DIA Losing Streak

Stock futures declined following the longest DIA losing streak since 2018. Traders are eagerly awaiting the Federal Reserve’s next rate decision, which will be announced at the end of the central bank’s final two-day policy meeting of 2024, starting Tuesday. According to CME Group’s Fed Watch tool, there is a 95% probability of a quarter-point rate cut on Wednesday. Wall Street is particularly focused on insights into future policy moves that will be discussed during the meeting and in Chair Jerome Powell’s press conference afterward.

Early Tuesday, European markets were mostly in negative territory as investors focused on upcoming central bank meetings. The Bank of England is set to meet on Thursday, with markets currently anticipating only a slim chance of a final rate cut for the year. Despite the overall negative trend, Germany’s DAX index was up by 0.2%, following Chancellor Olaf Scholz’s loss in a confidence vote in the German parliament on Monday, which has triggered a snap election scheduled for February 23. Key data releases in Europe on Tuesday include U.K. unemployment figures and Germany’s Ifo business climate and economic sentiment index.

Asia-Pacific markets showed mixed performance, reflecting the varied gains seen on Wall Street. In a significant move, Chinese leaders announced plans to increase the country’s budget deficit to 4% of GDP in 2025, aiming to sustain economic growth at around 5% next year, according to a Reuters report. The CSI 300 in China fell by 0.26%, and Hong Kong’s Hang Seng Index decreased by 0.16%. Conversely, Australia’s S&P/ASX 200 rose by 0.78%. Japan’s Nikkei 225 and Topix both declined by 0.24%, while South Korea’s Kospi and Kosdaq dropped by 1.29% and 0.58%, respectively.

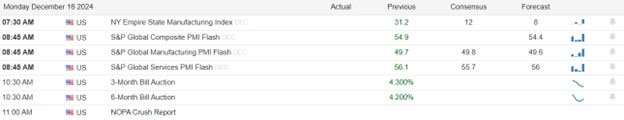

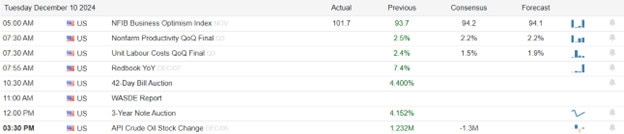

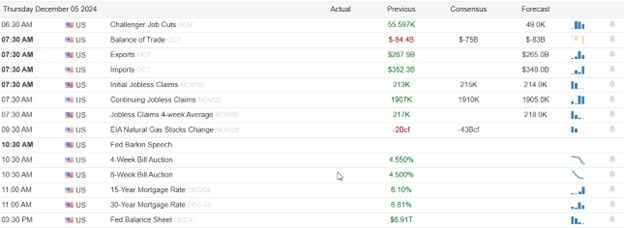

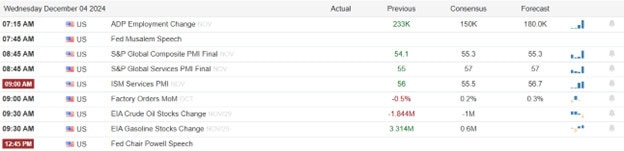

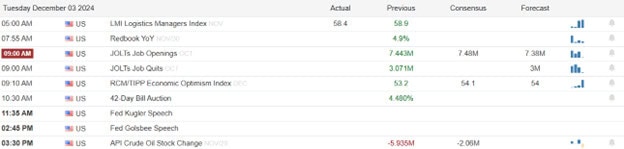

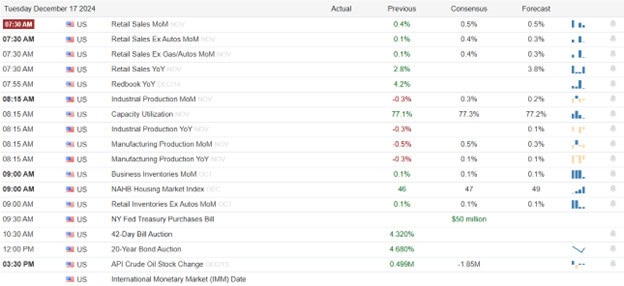

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell include HEI, & WOR. After the bell reports include CALM, & NEOG

News & Technicals’

Respondents to the CNBC Fed Survey for December are confident that the Federal Reserve will cut rates on Wednesday, with 93% predicting a quarter-point reduction. However, only 63% believe this is the appropriate action for the Fed to take. The survey, which included 27 respondents such as economists, strategists, and fund managers, also highlighted concerns about the impact of President-elect Donald Trump’s tariffs and threatened deportations on the economic outlook. These factors have tempered optimism among some forecasters. Economist Robert Fry expressed his uncertainty, stating, “I can’t remember being this uncertain about the inflation outlook.”

U.S. Treasury yields edged slightly higher as investors awaited key economic data ahead of the Federal Reserve’s upcoming interest rate decision. By 5:51 a.m. ET, the yield on the 10-year Treasury had risen by over 2 basis points to 4.418%, while the 2-year Treasury yield increased by more than 2 basis points to 4.272%. The U.S. retail sales figures for November, set to be released on Tuesday, are expected to provide new insights into consumer behavior and spending. This will be followed by the latest building permit and housing starts on Wednesday, just before the Fed announces its interest rate decision later that day.

An index of Asian currencies dropped to its lowest level in over two years due to growing pessimism about China’s economic outlook and expectations that Trump’s second administration will strengthen the U.S. dollar. The yen, which had weakened beyond the 154 level against the dollar overnight, ended a six-day losing streak. The yen’s sharp decline over the past week has led strategists to caution that further weakening could prompt verbal intervention from authorities and increase pressure on the Bank of Japan to raise interest rates. However, traders are currently pricing in less than a 20% chance of a rate hike in December, according to swaps market data.

Volkswagen, Mercedes-Benz Group, and BMW have recently issued profit warnings, attributing their concerns to economic weakness and sluggish demand in China, the world’s largest car market. This challenging situation is further exacerbated by the potential imposition of U.S. tariffs on European autos, which could significantly impact Germany’s economy. Germany, being Europe’s largest exporter of passenger cars to the U.S., exported 23 billion euros ($24.2 billion) worth of cars last year, representing 15% of its total exports to the U.S., according to Eurostat and ING Research. The introduction of tariffs would therefore worsen the already difficult circumstances for Germany’s top original equipment manufacturers (OEMs).

The DIA losing streak looks to continue today despite the T2122 indicator signaling a short-term oversold condition. Market breath continues to be extremely concerning as the tech giants soar to record highs seemingly sucking all the energy out DOW and Russell indexes. If a pullback begins be prepared for a possible quick substantial decline.

Trade Wisely,

Doug