Price resistance levels cut like butter as the bulls had a really good day following through from the overnight reversal with the Dow more than 1700 points off the low just four trading days ago. There suddenly seems to be no concern that bond yields point toward a recession, and with the coming rate hike, the desire to hurry up and buy something is taking over. However, be careful not to chase or overtrade, with the T2122 indicator suggesting a short-term overbought condition.

Asia markets rallied strongly overnight in reaction to the U.S. buying surge, with the Nikkei leading the buying, up 2.67%. However, European markets have reversed early bullishness after their inflation hit a 40-year high of 9.4%, worrying that Russia will shut down energy supplies. U.S. futures have also reversed from early bullishness after mortgage demand dropped to a 22-year low as inflation-driven rate hikes damage home buying demand. That said, don’t rule out the power of earnings and the fear of missing out as the wild volatility in price action continues.

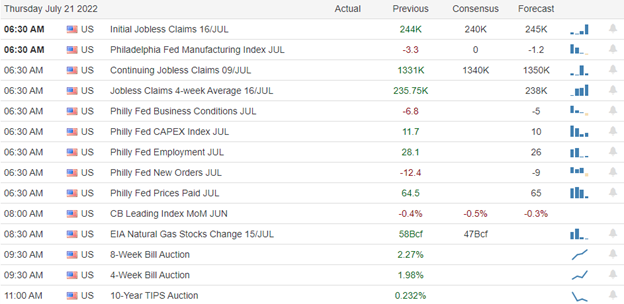

Economic Calendar

Earnings Calendar

The Wednesday calendar has about 30 confirmed earnings reports. Notable reports include ABT, ASML, BKR, BIIB, CMA, CCI, CSX, KMI, NDAQ, NTTRS, PACW, TSLA, & UAL.

News & Technicals’

Netflix lost nearly 1 million subscribers in the quarter after forecasting a dip of 2 million. The company forecast 1 million net adds for the third quarter, below Wall Street estimates of 1.8 million. Netflix is counting on changes, such as cracking down on password sharing and adding an advertising tier, to start in 2023. Bitcoin surged as high as $23,800 Wednesday, up 8% in 24 hours and trading at levels not seen since mid-June. Traders took comfort from the prospect of a rate hike from the Federal Reserve that is less aggressive than feared. Ether climbed above $1,500 amid optimism over a highly anticipated upgrade to its network known as the “Merge.” According to U.S. intelligence, Russia is laying the groundwork to annex parts of Ukraine. “We’re seeing ample evidence and intelligence and in the public domain that Russia intends to try to annex additional Ukrainian territory,” National Security Council spokesman John Kirby told reporters at the White House. Kirby that the U.S. observed a similar Russian playbook in 2014 ahead of the Kremlin’s annexation of Crimea, a Ukrainian peninsula on the Black Sea. Citing supply chain challenges due to Russia’s war in Ukraine, Gupta said the two countries capture a large part of the market share. Russia and Ukraine are the largest exporters of krypton — a gas used in chip production. Semiconductors are used in everything, from mobile phones and computers to cars and home appliances. Rising inflation and expectations of more monetary tightening are already causing a “consumer-led slowdown,” said Gupta. Last week, a spike in reported numbers of homebuyers halting mortgage payments prompted many banks to announce their low exposure to such loans. Across banks covered by Goldman Sachs, average exposure to property, including mortgages, was just 17%. If more homebuyers refuse to pay their mortgages, the poor sentiment would reduce demand — and theoretically, prices — in a vicious cycle. “It is critical for policymakers to restore confidence in the market quickly and to circuit-break a potential negative feedback loop,” Goldman Sachs chief China economist Hui Shan and a team said in a report Sunday. Treasury yields dipped slightly in early Wednesday trading, with the 2-year inverted at 3.13%, the 5-year at 3.11%, the 10-year at 2.98%, and the 30-year trading at 3.15%.

The bulls had a really good day on Tuesday, with the Dow closing up more than 1700 points from the low just four trading days ago. The buying party continued after the bell, with NFLX jumping more than 6% despite losing nearly 1 million subscribers and declining revenue. European inflation hit a 40-year high of 9.4%, with the risk of Russia shutting off the energy supply, yet the bulls push for a positive open fuelled by tremendous earnings speculation. The T2122 indicator suggests a short-term overbought condition, but that does not mean we can’t go higher, as the fear of missing out is a powerful motivator. That said, don’t allow greed to prevent you from taking some profits in case of a sudden reversal of sentiment comes into play.

Trade Wisely,

Doug

Comments are closed.