Earnings results continued to fuel an unstoppable buying enthusiasm as the bulls pushed the indexes higher right into the weekend. Adverse economic data such as rising rates, a negative GDP, and a PCE number that continued to show inflationary pressure was no deterrent to the rally’s energy. But, with many of the big tech reports now in the rearview, can the upcoming reports push the indexes through the significant overhead resistance? Keep an eye on the PMI, ISM, and Construction spending reports later this morning.

Asian markets closed green across the board with modest gains after a private survey showed Chinese factory activity grew. European market trade cautiously bullish this morning with modest gains across most indexes. As we kick off August, trading U.S. futures recovered from overnight losses suggesting a flat open at the time of this report. Ride the bullish wave as long as it lasts but keep an eye on the overhead resistance for the possibility of entrenched bears.

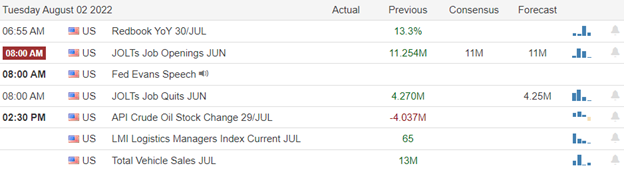

Economic Calendar

Earnings Calendar

Notable earnings include AFL, AMKR, AMRC, ANET, ATVI, CAR, BLDR, CF, CHKP, DVA, FANG, GNW, GBT, GPN, J, LEG, MOS, ON, OTTR, PINS, SBAC, SPG, YNO, & WWE.

News & Technicals’

Home price gains are cooling fast as demand wanes and supply builds. As a result, the annual rate of price appreciation fell two percentage points from 19.3% to 17.3%. However, price gains are still otherwise strong because of an imbalance between supply and demand. The housing market has had a severe shortage for years. Google CEO Sundar Pichai announced to employees Wednesday a new effort called “Simplicity Sprint,” which will solicit ideas from its more than 174,000 employees on where to focus and improve efficiency. Pichai said Google’s productivity as a company isn’t where it needs to be given the headcount it is and warned of a toughening economy. HR chief Fiona Cicconi also acknowledged industry-wide concerns about layoffs and said the company is “not currently looking to reduce Google’s overall workforce” but reiterated the need for greater efficiency and focus. Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, told CBS’ “Face the Nation” that inflation poses a larger threat than a potential recession. “We’re going to do everything we can to avoid a recession, but we are committed to bringing inflation down, and we are going to do what we need to do,” Kashkari said. Chinese e-commerce giant Alibaba said it would comply with U.S. regulators and work to maintain its listings in New York and Hong Kong. “Alibaba will continue to monitor market developments, comply with applicable laws and regulations and strive to maintain its listing status on both the NYSE and the Hong Kong Stock Exchange,” it said in a statement to the Hong Kong bourse on Monday. Last week, supplies via Nord Stream 1 were reduced to 20%, with Gazprom citing technical issues. There are renewed price pressures every time Russia decreases its supplies to Europe, given how important the commodity is for several sectors. With supplies reduced and prices higher, the gas crisis is shaking Europe’s economic prospects. Treasury yields traded higher in early Monday trading, with the 2-year at 2.89%, the 5-year at 2.68%, the 10-year at 2.65%, and the 30-year holding at 3.02%.

Last week the buying enthusiasm was unstoppable as earnings beat lowered expectations. Rising interest rates, a negative GDP, and a rising PCE (the Fed’s preferred inflation indicator) could not deter the bulls hungry for risk. With the indexes not facing significant overhead resistance and a T2122 continuing to signal an over-extended condition, can the earnings supply enough bullish inspiration to keep the rally going? We now seem to have the ability to ignore adverse economic reports, so maybe the PMI, ISM, and Construction numbers won’t matter all that much, but it would be wise to keep an eye on them for a potential reaction. Ride the wave as long as it lasts but observe for clues from bears at or near overhead resistance levels.

Trade Wisley,

Doug

Comments are closed.