The FOMC raised rates as expected and reiterated its commitment to a 2% inflation target, and the bulls partied hard as a result. However, Mike Wilson from Morgan Stanely warned the jump is a trap expecting more market pain on the way, and the T2122 indicator surged back into a short-term extended condition. Price action will likely remain very erratic with a massive day of earnings results that includes AAPL and AMZN with a GDP and Jobless Claims numbers to begin the day! Significant overhead resistance levels are near, so plan your risk carefully.

Asian markets closed mostly higher overnight with modest gains after a choppy session. European markets trade mixed with muted results after the Fed rate decision. As earnings roll out, U.S. futures currently point to modest declines ahead of the GDP report and the mega earnings results from AAPL and AMZN later today. Plan your risk carefully as overhead resistance approaches and the bulls try to keep the party going.

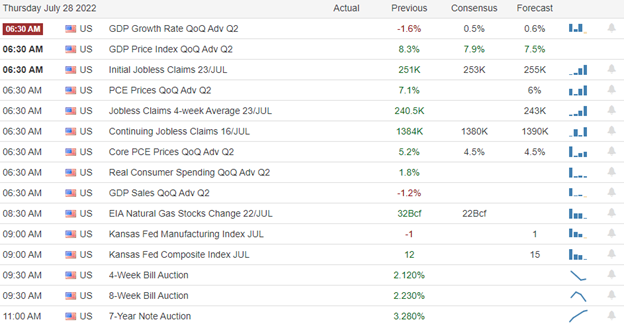

Economic Calendar

Earnings Calendar

Today is the busiest day on the earnings calendar so far, with about 225 companies listed. Notable reports include AAPL, AMZN, AOS, AGCO, MO, AMT, ARES, ABG, BAX, BZH, CPT, CE, CC, COHU, CLR, DECK, DXCM, DSX, DLR, EW, EGO, FHI, FSLR, FTS, BEN, GLPI, HOG, HIG, HSY, HTZ, INTC, KLAC, KDP, LH, MDC, MMP, MLM, MA, MRK, MHK, NOC, OLN, OSK, OSTK, PCG, BTU, PFE, PBI, ROKU, SGEN, SIRI, SO, LUV, SWK, TROW, X, VFC, VLO, VRSN, WFRD, WING, & ZEN.

News & Technicals’

Morgan Stanley’s Mike Wilson believes stocks are on a collision course with more pain due to the economic slowdown. The firm’s chief U.S. equity strategist and chief investment officer said on CNBC’s “Fast Money” that investors should resist putting their money to work in stocks despite the market’s post-Fed-decision jump. Meta missed on the top and bottom lines and gave a troubling forecast for the third quarter. As marketers pull back on ad spending, the shares have lost about half their value this year. The company said its guidance reflects the “continuation of the weak advertising demand environment.” The British bank reported a £1.071 billion ($1.30 billion) net profit attributable to shareholders for the second quarter — down 48% from the same period in 2021. The bank announced earlier this year that it had sold $15.2 billion more in U.S. investment products — known as structured notes — than it was permitted to. The related £1.3 billion in litigation and conduct charges booked in the second quarter were “substantially offset,” according to the bank, by a hedge that generated an income of £758 million. Ford reported second-quarter results that beat Wall Street’s estimates. The company’s adjusted operating income more than tripled from a year ago, when its production was hit hard by a global shortage of semiconductor chips. Ford reiterated its previous guidance for the full year and said it would raise its dividend but wouldn’t comment on reports that it’s planning layoffs. On Wednesday, Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.V. unveiled a long-anticipated reconciliation package that would invest hundreds of billions of dollars to combat climate change and advance clean energy programs. The legislation, called the “Inflation Reduction Act of 2022,” provides $369 billion for climate and clean energy provisions, the most aggressive climate investment ever taken by Congress. The package would curb the country’s carbon emissions by roughly 40% by 2030, according to a summary of the deal.

The bulls partied hard after the FOMC rate decision as the committee reiterated its commitment to bring inflation back to its 2% target. However, Morgan Stanley’s Mike Wilson warned the market jump is a trap suggesting more pain is coming due to the economic slowdown. One thing for sure is that the T2122 indicator points to a short-term overbought condition after the rally, so chasing the move up may be unwise. Expect the price volatility to continue today with a reading on GDP, Jobless Claims, and the mega reports from AAPL and AMZN after the bell. Though the bulls remain in party mode, it would be wise to remember the significant overhead resistance and macroeconomic details that point to a slowing U.S. economy.

Trade Wisely,

Doug

Comments are closed.