil’s surging profits and called on the U.K. government to impose meaningful measures to bring down the cost of rising energy bills. The International Monetary Fund last week upgraded Russia’s GDP estimate for 2022 by 2.5 percentage points, meaning the economy is now projected to contract by 6% this year. However, many economists see long-lasting costs to the Russian economy from the exit of foreign firms, the loss of its long-term oil and gas markets, and its diminished access to critical imports of technology and inputs. Pinterest posted disappointing financial results and guidance that missed Wall Street expectations, but user numbers were better than expected. The company blamed a weak advertising market for its revenue miss, following similar comments from Meta, Twitter, and Snap. Elliott Management confirmed that its Pinterest’s biggest investor and said it has “conviction” in the company.

Although the bulls gave it a solid effort, the overhead resistance slowed their advance and could be the short-term line of defense for the bears. The Pelosi visit to Taiwan is raising tensions will China and having a negative effect on markets around the world. According to reports, China’s warplanes are buzzing the line that divides the Taiwan Strait, once again proving they are no friend to the United States. Today is a busy day for earnings, vehicle sales data, and the JOLTS report with some Fed speak tossed in for good measure. It will be interesting to see if the earnings results can overcome the significant price resistance and the Chinese saber-rattling. After such a strong rally, a little rest or consolidation would be healthy for the market as long as price supports and trends hold.

Trade Wisely.

Doug